Gold prices skyrocketed today as the Ukraine-Russia conflict escalated dramatically. Ukraine has reportedly used U.S.-supplied long-range missiles to strike inside Russian territory for the first time in history.

This escalation of war, with worldwide implications, has rattled global markets, intensifying investor concerns a day after the G20 Summit.

According to Russia’s Defense Ministry, Ukrainian forces launched six U.S.-made Army Tactical Missile Systems (ATACMS) into the Bryansk region early this morning. While Russia claims to have intercepted most of the missiles, debris caused a fire at a military facility.

The action comes shortly after the Biden administration authorized Ukraine to use these long-range missiles within internationally recognized Russian borders.

Gold and markets’ reaction as investors seek safe havens

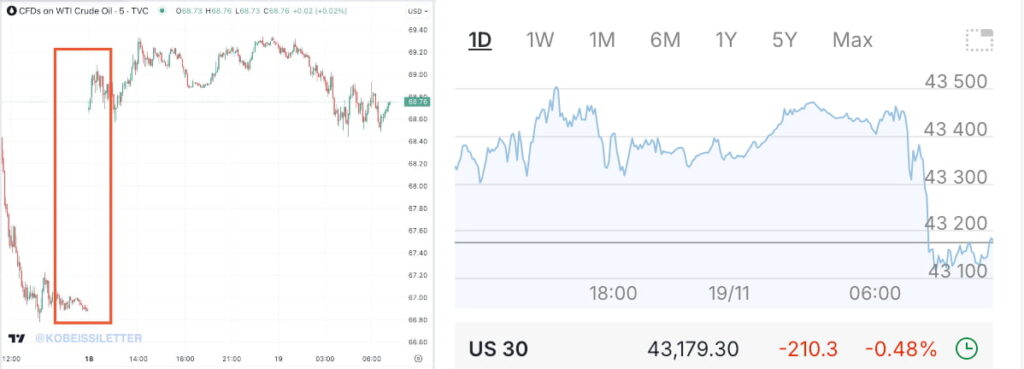

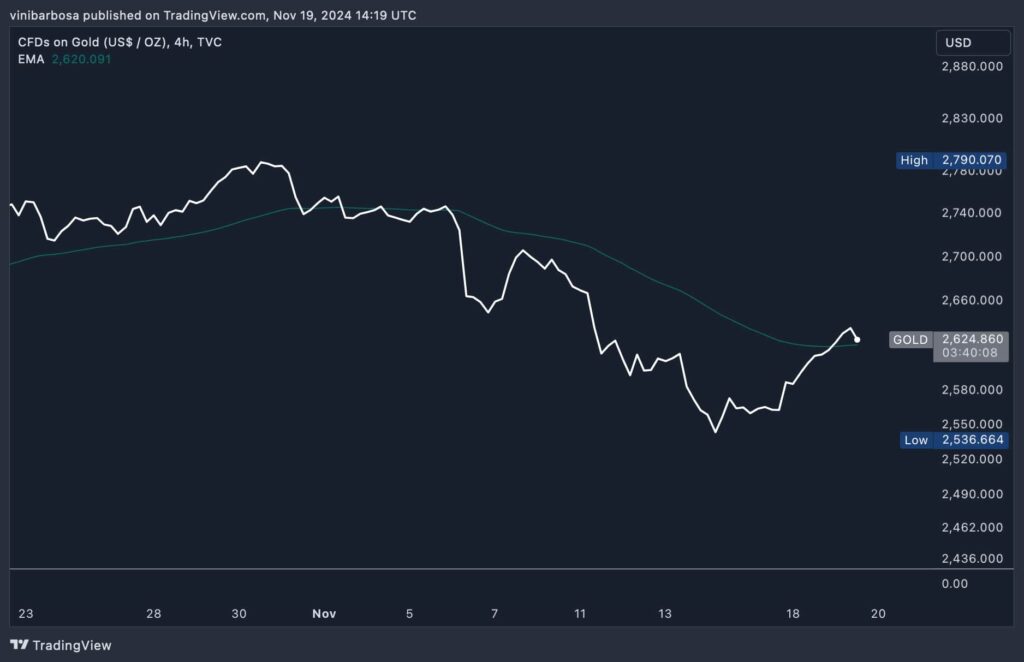

As the conflict intensifies, global markets react. Gold, a traditional safe-haven asset, has surged nearly $100 from its low last week, according to The Kobeissi Letter’s post.

Despite a stronger U.S. dollar, gold prices continue to climb, an unusual behavior for the yellow metal. Goldman Sachs recently projected that gold could rise above $3,000 by 2025, as Finbold reported.

Moreover, oil prices have surged back toward $70 per barrel. Investors are factoring in potential disruptions to oil supply due to the heightened geopolitical tensions. The Dow Jones Industrial Average futures dropped over 200 points following the news of the missile strikes, reflecting growing market anxiety.

Additionally, volatility indexes are on the rise. Markets are grappling with the possibility of prolonged conflict and the implications for global stability. Historical data suggests that while wars cause short-term volatility, markets often rebound.

However, the prospect of nuclear involvement introduces unprecedented uncertainty.

Gold price analysis

Notably, gold is currently trading at $2,624 – retesting the 50-period exponential moving average of the four-hour chart. Holding above this previous resistance could reverse the commodity’s downtrend back to a gold bull market, eyeing $3,000.

Ukraine deploys U.S. long-range missiles against Russia

The use of ATACMS signifies a new phase in the ongoing war. Previously, Ukraine had deployed these missiles only within its own occupied territories. Now, with the ability to reach deeper into Russian soil, including the strategically important Kursk region, the dynamics of the conflict are shifting.

Furthermore, Russian President Vladimir Putin has updated Russia’s nuclear doctrine in response. He stated that any attack from a non-nuclear state supported by nuclear power would be treated as a joint assault on Russia. This policy change escalates the tension and raises concerns about the potential for a broader conflict.

Meanwhile, the Ukrainian military confirmed striking an ammunition warehouse in Bryansk but didn’t specify the weapons used. The attack reportedly caused multiple secondary explosions, indicating substantial damage.

Looking Forward

As markets digest this new reality, the focus shifts to how Russia will react to these incursions. With the Russian Defense Ministry confirming the strikes and President Putin adjusting the nuclear doctrine, the international community watches closely.

“The question now becomes, how will Russia respond?”

The strategic use of ATACMS by Ukraine, capable of striking deep into Russian territory, tests not only the boundaries of warfare but also the resilience of global markets. While gold acts as a buffer against geopolitical risks, the sustained market volatility suggests a prolonged period of uncertainty ahead.

In conclusion, the escalation with long-range missiles has ignited not just a physical conflict but a financial one, where the true cost might be measured in economic stability as much as in human and infrastructural terms.

Featured image from Shutterstock.