Amid the financial world’s debate over which asset is a better option—gold or Bitcoin (BTC)—popular investor Robert Kiyosaki has weighed in with his views on the discourse.

Kiyosaki, the author of the best-selling personal finance book Rich Dad Poor Dad, expressed his frustration about why the debate exists in the first place, he lamented in an X post on September 13.

The financial educator pointed out that the ‘only facts that count’ are the ownership of the assets rather than focusing on which performs better in the market or offers superior technological innovation.

Picks for you

“I don’t get it. Why all the debate about what is better? Gold or Bitcoin? In my opinion the only facts that count are how many gold coins do you own and how many Bitcoin? End of discussion,” he said.

The Bitcoin vs. gold debate

It’s worth noting that the debate between Bitcoin and gold revolves around factors related to their roles in financial markets. Due to its scarcity, similar to that of precious metals, Bitcoin has often been dubbed “digital gold,” having recorded massive growth in a short period.

However, critics argue that due to Bitcoin’s historically high volatility, it’s a risky asset for consideration as a store of value, ruling out the possibility of the cryptocurrency cushioning investors during economic hardships.

On the other hand, gold has acted as a consistent store of wealth for decades but lacks the disruptive potential and growth trajectory that Bitcoin offers.

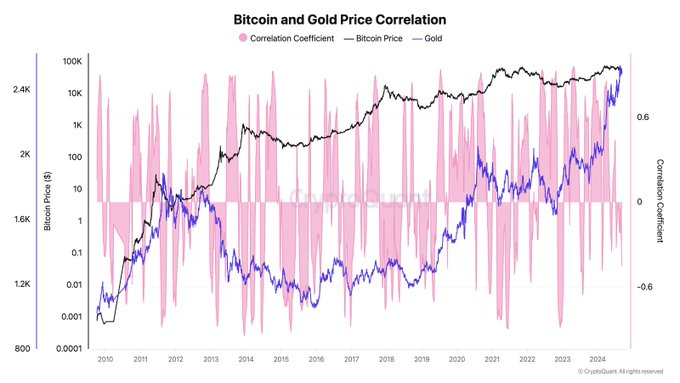

Meanwhile, data shared by a crypto analyst with the pseudonym TheDustyBC in an X post on September 13 showed a strong positive correlation between the prices of Bitcoin and gold. The data, sourced from the crypto analysis platform CryptoQuant, indicated that the relationship between the two assets had fluctuated historically, with the correlation coefficient swinging between positive and negative values.

However, 2024 shows a rising alignment, with the coefficient nearing 0.6.

Indeed, the data tracked Bitcoin’s growth from its early days to the current valuation, alongside gold’s steady increase. Therefore, with a positive correlation emerging, it can be deduced as a signal of Bitcoin’s maturity as a possible store of value akin to gold.

Kiyosaki’s Bitcoin and gold advocacy

Elsewhere, Kiyosaki has long advocated alternative financial assets, recommending that investors hold both gold and Bitcoin. He maintains that these assets will offer protection, especially as he projects an impending financial market crash.

The author has consistently warned that the “biggest crash in history” is imminent. In this line, Kiyosaki shared what he termed the “five Gs” needed to survive the downturn: gold, grub (food, as “the Fed cannot print cattle”), ground (real estate), gasoline (oil wealth, but not oil stocks), and guns, as “every small war turns into a big war,” Finbold reported on September 10.

Overall, the debate between Bitcoin and gold will likely rage further, considering the cryptocurrency is still maturing while proponents maintain that its full potential has yet to be realized.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.