Gold’s rally in 2024 has been nothing short of historic. The yellow metal has reached new highs, recently trading at a peak of $2,790 for the first time in history.

With this momentum, attention has turned to how far gold can go in 2025, making its price a key area of focus.

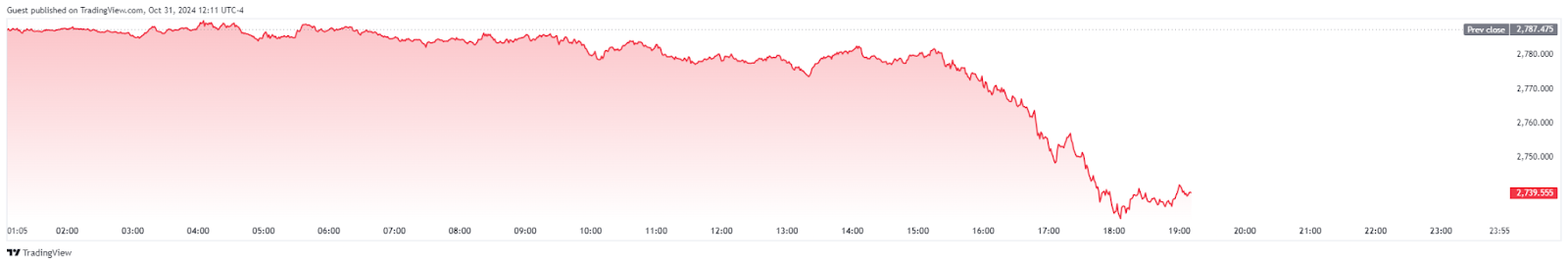

One aspect that has emerged is that gold markets remain bullish in the long term despite a short pullback during the October 31 trading session.

The metal traded at $2,736 at press time, plunging about 1.7% in the past 24 hours. Year-to-date, gold is among the best-performing commodities, rising 32%, marking lucrative returns for investors.

Gold’s 2025 price outlook

Looking ahead to 2025, Goldman Sachs Research commodity strategist Lina Thomas shared insights on what to expect.

Thomas noted that central banks’ accumulation of gold in recent months may have boosted the metal’s price growth in 2024, alongside traditional drivers like the commodity’s relationship with interest rates.

Historically, as a non-yielding asset, gold loses investor interest when rates are high and becomes more desirable when rates fall. Indeed, recent momentum accelerated after the Federal Reserve implemented its first rate cut in four years amid escalating geopolitical tensions in the Middle East.

Thomas projects that the metal will likely reach a valuation of $3,000 per ounce by the end of next year.

According to the strategist, the upcoming United States presidential election is one key driver for this bullish outlook. She noted that the uncertainty surrounding the poll outcome might push investors toward traditional safe-haven assets like gold.

“Long-term investors are now interested in holding gold because rates are lower. “At the same time, central banks holdings are probably still going to pile up,” she said.

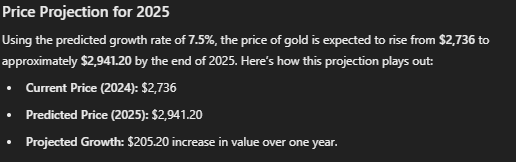

To gather further insights on gold’s potential for the coming year, Finbold consulted OpenAI’s ChatGPT-4o.

Using a projected growth rate of 7.5%, the AI tool’s analysis shows that gold might align with Goldman Sachs’ target, potentially trading at $2,941 by the end of 2025.

In the same breadth, with gold largely bullish, a previous Finbold report noted that 2025 might be an ‘extraordinary’ period for the metal, as the S&P 500 to gold ratio signals a potential turning point for gold’s trajectory.

Gold’s technical outlook

Commodity trading expert Zafar Shaikh, on the other hand, provided a technical outlook for gold. In an X post on October 31, Shaikh highlighted two critical Fibonacci extension targets at $2,797 and $3,528.

With gold nearing the $2,797 mark, he warned there are signs of a brief pause in its upward momentum.

However, the market analyst remains optimistic, projecting that gold could surge to $3,528 in the coming year.

For now, attention remains on how the metal interacts with the $2,800 resistance; consolidation below the level could trigger potential sustained losses.

Featured image:

NAOWARAT– 14 June 2023. Digital Image. Shutterstock.