Gold’s 2024 rally recently faltered, casting doubt on the metal’s $3,000 record-high target.

Now, referencing current market trends, the $3,000 target is back in play, supported by key underlying fundamentals likely to push the precious metal to new highs in 2025, according to Bloomberg Intelligence Commodity Strategist Mike McGlone.

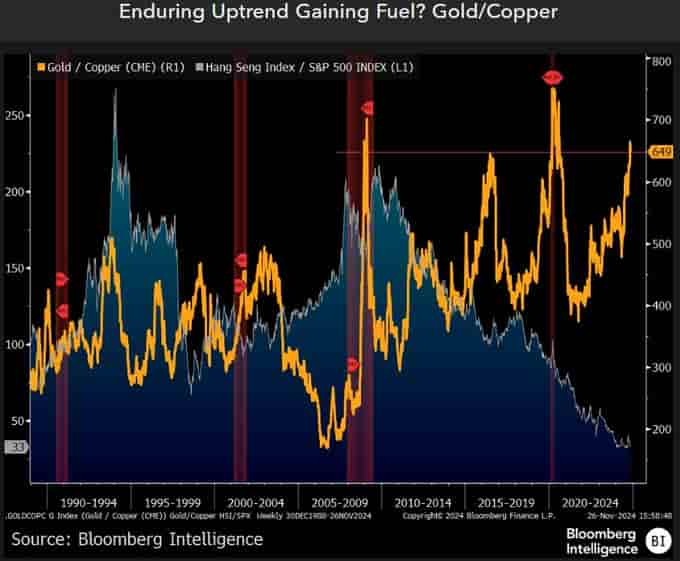

In an X post on November 27, the strategist noted that gold and copper reached new highs in 2024, yet due to macroeconomic and geopolitical factors, gold could outperform in 2025.

McGlone highlighted unfavorable geopolitical trends—specifically China’s alignment with Russia—as a headwind for industrial metals like copper. However, the potential for a shift in U.S. leadership and policies to reduce trade imbalances could further enhance gold’s appeal as a safe haven.

While copper could remain under pressure, gold may gain strength relative to most commodities. The analyst noted that any reversal in unfavorable trends could support industrial metals, but gold’s momentum remains dominant heading into 2025.

More gold bullish stand

On the other hand, a price prediction from banking giant Goldman Sachs (NYSE: GS) supports McGlone’s outlook for a $3,000 target. As reported by Finbold, the bank views the new high as achievable in 2025, driven by U.S. fiscal instability, rising geopolitical tensions, and increased central bank buying.

Similarly, Bank of America (NYSE: BAC) strategist Michael Hartnett noted that gold could breach the $3,000 resistance after the 2024 rally pushed the commodity to a record high of $2,700.

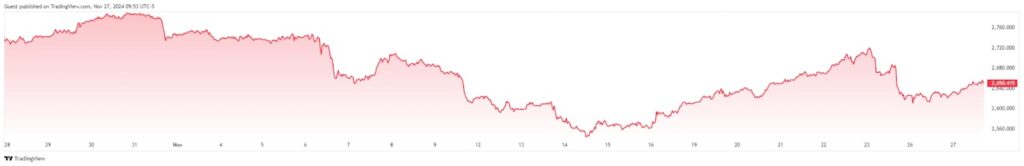

Meanwhile, dissenting voices are less optimistic. For instance, trading expert Rlinda cautioned that gold had entered a sell-off phase that could see its price target at the $2,530 support zone. This warning followed a notable drop on November 25, driven by news of a possible ceasefire between Israel and Hezbollah in the ongoing Middle East conflict.

Gold price analysis

As of press time, gold has rebounded from Monday’s dip, trading at $2,653 and rallying 0.80% in the last 24 hours. However, the metal remains down over 2% on the monthly chart.

From a technical perspective, analysis by Gold Predictors suggests that the perennial inflation hedge is consolidating within the $2,500–$2,600 range, trading near strong resistance in an ascending channel on the weekly chart. This price action indicates sideways movement with increased volatility in the short term.

In this context, a sustained breakout above $2,600 could signal further upside, while a pullback might test lower support near $2,400 within the ascending channel.

In summary, gold has the potential to climb higher toward $3,000 if the fundamental factors remain steady moving into 2025 while maintaining its price above the $2,600 support zone.

Featured image via Shutterstock