As the advances in the artificial intelligence (AI) sector, triggered by the invention of ChatGPT by OpenAI and furthered by Google Gemini, as well as other popular AI products, continue, the technology has demonstrated its usefulness in analyzing trends in various markets, including gold.

Taking into account such instrumental assistance in projecting prices of assets and commodities like the popular precious metal, Finbold asked the generative conversational AI innovation by Google (NASDAQ: GOOGL) where it saw the price of gold moving by the end of this year.

Google Gemini gold price prediction

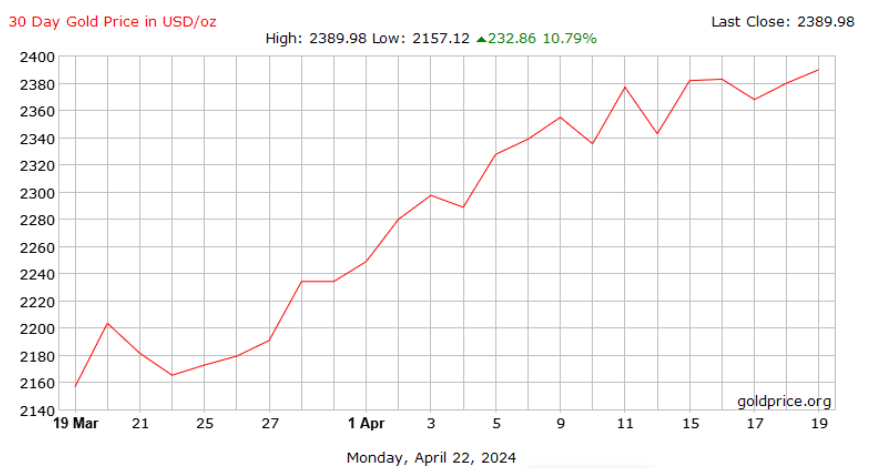

As it happens, Google Gemini has observed that “gold has already surpassed some year-end predictions due to a strong rally in early 2024,” including those that were clustered around $2,000 – $2,200,” as gold has recently again hit its new all-time high (ATH) and is currently trading at $2,375, as of April 22.

Furthermore, based on available data, Gemini has offered a low-end prediction that stands at $2,000 per ounce, “assuming a correction after a recent surge,” as well as a high-end forecast at $2,500 per ounce, “based on optimistic forecasts and ongoing geopolitical tensions.”

At the same time, the AI chatbot highlighted a couple of important caveats when predicting gold’s price, including the precious metal’s volatility and the possibility of unexpected turns of events, therefore making a precise gold price prediction an exceptionally challenging task:

Gold price analysis

Meanwhile, the price of gold at press time stood at $2,359.8 per ounce, recording a 1.67% decline from its recent ATH of $2,399.91 it had hit on April 12, and a drop of 1.23% on its daily chart but, nonetheless, achieving an increase of 2.01% across the week, and advancing 10.79% over the past month.

So, why is gold down today? Notably, one of the reasons for gold’s sudden tumble in the last 24 hours could be the signs of easing of geopolitical concerns that have pushed investors to switch their interests elsewhere – particularly toward stocks and other risk assets.

Indeed, as ActivTrades senior analyst highlighted in a recent note to clients:

“With tensions in the Middle East showing signs of easing, the market’s attention shifted towards assessing the resilience of the US economy and the persistent grip of inflation.”

All things considered, Gemini’s gold prognoses might be on the right track, but Google’s AI platform is just that – an AI platform – and it should not serve exclusively as a predictor of gold’s price at the end of 2024. Investing is risky, so doing one’s own research and weighing these risks is critical.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.