Compound interest might sound innocuous, but it can be the right tool to grow your wealth exponentially. It can be used for different financial assets, such as retirement savings, emergency funds, or stock market investments, to accelerate growth with time. Regardless of your goals, with enough time, patience, and consistency, compound interest has the potential to turn rags to riches.

However, you need to understand compound interest to utilize it successfully. Here, we will briefly explain the basics of the concept and some ways to use it and grow exponentially richer.

Understanding compound interest

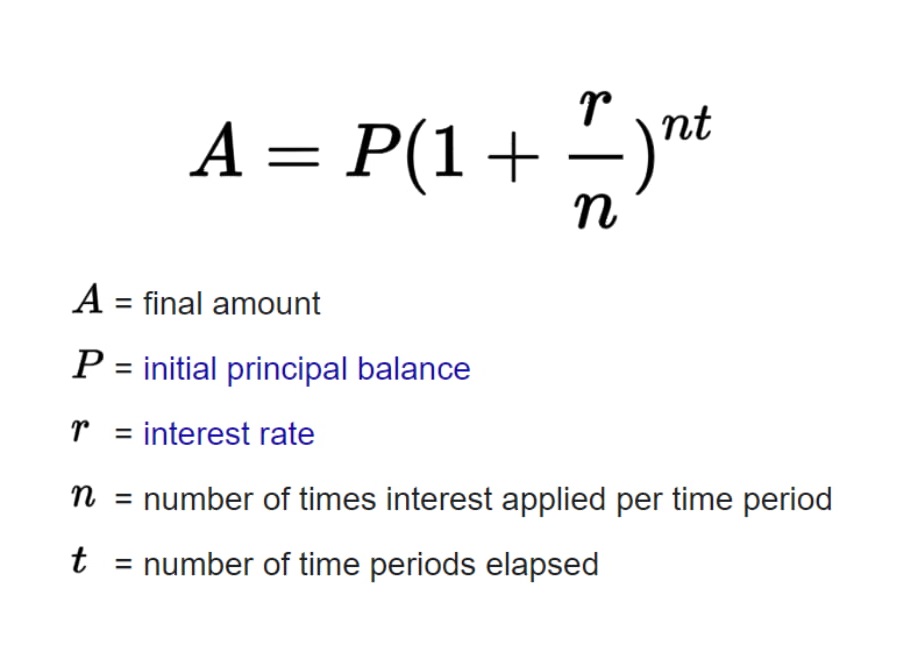

The formula might look complex, but it’s easy once you get into it:

Alternatively, you can use the rule of 72 to estimate how long it will take for your principal to double in value. All you have to do is to divide 72 by your rate of return. For example, if you have $1000 that is earning a 6% return, it would double and become $2000 in (72 / 6) years, which is 12 years.

Recommended video: Compound Interest Explained in One Minute

Interest can be calculated over various periods, such as annually, semi-annually, quarterly, or even daily. The more frequent the period, the faster the investment grows.

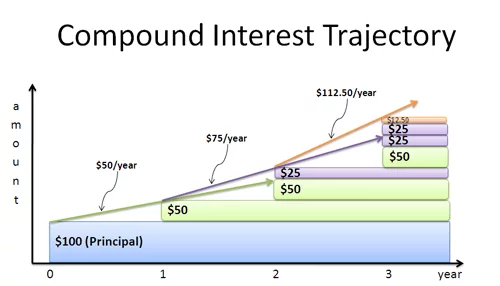

How compound interest grows your wealth exponentially

Compound interest has applications on various financial assets, including investment and savings accounts, dividend stocks, CDs, and bonds. However, the essence remains the same: the longer you compound, the more you will earn over time:

Compound interest pros and cons

Pros

- Building long-term wealth: Compound interest benefits savings and investments, as your returns earn returns, and not just your principal;

- Extra loan repayments: Paying more than the minimum payment on your rate allows you to leverage compounding and save on total interest;

- Anulls wealth erosion: The exponential growth of this interest allows you to mitigate heightened cost of living or inflation.

Cons

- Works against high-interest debt: If you pay the minimum rate on your high-interest debt, compounding interest can make the total debt grow, plunging you into a debt spiral;

- Complex calculation: Calculating compound interest is much more complicated than calculating simple interest. Luckily, there are online calculators that offset this;

- Eligible for taxation: Earnings gained this way are taxable (if not stored in a tax-sheltered account).

The bottom line

Ultimately, compound interest allows you to leverage time and patience to grow your wealth exponentially. Hopefully, we have revealed its secrets to you: calculating the amount you can earn is relatively easy, and you can see for yourself how powerful it can be.

Reinvesting your returns is a universally accepted rule of thumb, and that is precisely what compound interest does; however, remember that it can sometimes work against you. Make sure you do your own research before investing!

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.