Web3 has been fascinating in that we are seeing brand new elements of an industry, while at the same time seeing some of the tried and true elements of finance that have been a part of TradFi for centuries. The global connectivity, borderless ecosystems, and fully decentralized elements are true innovations that will transform how we work together. However, the basic financial instruments used to build up and track the Web3 market are similar in many ways to those we use today.

There is a third category in this comparison: those items in Web3 that seem similar to TradFi items on the surface, but that have a much broader purpose in how they are used. We can see this especially in various forms of tokens, whether they are a cryptocurrency, utility token, or an NFT.

Tokens can be used as a form of currency, like cash. They can also be used to take part in governance, or participate within a network. They can have value on their own, or represent permission/access to some network activity. And as Web3 ecosystems grow, we are starting to see their use as an index asset.

Let’s dive into this last element, first exploring what an index represents in the Web3 context, how a token can take on an index context, and what potential risks there might be in making an index token too large a portfolio item. Because of its strong growth and activity, we will use Andromeda’s $ANDR as a case study for the emerging Web3 Index Token.

What makes an index token?

Before we look at the power of index tokens, we need to clarify exactly what one is. In TradFi, an index fund is that which invests in a representative sample of companies that make up the entire market. The S&P 500 invests in the top 500 companies, while the Dow Jones invests in 30 large companies in the market.

With these, along with other index funds, the goal is the same: to invest in the growth of the market as a whole. Not every company can do well all the time, but the market tends to grow over time, making this a strong long term investment. No one will get rich quickly using an index fund, but there are few if any long term investment strategies stronger than betting on the index.

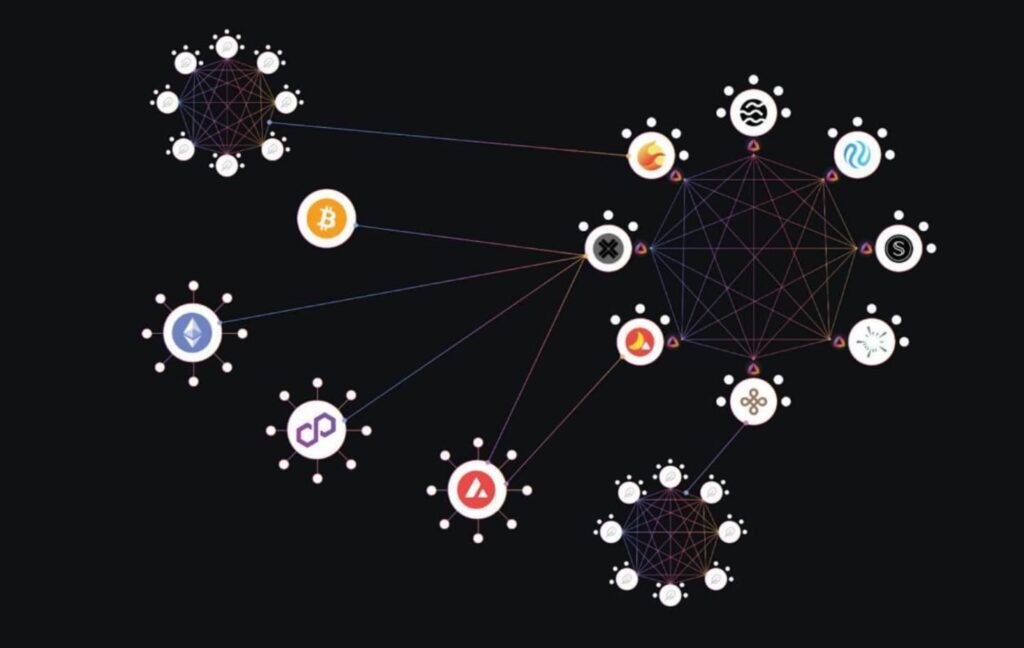

With Web3, the idea is the same but the details are a bit different. For one thing, there are many different markets across Web3. Each of these ecosystems has its own L1 foundation, with many different offshoots in the form of L2s, parachains, or other networks that rely on the base chain. This base chain has a consensus method, security, and block creation that all of its smaller elements rely upon.

To be considered an index token, a token must represent a large, diverse, and ultimately a growing ecosystem of platforms. It must be able to measure the overall rise and fall of the ecosystem, never affected significantly by any one part of that ecosystem.

This is where the Andromeda ecosystem becomes even more interesting. Instead of serving as just an L1 chain, Andromeda has developed one of the first Web3 operating systems, called aOS. It was meant to be used by anyone, creating an easy building block style using ADOs, or Andromeda Digital Objects, to build up complex functionality with minimal effort. It was meant to reach across blockchains through the use of Inter-Blockchain Communication (IBC), which transports lightweight configuration data from chain to chain, connecting any chain in the Cosmos with any other project. This ecosystem then grows out much more than a typical chain, creating the diversity necessary for Andromeda’s $ANDR to call itself an index token.

Beyond the index

Given this, how is $ANDR a true index token and how does Web3 allow it to go beyond what an index instrument normally is? Like many different Web3 ecosystems, $ANDR powers the transactions and interactions of its different players. However, since it does this for any chain or project that is built using Andromeda’s aOS, this reach is much more broad. This creates a true index because the token is an active, necessary part of operating these growing elements of the ecosystem, and the diversity of the different projects is critical to measuring the overall growth of the ecosystem, if not the Web3 industry as a whole.

What takes $ANDR beyond just a normal index asset is the Web3 element, along with its ties to aOS. Whereas a normal investment just sits there and represents the value of a certain company or index, a Web3 token is utilized constantly to power transactions, communication, rewards for network participants, and more. It is more than a currency because it has multi-faceted utility.

This element of Web3 makes index tokens much more interesting than TradFi index funds. For Andromeda specifically, its heavy investment and innovations toward a true Web3 operating system have already shown strong results, with more and more projects building using aOS. This means that more projects will be regularly circulating $ANDR as they operate, increasing its value; and that as these projects grow outward, the token will more likely experience exponential growth that positively reinforces itself: networks that attract more partners and builders create more utility, thus attracting even more users.

Index token risks

So what can go wrong with index tokens? While they can be a powerful part of any Web3 portfolio, it’s important to stay diligent and watch for potential risks. In the case of Andromeda, the risks are typical of any other index token. First, it may seem obvious but it’s important to note that an index should reflect the larger ecosystem and if possible, the market as a whole.

If the Web3 market is on the rise and growing, this bodes well for the index. In times of bear markets, this could result in drops to an index token’s value. As mentioned above, index tokens aren’t meant for short term investors, but rather for those with a long view of the market.

The other risk is to the specific ecosystem itself. It’s important to understand the tokenomics of a given platform to ensure there is little risk of rug pulls, of centralized corruption risks, or other red flags that can hit Web3 platforms. In Andromeda’s case, there are positive signs here as only a small portion of total tokens are in supply, and the vesting and release plans will most benefit those who hold tokens for a longer time period, which ensures that investors’ interests are aligned well with the long term benefit of the ecosystem.

Wrapping up

While index tokens are a newer element to Web3, they are already showing tremendous promise as a key element to a diverse and healthy portfolio. Since tokens also rely on utility, there are more opportunities for the tokens to spread into many hands, and as long as the ecosystem continues to grow, the value of the token will likely grow as well. We will likely see more index tokens establish themselves across Web3, and perhaps someday even see a few that represent the entire Web3 industry.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.