Summary: Futures are financial contracts that derive value from changes in the underlying asset’s price, allowing traders to potentially profit from both downward and upward price fluctuations. In this guide, we’re talking about futures trading on PrimeXBT.

What is PrimeXBT?

PrimeXBT is a trading platform that offers contracts for differences (CFD) trading for a range of assets (including cryptocurrencies, Forex, commodities, and indices) as well as a variety of crypto futures, including Bitcoin, Ethereum, and Litecoin. The platform puts a strong emphasis on copy trading, allowing users to replicate trading strategies employed by more experienced traders.

PrimeXBT futures trading

On PrimeXBT, users can also trade 8 different crypto futures contracts, which are contracts or agreements that oblige you to buy or sell a specific cryptocurrency at a predetermined price at a future date. This allows users to speculate on crypto price movements without owning any underlying assets.

When you actually own cryptocurrencies, their value changes due to the volatile nature of the market. That is, if the price of the asset decreases, the value of your portfolio likewise goes down. However, when trading crypto futures, you can enter a “long” position, betting that the price will rise, or a “short” position, betting that the price will fall. In other words, you can potentially profit regardless of market direction.

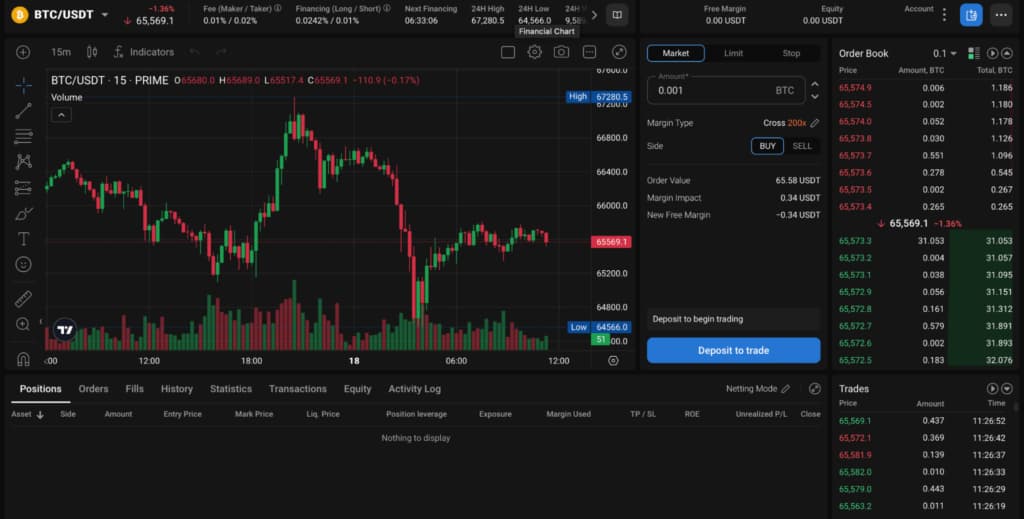

On PrimeXBT, users have access to an order book that displays bid and ask depth, helping them gauge the market profile and detect potentially lucrative positions held by prominent players. The user interface is customizable and features a watch list, pending order management, integrated TradingView charts, etc.

Leverage

Among the more notable trading features on the platform is an adjustable leverage system. Namely, PrimeXBT allows for leverage of up to 200x on cryptocurrencies like Bitcoin (BTC), Dogecoin (DOGE), and Solana (SOL). This lets traders tweak their positions to match their risk appetite and profit objectives.

The leverage system also allows users to switch between cross and isolated margins for greater risk management. “Stop loss” and “take profit” orders can help users modify leverage and other parameters after opening their position.

How to trade futures on PrimeXBT

To start trading futures on PrimeXBT, follow these simple steps:

- Create a PrimeXBT account: First, register an account with PrimeXBT. Simply go to the PrimeXBT website, click on the register button in the upper right corner, and follow the registration instructions or alternative sign in using your Apple or Google account;

- Fund your account: Next, fund your account via your preferred deposit method. Depending on their location, users can fund their accounts on PrimeXBT through direct crypto transfers from their personal wallets, utilize fiat-to-crypto exchange services, or deposit cash directly;

- Choose the futures market: Select your desired futures market from the dropdown menu in the PrimeXBT futures trading dashboard;

- Customize the trade: Customize your trade according to margin and other parameters and click Buy;

- Monitor your trade: Track your order to ensure it’s performing as expected.

Pros and cons of crypto futures

There are a lot of advantages to futures trading. However, it also comes with a fair share of risks, so having a solid trading plan is essential.

Some of the main advantages of futures trading are:

- Hedging: By trading futures, traders can prevent potential losses and provide a safety net against market volatility, as futures allow traders to profit from market fluctuations in both directions;

- Liquidity: Crypto liquidity ensures traders can enter and exit positions with minimal slippage;

- Leverage: Leverage in futures trading can magnify gains, allowing traders to open larger positions with a smaller capital outlay;

- Diversification: Diversifying with crypto futures can help ensure your portfolio is more resilient in case some of your other assets fail to perform as expected;

- Arbitrage: Traders can buy futures contracts at a lower price in one market and sell them at a higher price in another, securing risk-free profits.

On the other hand, key disadvantages include:

- Volatility: Crypto markets are known for their high volatility, which can lead to substantial gains but also poses the risk of large losses;

- Leverage: Leverage can amplify profits but also increases the potential for losses;

- Regulatory risk: The crypto futures market is subject to evolving regulatory standards. Changes in regulations can impact the legality and mechanisms of crypto futures trading;

- Counterparty risk: There is always a chance that the other party in a financial contract will not fulfill their financial obligation;

- Overtrading: Overtrading, or engaging in too many trades without a clear strategy, can erode profits through fees and lead to poor decision-making.

Conclusion

Cryptocurrency futures are a compelling way to engage with the cryptocurrency market without having to own the underlying assets themselves, as price fluctuations in both directions can create opportunities for profit, strategic investment, and portfolio diversification.

However, understanding the advantages and risks of futures is essential, as it allows traders to navigate the market more confidently. Whether you’re a newbie to trading or looking to diversify, crypto futures can offer a versatile and dynamic growth opportunity, provided you trade with a verified broker and do a lot of research.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs about PrimeXBT futures trading

What are futures in trading?

Futures are financial contracts that oblige the trader to buy or sell an asset at a predetermined future date and price.

What crypto futures can you trade on PrimeXBT?

On PrimeXBT, you can trade 8 crypto futures, including Bitcoin, Ethereum, and Litecoin.

Is futures trading risky?

Futures come with leverage, market volatility, and liquidity risks. The riskiest aspect of futures trading is leverage, which allows you to enter a large position with a small capital. While this can amplify gains, it also magnifies losses.

Are there crypto futures on PrimeXBT?

Yes, PrimeXBT offers crypto futures trading.

How do I open a futures trading account on PrimeXBT?

You can trade futures on PrimeXBT with a regular trading account.

Can you trade crypto futures on the PrimeXBT mobile app?

Yes, crypto futures are available on the PrimeXBT mobile app.

Can you trade futures on PrimeXBT in the US?

No, PrimeXBT is not available in the US.

![PrimeXBT Futures Trading [2024] A Guide for Beginners](https://assets.finbold.com/uploads/2024/06/PrimeXBT-Futures-Trading-2024-A-Guide-for-Beginners-1.jpg)