Sometimes, there’s a thin line between picking a promising tech start-up stock with the potential to reshape the market and a quirky company selling glittery dust. It can be incredibly difficult to keep faith in a product with a still non-existent market—almost as complex as creating a new market from scratch. After all, countless tech start-ups sank as investors abandoned ship and their products never saw the light of day.

This could have been the story of this company, as mere days separated it from bankruptcy, not once but twice. Today, that tech start-up stock is one of the most recognized names in the tech industry. Today’s ultimate comeback story is Tesla (NASDAQ: TSLA).

The near-fatal Christmas Eve of 2008

You might not be familiar with the fact that December 2008 could have been the end for Tesla. Christmas Eve would have been the day the company ran out of money to cover the payments, and three days later, it would have to file for bankruptcy.

A crucial investor, VantagePoint Capital, led by Alan Salzman, resisted Tesla’s lifeline bid to raise $20 million and keep the company afloat due to the strategic direction of the company. Allegedly, Salzman wanted to shift Tesla towards supplying batteries to traditional car manufacturers and give up on electric vehicles like other major car industry players.

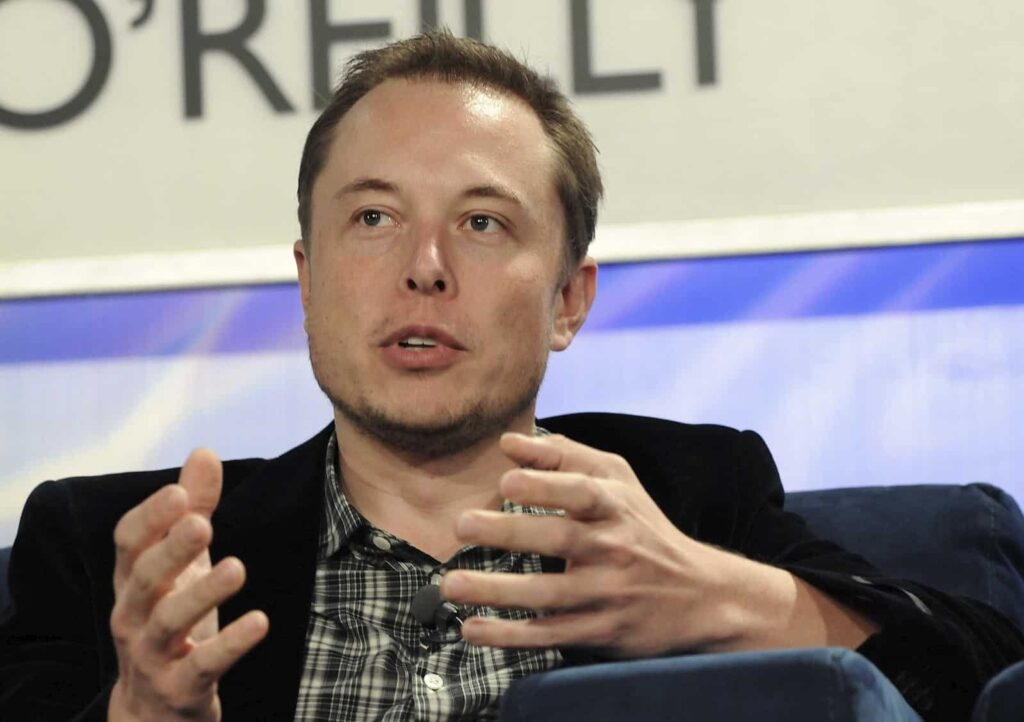

Elon Musk fiercely opposed this, but Salzman had the power to veto the crucial investment round. At the last moment, a meeting with a restructured financing plan was scheduled. Ultimately, the agreement was reached, and the company missed its demise by a thread.

Musk later stated that, had things gone the other way around, Tesla would be dead, and the entire electric car industry would not have taken off for many years as carmakers worldwide discontinued their EV efforts.

The “production hell” of mid-2017 to mid-2019

December 2008 would not be Tesla’s last financial struggle; according to Musk himself, the period between mid-2017 and mid-2019 was also difficult for the company.

Tesla went through a cash crunch as mounting losses accompanied production targets for its Model 3 sedan. Unlike its previous luxury vehicle models, the Model 3 was cheaper, and the company had a huge number of pre-orders. In an effort to hit their production targets faster and optimize the manufacturing process, Tesla put significant resources into robotics and automation. However, the move backfired as production encountered massive delays.

The company ended up dangerously close to bankruptcy—again. On August 8, 2018, Elon Musk tweeted that he was considering turning Tesla into a private company. Subsequently, he faced multiple lawsuits, including a securities fraud charge from the SEC, which forced him to resign as the company’s chairman.

By the end of that year, Tesla had solved the production issues, and the Model 3 was the world’s most sold electric car until 2021.

Tesla today

Founded in 2003 and headquartered in Austin, Texas, Tesla is a tech giant employing over 140,000 people worldwide. It is among the world’s most valuable companies, boasts a worldwide recognized brand, and remains within the top ten companies by index weight in the S&P 500.

Tesla has disrupted the automotive industry with electric cars like the Roadster, Models S, 3, X, Y, and the Tesla Semi truck. The company is also spearheading sustainable energy, and it has made strides towards artificial general intelligence (AGI) with projects like Optimus.

Elon Musk, the CEO, co-founder, and former chairman of Tesla is the world’s richest person and among the most controversial. Even without “the Musk effect,” Tesla has a global influence on the market and will likely remain a crucial vector in the future of commerce.

Tesla stock is a component of the Nasdaq-100, S&P 100, and S&P 500 indices. It trades on the NASDAQ under the TSLA ticker symbol.

The bottom line

Although it may be hard to imagine Tesla as a tech start-up nearing bankruptcy, it happened twice. If it happened to Tesla, it could happen to any company. Next time you pick a penny stock claiming disruptive market potential, do the research twice: you might give up on a penny and miss a fortune!

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.