At the intersection of Wall Street and prime-time TV, Jim Cramer, the effervescent host of CNBC’s “Mad Money,” undoubtedly takes center stage. With his dynamic on-air presence and a knack for breaking down complex financial concepts into digestible advice, Cramer has carved out a unique niche in the media landscape. Yet, beyond those signature rolled-up sleeves and a cacophony of buzzers and sirens, just who is Jim Cramer?

In this guide, we will investigate the life and career of Jim Cramer, how he’s amassed his wealth, his estimated net worth, and why he is a figure of both admiration and contention among the American public.

Best Crypto Exchange for Intermediate Traders and Investors

-

Invest in cryptocurrencies and 3,000+ other assets including stocks and precious metals.

-

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

Copy top-performing traders in real time, automatically.

-

eToro USA is registered with FINRA for securities trading.

Who is Jim Cramer?

How much is Jim Cramer worth?

According to Celebrity Net Worth, Jim Cramer’s net worth is $150 million. This includes his lucrative stint as the manager, founder, and senior partner of the hedge fund Cramer Berkowitz, along with his earnings after leaving the fund in 2001 when he transitioned to a career as an author, television personality, and CNBC commentator.

Other notable projects Cramer include serving as the “editor at large” for SmartMoney magazine and co-founding “TheStreet,” a website dedicated to financial news and improving financial literacy.

Cramer has authored several finance books, including “Jim Cramer’s Mad Money: Watch TV, Get Rich,” “Jim Cramer’s Real Money: Sane Investing in an Insane World,” “Confessions of a Street Addict,” and “Jim Cramer’s Get Rich Carefully.”

Now let’s take a closer look at Jim Cramer’s life and accomplishments.

Best Crypto Exchange for Intermediate Traders and Investors

-

Invest in cryptocurrencies and 3,000+ other assets including stocks and precious metals.

-

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

Copy top-performing traders in real time, automatically.

-

eToro USA is registered with FINRA for securities trading.

Jim Cramer’s early life, education, and career

Jim Cramer was born on February 10, 1955, in the Philadelphia suburb of Wyndmoor, Pennsylvania, to Louise A. Cramer, an artist, and N. Ken Cramer, an entrepreneur who owned a business selling packaging supplies to retailers.

Starting in 1971, among his first employments was vending Coca-Cola and, later, ice cream at Veterans Stadium during Philadelphia Phillies games. Even as a fourth-grader, he displayed an interest in the stock market, an enthusiasm he carried throughout high school.

Cramer graduated with high honors, earning a Bachelor’s degree in Government from Harvard College in 1977. While at Harvard, he was president and editor-in-chief of The Harvard Crimson.

Post-graduation, he worked as a reporter for a number of publications, including the Tallahassee Democrat in Florida, where he was among the first reporters to cover the infamous Ted Bundy murders. He later took a job at the Los Angeles Herald-Examiner, penning obituaries.

Unfortunately, during this time, Cramer experienced a major setback when his apartment was robbed, forcing him to live out of his car for nine months. Despite the misfortunes, however, he persisted with his investment practices: “I put $100 into the Fidelity Magellan Fund every month.”

In 1984, Cramer graduated from Harvard Law School with a Juris Doctor degree. During his law school years, he started investing in stocks and managed to pay his tuition from his trading profits. Cramer’s knack for picking successful stocks eventually landed him a role as a stockbroker at Goldman Sachs.

Cramer & Co

In 1987, capitalizing on his knowledge of the stock market, Jim Cramer founded his own hedge fund, Cramer & Co (later Cramer, Berkowitz & Co.). He actively managed this fund from 1987 to 2000, experiencing only one year of negative returns. In 2001, Cramer decided to retire from his hedge fund, having achieved an impressive (alleged) average annual return of 24% from 1987 to 2001 and generating an annual return of over $10 million for himself over these 14 years.

“TheStreet”

In 1996, while managing his hedge fund, Cramer co-founded “TheStreet,” a website offering insights and guidance to the stock market. Cramer is one of the company’s largest shareholders, which, at the peak of the dot-com bubble, saw its market cap soar to $1.7 billion.

In August 2019, “TheStreet” was acquired by TheMaven for $16.5 million.

Mad Money

Now, to the role that made Jim Cramer a household name: “Mad Money.”

The finance program debuted in 2005 and features Cramer sharing his expert knowledge about the markets to advise viewers looking to understand the complexities of the financial world. In his own words:

“My job is not to tell you what to think, but to teach you how to think about the market like a pro. This show is not about picking stocks. It’s not about giving you tips that will make you money overnight – tips are for waiters. Our mission is educational, to teach you how to analyze stocks and the market through the prism of events. I come out every night to help level the playing field, so you can try to have a fighting chance against the big boys, the fat-cat hedge fund managers who think they own the market. To them, the world of investing in stocks is a posh country club. They don’t want to let you in. They don’t want you to know what they know because then you could make money, and they would lose their edge. Mad Money is all about breaking into the country club.”

While “Mad Money” incorporates the typical components of a finance show, like market analysis, stock recommendations, and interactions with business reporters, it is Cramer’s eccentric persona that makes it stand out. With his rolled-up shirtsleeves, he animatedly paced around the TV studio, shouting at the camera and utilizing an array of unusual props to illustrate his points. This unique approach swiftly elevated his fame, surpassing the typical confines of cable news, leading to his guest appearances in movies and on other television programs.

Recommended video: A typical “Mad Money” episode featuring Cramer’s trademark presentation style, as well as various props and sound effects.

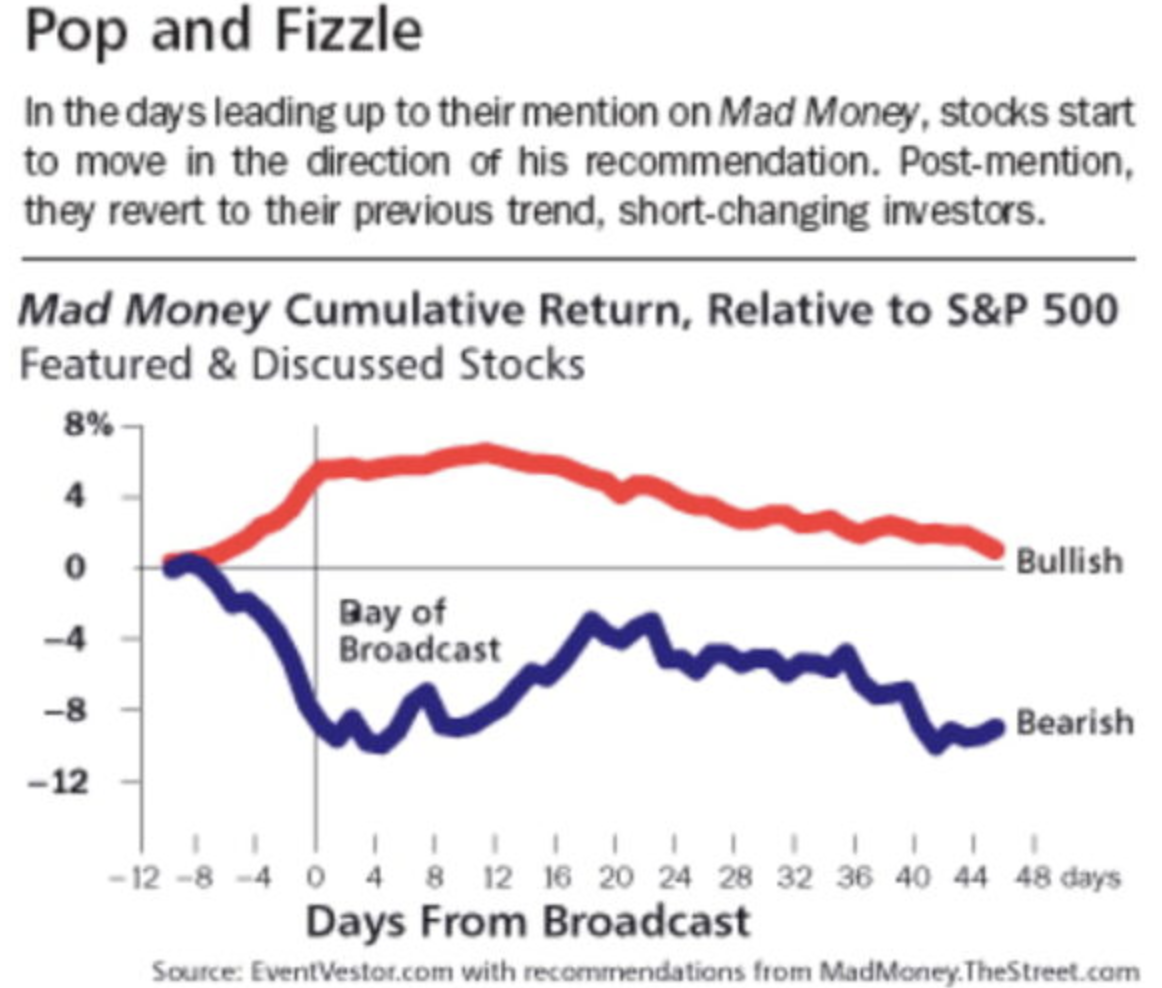

The Cramer bounce

The “Cramer bounce” refers to the immediate overnight surge in a stock’s price after Cramer has recommended it on “Mad Money.” This phenomenon is primarily due to Cramer’s reputation as a seasoned stock-picker, his persuasive on-screen presence, and the tendency of investors to follow popular opinion.

Several studies have documented the market’s response to Cramer’s stock suggestions. For instance, a 2006 study titled “Is the Market Mad?: Evidence from ‘Mad Money’” conducted by Northwestern University revealed that the average cumulative return on Cramer’s recommended stocks was 5.19%. However, notably, almost all these gains disappeared within a span of 12 days.

Cramer is known to recommend stocks showing momentum, either upward or downward. As a result, while his suggestions influence stock prices, this impact usually reverses quickly, aligning with the notion of pricing pressure created by viewers acting on Cramer’s advice. His sell recommendations also influence stock prices, although these effects do not tend to reverse as rapidly.

Controversies

Cramer’s blunt personality and candidness have undeniably contributed to his notoriety. In other words, as the New York Times Magazine noted, he “gets away with a lot,” primarily because he tends to make a lot of money for people, including himself. His catchphrase on “Mad Money” sums up his approach: he’s not here to “make friends, but to make you money.”

As a result, his methods have attracted critics and stirred controversy. For example, in 1995, Cramer was accused of manipulating stock prices after writing about several small-cap companies where he held shares, resulting in a $2 million profit as his audience drove up their value. So naturally, this prompted some to accuse him of having a conflict of interest when hyping stocks that he personally owns or holds in his funds.

In another instance, in March 2008, Cramer responded to a viewer’s question about the stability of investment bank Bear Stearns, stating, “No! No! No! Bear Stearns is not in trouble. If anything, they’re more likely to be taken over. Don’t move your money from Bear.” Unfortunately, this advice turned out to be one of the worst Wall Street predictions, as Bear Stearns’ stock plummeted 92% by March 14 and ended up being sold to J.P. Morgan for $2 a share after trading over $60 a share just a week prior.

Cramer maintained that he was referring to brokerage accounts and not common stock. Still, “The Daily Show” picked up this segment, where host Jon Stewart lambasted Cramer and other financial pundits.

Recommended video: John Stewart slams Jim Cramer

How accurate is Jim Cramer: track record as a stock picker

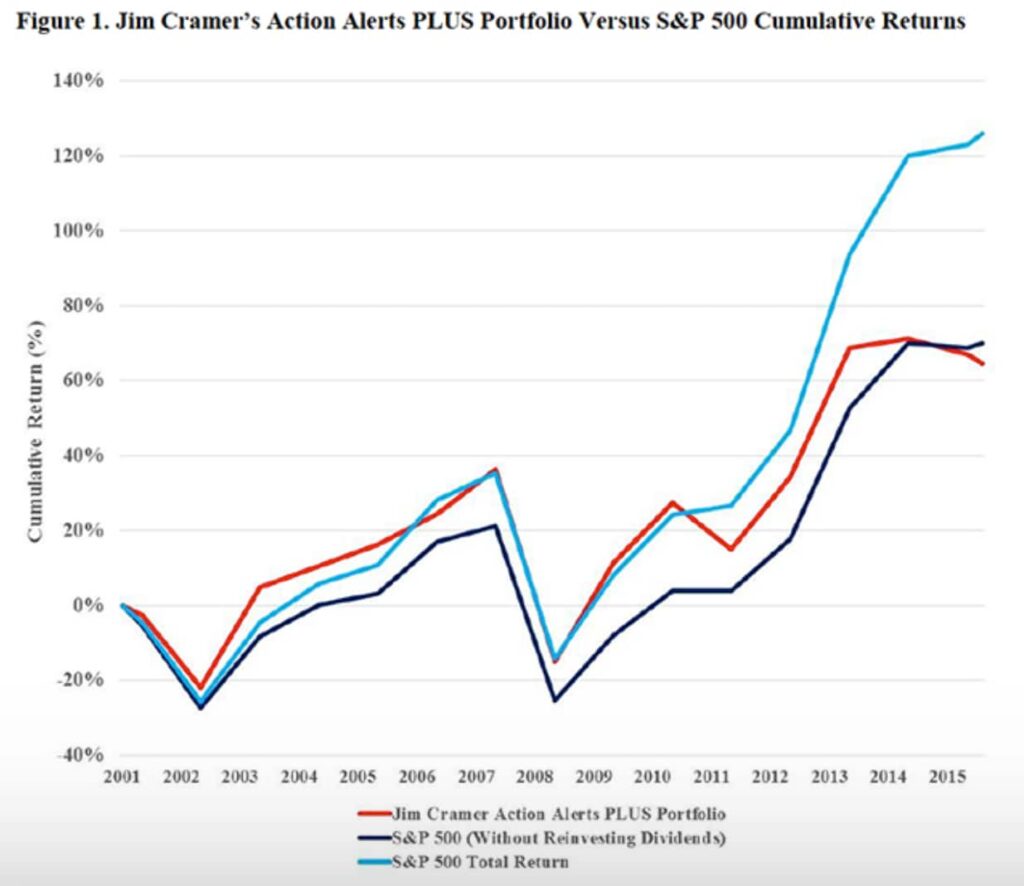

Cramer has also faced criticism regarding his track record as a stock picker. For example, according to a 2007 article by Barron’s, investors who followed Cramer’s advice would have seen just a 12% increase over the previous two years compared with a 22% rise in the Dow Jones Industrial Average (DJIA) and a 16% rise in the Standard & Poor’s 500 index.

Unfortunately, Cramer’s recent performance isn’t much better. For instance, according to a 2016 MarketWatch article, his Action Alerts Plus portfolio (“TheStreet”) has been lagging behind the S&P 500 since its inception in 2001. Moreover, the underperformance seemed to have worsened from 2011 onwards, a year in which the portfolio dropped by 11% while the S&P 500 maintained its value.

In conclusion

With his sleeves perennially rolled up, Cramer is the human embodiment of financial punditry – very loud and surprisingly enduring. His knack for taking Wall Street’s convoluted machinations and serving them up in an engaging and entertaining manner has led him to become a highly recognized figure in television and media.

However, like any public figure, his fame has not come without its share of controversies and mixed opinions. In fact, while he’s amassed a small fortune for himself, his on-air stock tips haven’t exactly been giving the S&P 500 a run for its money. It’s a stark reminder to investors that no financial advice is infallible, no matter how passionately delivered.

Still, one can’t deny his mark in the landscape of financial media. And it’s not just about the madcap antics or sound-bite-heavy approach. Cramer has made strides in humanizing the often impersonal, inaccessible world of finance, and for that alone, he deserves his kudos.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs about Jim Cramer

Who is Jim Cramer?

James Cramer is an American TV personality, ex-hedge fund manager, co-founder of “TheStreet,” and author of several best-selling books. He is most recognized for hosting CNBC’s “Mad Money.”

What is Jim Cramer's net worth?

According to Celebrity Net Worth, Jim Cramer’s net worth is $150 million.

What is "Mad Money"?

“Mad Money” is a TV program hosted by Jim Cramer on CNBC. The show, which first debuted in 2005, is designed to provide entertaining, engaging, and practical insights into the stock market.

How accurate is Jim Cramer?

The accuracy of Jim Cramer’s stock picks is a mixed bag. For instance, during his 14 years at Cramer & Co (the hedge fund he started), he reported annual returns of 24%. On the other hand, a 2016 article from MarketWatch indicated that, since its inception in 2001, Cramer’s Action Alerts Plus portfolio has underperformed when compared to the S&P 500.

How much does Jim Cramer make?

According to Celebrity Net Worth, Jim Cramer’s annual salary from his role at CNBC amount to $5 million. He also earns additional income through royalties and advances from his books.

Where is Jim Cramer today?

Jim Cramer is the of “Mad Money” on CNBC, offering stock market advice and insights.

Who is Jim Cramer's wife?

Jim Cramer’s wife is Lisa Cadette Detwiler. They got married in 2015. Detwiler is a real estate broker and general manager of The Longshoreman, an Italian restaurant in Brooklyn, New York.

Best Crypto Exchange for Intermediate Traders and Investors

-

Invest in cryptocurrencies and 3,000+ other assets including stocks and precious metals.

-

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

Copy top-performing traders in real time, automatically.

-

eToro USA is registered with FINRA for securities trading.