In a sobering analysis for cryptocurrency enthusiasts, veteran trader Peter Brandt casts doubt on the continuation of the current Bitcoin (BTC) bull run, suggesting that a possible peak has already been reached with serious retracements potentially on the horizon.

This assessment, deeply rooted in historical price cycle data, presents a grim outlook for the near future of Bitcoin‘s market value.

Historical patterns and exponential decay

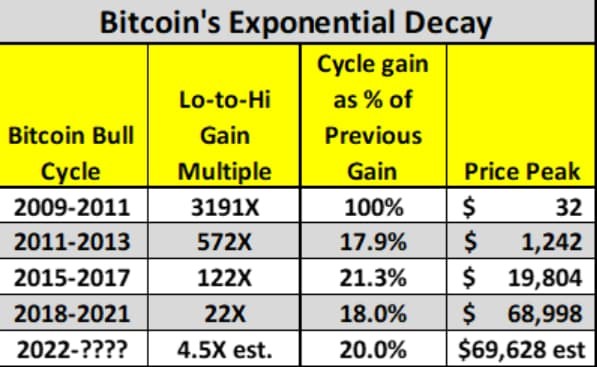

Brandt’s detailed analysis examines the diminishing momentum seen across Bitcoin’s previous bull cycles. According to Brandt, each cycle since Bitcoin’s inception has experienced a sharp decrease in exponential growth, culminating in what he describes as ‘Exponential Decay’.

Specifically, this indicates that the current cycle’s peak might be capped at around $72,723, a figure briefly touched in March 2024.

There have been four major bull cycles in Bitcoin, with the current advance the fifth major bull cycle

Dec 21, 2009 to Jun 6, 2011 [3,191X advance]

Nov 14, 2011 to Nov 25, 2013 [572X advance]

Aug 17, 2015 to Dec 18, 2017 [ 122X advance]

Dec 10, 2018 to Nov 8, 2021 [ 22X advance]

Nov 21, 2022 to xxx x,, yyyy [high so far is $73,835 registered on Mar 14, 2024]

The essence of Brandt’s analysis focuses on the “exponential decay” observed in the growth rates from one cycle to the next, where each cycle’s magnitude is roughly 20% of its predecessor.

This suggests an 80% reduction in growth momentum, indicating a cooling off of the aggressive bullish trends previously seen in Bitcoin’s market behavior.

Now, here is where Exponential Decay is showing its ugly head.

The magnitude of the 2011-2013 was approx. 20% of the 2009-2011 cycle

The magnitude of the 2015-2017 was approx. 20% of the 2011-2013 cycle

The magnitude of the 2018-2021 was approx. 20% of the 2015-2017 cycle

Worded another way, 80% of the exponential energy of each successful bull market cycle has been lost.

Brandt’s data implies that Bitcoin might have already reached its peak for the current cycle and could see a significant downturn, potentially revisiting the mid-$30,000 range seen in previous lows.

However, he also remains optimistic that such a pullback could set up a future rally, akin to historical patterns observed in the gold market, where after significant corrections, long-term gains followed.

Despite his significant investment in Bitcoin, Brandt candidly reflects on the necessity of confronting the data head-on. He states, “The fact is that the bull market cycles in Bitcoin have lost a tremendous amount of thrust over the years,” highlighting the need for data-driven decision-making.

However, the current evidence suggests a 25% likelihood that Bitcoin has reached its peak for this cycle, indicating that investors might need to brace for possible declines or adjust their strategies accordingly.

Insights from experts like Brandt are invaluable for investors in the highly volatile cryptocurrency market. They emphasize the critical role of data-driven decision-making in navigating an ever-evolving financial landscape.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.