Summary

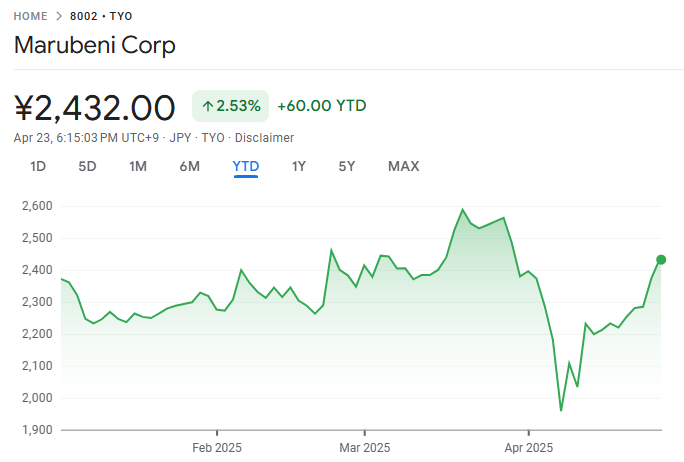

⚈ Marubeni is the only gainer, up 2.53% year-to-date

⚈ Buffett remains optimistic, praising the firms’ discipline and planning further investments.

Warren Buffett’s wager on Japan’s major trading houses, initiated in 2019, has faced a challenging year in 2025, yielding mixed results that are mostly tilted toward the red.

In March, Berkshire Hathaway (NYSE: BRK.A) increased its stakes in the five houses, Itochu, Marubeni, Mitsubishi, Mitsui, and Sumitomo. All of these have experienced notable volatility, with four posting year-to-date (YTD) losses.

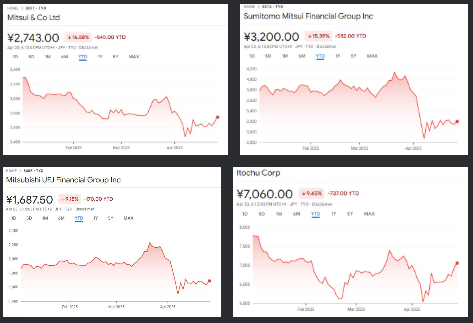

According to market data, Itochu has declined 9.45% year-to-date, trading at ¥7,060 ($49.78) as of the time of this press release. Mitsubishi has seen a similar drop, down 9.15% to ¥1,687.50 ($11.90).

Mitsui and Sumitomo have fared worse, with 16% and 15% YTD losses, trading at ¥2,743 ($19.34) and ¥3,200 ($22.56), respectively.

Marubeni is the only gainer, up 2.53% YTD at ¥2,432 ($17.15).

Buffett’s bullish bet on Japan

Berkshire disclosed it had raised its stakes in the five trading houses by 1 to 1.7 percentage points, bringing its ownership between 8.5% and 9.8%. The March announcement offered a brief boost to the Japanese stock market, which has struggled in 2025.

The move followed Buffett’s praise in his February 2025 shareholder letter, where he commended the firms’ disciplined capital allocation and modest executive compensation compared to American standards.

He also signaled his intention to increase Berkshire’s holdings further, a plan made possible by lifting the 10% ownership cap originally agreed upon when he began investing in 2019.

Berkshire revealed its investment in August 2020, on Buffett’s 90th birthday. The company called the opportunity “confounding” and praised the firm’s dividend growth and diversified operations.

Meanwhile, Japanese stocks have come under pressure from a weakening yen and rising geopolitical risks, partly due to the trade war triggered by the United States.

These developments can potentially slow global trade flows, a key source of revenue for the Asian country’s trading conglomerates.

Ultimately, Buffett’s investments indicate his long-term bet on companies, while disregarding the near-term headwinds facing Japan’s markets in 2025.

Featured image from Shutterstock