Black Monday 2025 — while the term might have been prematurely set, was still an incredibly volatile day for the stock market.

The latest round of tariffs implemented by the White House is increasing the chance of a recession in 2025, at least per prediction markets. Moreover, Wall Street has soured significantly on the S&P 500, with major firms having revised their targets for the benchmark index downward by an average of 16.4%.

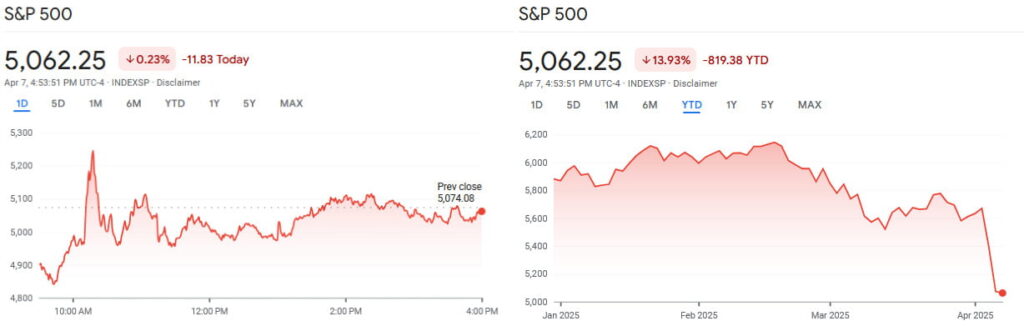

With the day concluded, the index closed at 5,062.25, some 0.23% lower than the day prior. This latest development has brought year-to-date (YTD) losses up to 13.93%.

To call the final results of this session surprising would be an understatement. Moreover, whereas in the last couple of days, everything was in the red, this time around, the gains and losses were anything but evenly distributed. Several major stocks rallied quite a bit, as did a narrow majority of the Magnificent 7.

Tractor Supply Co (NASDAQ: TSCO)

Examining which stocks were hit hardest during Black Monday 2025 — and whether or not they represent buying opportunities at their new, reduced prices, brings up Tractor Supply Co (NASDAQ: TSCO), headquartered in Tennessee.

TSCO was the worst-performing stock in the S&P 500 on Black Monday 2025.

Despite the name, the company does not sell tractors — but it does sell everything else you could think of that has to do with agriculture, from tools to animal feed and tillers. Unsurprisingly, all of those products are exposed to tariff risks. TSCO shares lost 5.82% in value on April 7, having seen prices drop from $52.40 to $49.35.

Despite the move to the downside, Tractor Supply Co stock remains a consensus ‘Moderate Buy’ per the 19 analysts who track the stock and issue ratings for it. The average 12-month price forecast for TSCO stock currently sits at $56.24, which equates to a 13.96% upside.

While readers should note that it is highly likely that analysts will revisit their coverage in the coming weeks, the main cause of the stock’s move to the downside — Trump’s tariffs, was not an unknown factor before they went into play. Wall Street might well revise its projections for Tractor Supply downward, but we’d be surprised to see significant cuts.

Stanley Black & Decker (NYSE: SWK)

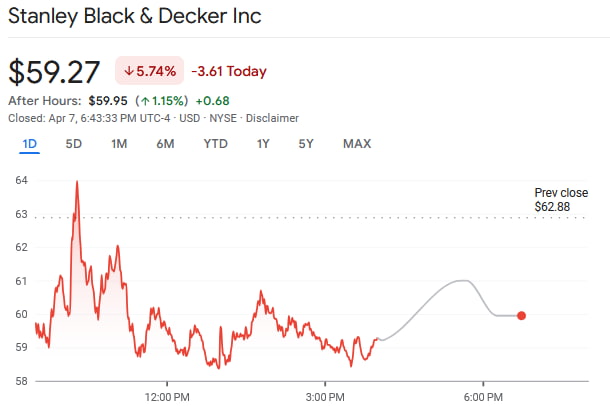

Stanley Black & Decker (NYSE: SWK) is a business that owns some of the most popular brands of power tools in the world. Unfortunately for holders of SWK shares, the company has a rather large manufacturing footprint in Asia, and, just like the previous entry on this list, is at significant risk from the escalating trade war.

On Black Monday 2025, SWK stock lost 5.74% in value, having dropped from $62.88 to $59.27.

Stanley Black & Decker stock remains a consensus ‘Moderate Buy’. At present, 9 equity researchers cover the stock. With an average price target of $101, which implies a 70.41% upside, SWK shares could represent a buying opportunity.

At its new, reduced price, Stanley Black & Decker shares are trading at a forward price to earnings (P/E) of just 11.17. While readers should keep an eye out for analyst revisions in the days and weeks to come, the stock definitely deserves attention as a potential long-term value play.

Genuine Parts (NYSE: GPC)

Genuine Parts (NYSE: GPC) is chiefly the business of providing automotive replacement parts and accessories, with some exposure to industrial parts as well.

Here’s the issue — roughly 45% of the vehicles sold in the U.S. are imported. To make matters worse (for GPC, at least), the country imports $93.5 billion worth of automotive components# on an annual basis. Once again, a huge tariff risk.

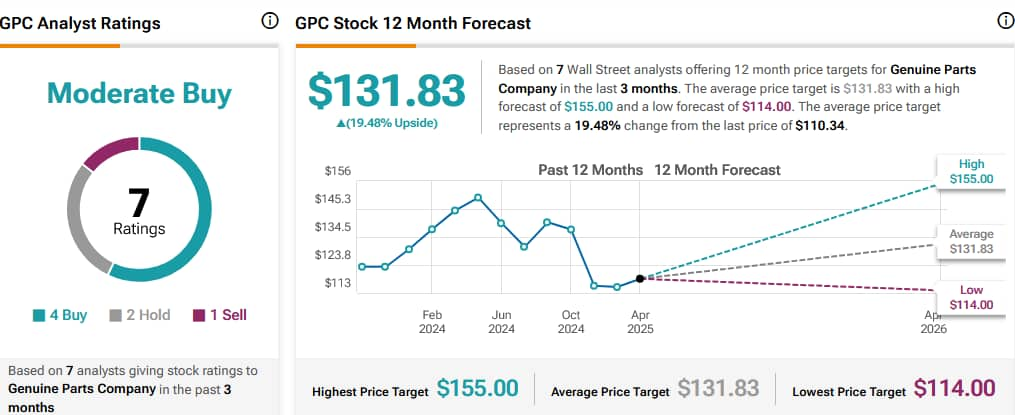

Genuine Parts shares closed at $110.34 on Black Monday 2025, down from $116.81 a day prior. This 5.54% move has erased all the gains made since the start of the year — GPC stock is currently down 4.93% on a year-to-date (YTD) basis. Not great, but not terrible either.

Currently, Genuine Parts shares enjoy a ‘Moderate Buy’ consensus rating from the 7 Wall Street analysts who issue ratings. The average 12-month price forecast is pegged at $131.83, a figure that represents a 19.48% upside.

Lastly, readers should note that, as much of a ‘buy the dip’ opportunity as these stocks might look like, investing in the midst of the unprecedented volatility we’ve seen in the past couple of days is most likely unwise. Waiting for the dust of Black Monday 2025 to settle (and for analysts to revise their coverage) will allow investors to make more prudent decisions, based on more material outlooks.

Featured image via Shutterstock