Investors and economists are increasingly confident that the US economy is heading for a “soft landing,” where inflation cools without triggering a recession. However, this is a historically rare event, which raises questions of how likely it really is to happen.

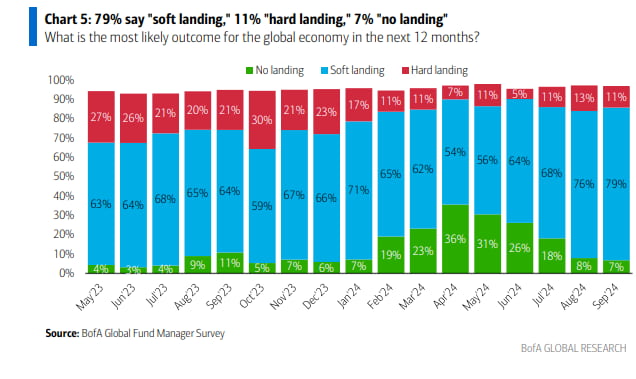

A recent survey by the Bank of America (BofA) shows that 79% of fund managers believe in a soft landing. Conversely, 11% see a “hard landing” in the next 12 months, while 7% are betting on a “no landing” scenario.

On the other hand, gold’s aggressive surge, which is continuously making new all-time highs, still raises concerns about an incoming black swan event, as Finbold reported.

Investors confidence in a ‘soft landing’ for the United States

According to Bank of America’s August Global Fund Manager Survey, optimism about a soft landing has surged among investors. This marks the highest confidence level since May 2023, as highlighted in the chart. Markets have even priced at an 80% chance of this outcome, reflecting a significant shift in sentiment against recession fears.

Meanwhile, key economic data supports this optimism. Inflation is gradually retreating toward the Fed’s 2% target. At the same time, consumer spending remains robust, and unemployment rates are low.

Stephen Juneau, senior US economist at Bank of America Securities, told Yahoo Finance:

“We still have significant consumer demand. We’re not really seeing investment slow down sharply. So where’s that kind of hard landing coming from? We just don’t see it … in the data right now. We do see some normalization. We see some cooling. But that’s a soft landing … So we think that’s very consistent with the data.”

– Stephen Juneau

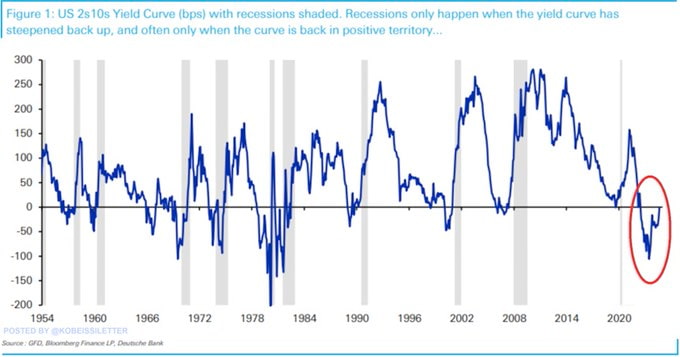

Moreover, the yield curve, which was inverted for a record 565 consecutive sessions, has recently turned positive. The Kobeissi Letter, however, explained that most recessions started after this curve turned positive.

Historically, recessions often begin after such a shift. Nevertheless, investors remain bullish.

“If the market prices less Fed easing because the economy proves resilient, equities will rise despite higher bond yields,” David Kostin, chief US equity strategist at Goldman Sachs, noted

Achieving a soft landing is historically rare

Since 1980, the Federal Reserve has managed to achieve a soft landing only once, in the mid-1990s. Then-Fed Chairman Alan Greenspan described that period as “one of the Fed’s proudest accomplishments.” The current economic backdrop is vastly different, raising questions about the Fed’s ability to replicate that success.

The Kobeissi Letter highlighted these concerns, pointing out that “ONLY 17% of rate cut cycles have ended in a soft landing.”

Additionally, they noted that before past recessions in 1990, 2001, and 2007, economists widely predicted soft landings that did not materialize. “It’s always a situation where ‘this time is different.’ Usually, this proves to be false,” they cautioned.

Furthermore, today’s economy is recovering from pandemic-induced disruptions, dealing with the aftermath of high inflation, and adjusting to the fastest rate hike cycle in history. In contrast, the 1995 soft landing occurred during low inflation and steady recovery without significant yield curve inversion.

The rarity of soft landings suggests that obstacles remain despite a growing optimism. The coming months will reveal whether the Fed can achieve this delicate balance. Investors and policymakers must remain vigilant, recognizing both the current economic landscape’s potential and challenges.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.