During the worldwide IT outage, Microsoft (NASDAQ: MSFT) operative systems using CrowdStrike (NASDAQ: CRWD) cybersecurity experienced a crash due to a faulty update, causing billions in damages.

Since then, CRWD stock has lost 26.48% of its value, with broader losses of 41.77% in the previous month.

Most recent sessions show no sign of recovery, as losses of 3.34% from the latest trading session extended the 13.62% price reversal from the previous five days.

With losses of 1.44% in the pre-market on August 2, traders remain curious about how low CRWD stock can go.

Multiple lawsuits are set to harm CRWD stock even further

The first lawsuit CrowdStrike faces comes from Delta Air Lines (NYSE: DAL), which has retained a law firm to pursue legal action against Microsoft and CrowdStrike on July 29. Delta is seeking compensation for a recent global cyber outage that severely disrupted its operations.

The outage caused significant disruptions, with Delta being the slowest among major U.S. carriers to recover. On July 19, the airline experienced over 2,200 flight cancellations, contributing to a total of more than 6,000 cancellations. Analysts estimate the financial impact on Delta could range from $350 million to $500 million.

On August 1, CrowdStrike shareholders sued the company after a faulty software update crashed over eight million computers globally, causing widespread disruption. The lawsuit accuses the company of making “false and misleading” statements about its software testing. Following the incident, CrowdStrike’s share price dropped over 26%, leading to a $25 billion loss in market value.

CrowdStrike denies the allegations and intends to defend itself against the proposed class action. The company announced that the global IT outage was resolved by July 29, ten days after it began. The lawsuit, filed in Austin, Texas, seeks compensation for investors who owned shares between November 29 and July 29.

Meanwhile, Wall Street is losing its confidence in CRWD stock

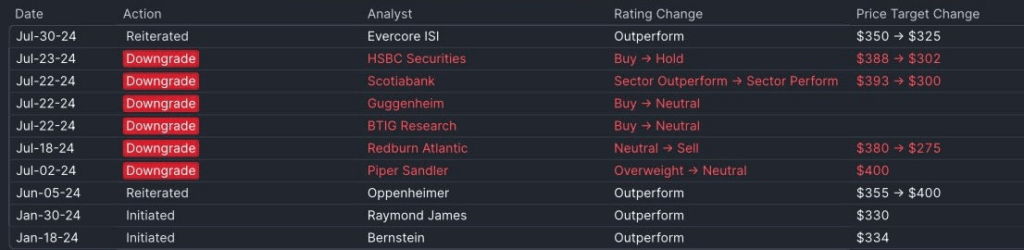

Despite the “strong buy” rating on CRWD stock, which persists due to older reports that haven’t been updated since the reports after the update show rank and price target downgrades.

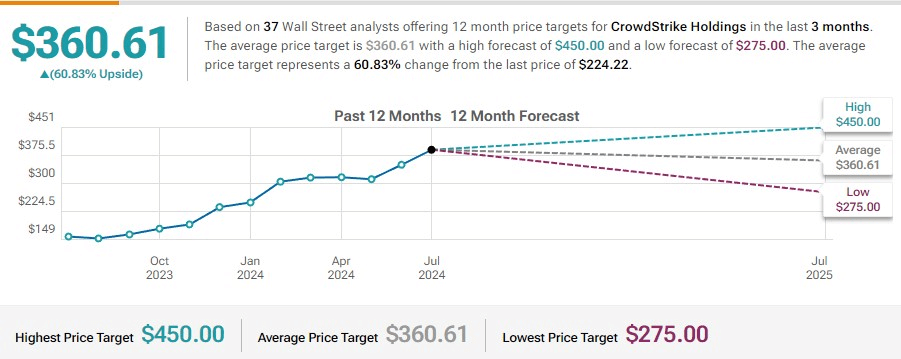

As CRWD stock continues declining, analysts’ average price target shows a $360.61 level, which would indicate a recovery of 60.83% from the current price levels.

Interestingly, CRWD shares currently trade below the lowest average price target of $275, assigned by Redburn Atlantic analyst Nina Marques.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.