United States Rep. Marjorie Taylor Greene’s well-timed April 2025 purchase of Qualcomm (NASDAQ: QCOM) stock is back in focus, as the position now sits on a notable gain following the chipmaker’s AI-driven rally.

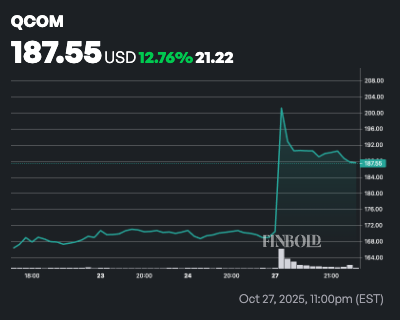

According to congressional financial disclosures, Greene bought between $1,001 and $15,000 worth of Qualcomm shares on April 8, 2025. At the close of the last session, QCOM was trading at $187, up 11%, while year-to-date, the stock has rallied 22%.

Combined with earlier tech sector gains, Greene’s April purchase has risen roughly 50.6%, far outpacing the S&P 500’s 37.9% gain over the same period. Her position, initially worth at most $15,000, could now be valued near $22,500, implying a paper profit of about $7,500 at the upper end.

Controversy around Greene’s Qcom stock trade

The Congress trade came with controversy, as it was made just days before the Trump administration announced a 90-day pause on tariffs covering semiconductors and other electronics. That policy shift initially sent the broader tech sector surging, fueling suspicions that lawmakers may have used insider knowledge to time trades.

Receive Signals on US Congress Members' Stock Trades

Stay up-to-date on the trading activity of US Congress members. The signal triggers based on updates from the House disclosure reports, notifying you of their latest stock transactions.

Since then, Qualcomm has received another boost. In this case, on October 27, the company unveiled two new AI chips, the AI200 and AI250, targeting enterprise data centers. Scheduled for release in 2026 and 2027, these chips position Qualcomm to compete with industry leaders like Nvidia and AMD.

Beyond Qualcomm, Greene’s earlier trades in Palantir, AMD, Tesla, and Novo Nordisk also yielded substantial gains, including a PLTR surge after a $30 million ICE contract. Critics have questioned the timing of some trades, citing potential conflicts of interest.

However, the lawmaker has denied any wrongdoing, stating that an independent financial adviser manages her portfolio and that she does not direct individual trades.

Nevertheless, the timing of her Qualcomm investment, coming just before a policy change that benefited the tech sector, has continued to fuel calls for stricter rules on congressional stock ownership.

Featured image via Shutterstock