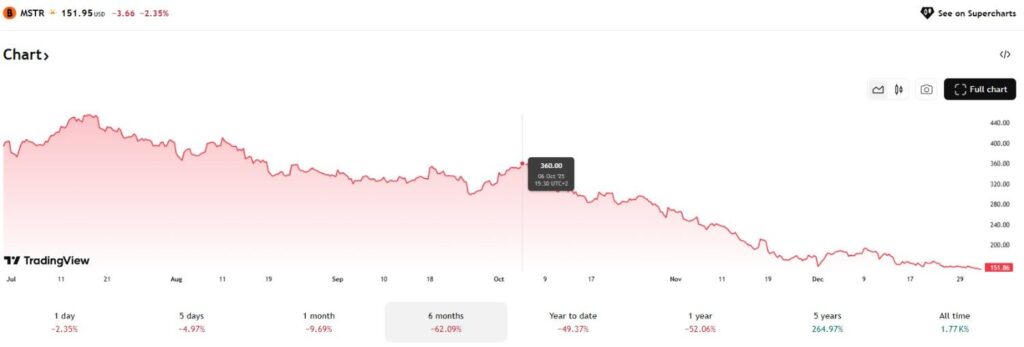

Strategy (NASDAQ: MSTR), formerly MicroStrategy, had a rough 2025, but its shares started seriously sliding in October, just as Bitcoin (BTC) began losing ground after hitting a new all-time high.

Namely, since October 6, 2025, MSTR shares have dropped from $360 to $151.86 at the time of writing, January 2, 2026, marking a nearly 58% drop in less than three months. Over the same period, Bitcoin has fallen just north of 29% from its record price of $126,198 to approximately $89,370. Overall, MSTR stock has experienced losses nearly two times those of BTC.

This downturn entails a loss of roughly $53 billion from Strategy’s market capitalization, which now sits at $47.2 billion according to the official website. At the same time, the mobile software leader still holds $60 billion worth of ‘digital gold.’ In other words, Strategy is trading at roughly 21% below the value of its underlying Bitcoin holdings.

While the flagship crypto is not the sole factor driving Strategy’s stock, the timing of the joint decline is still noteworthy, as it nonetheless illustrates the relationship between Bitcoin and the company’s market performance, particularly given that executive chairman Michael J. Saylor has long championed aggressive Bitcoin moves as a core part of the firm’s strategy.

Furthermore, it illustrates just how volatile the interplay between Bitcoin and premium valuation is in the broader market. That is, the trend may cause similar ventures to rethink the way they approach digital assets and their balance sheets.

MSTR one of the worst-performing stocks in 2025

At the current price, Strategy shares are trading at their 52-week lows. Looking back at last year’s performance, economist Peter Schiff noted that, if Strategy was a part of the S&P 500, it would be the sixth-worst-performing stock in the index.

In addition, Schiff criticized Saylor’s strategy, claiming his emphasis on Bitcoin destroyed shareholder value:

“Saylor claims the best thing a company can do is buy Bitcoin. Well, that’s basically all MSTR did, and the strategy destroyed shareholder value,” Schiff wrote.

Further pressure is mounting because the MSCI Index rule change reclassifies companies with more than 50% of total assets in cryptocurrencies as investment funds rather than operating businesses.

A potential silver lining could be that MicroStrategy’s Bitcoin portfolio would still be worth roughly $50 billion even if BTC prices fell to $75,000, with no collateral-backed Bitcoin debt.

Featured image via Shutterstock