The US presidential election has started today, on November 5, and the market is already pricing its outcome as over 70 million Americans are casting ballots in person to decide upon Donald Trump or Kamala Harris as the next United States president.

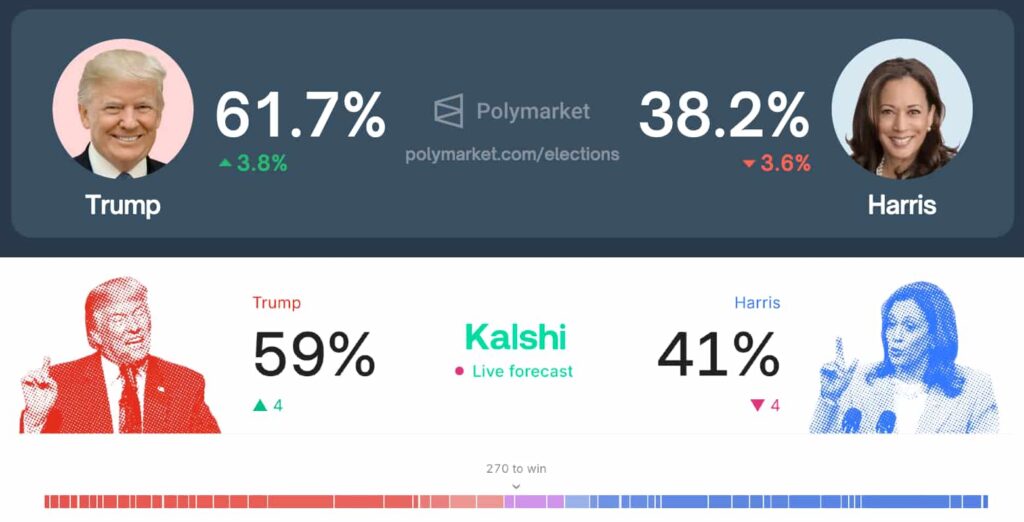

According to data retrieved by Finbold, Trump leads the dispute in the two most popular prediction markets by press time. This is a notably different scenario than what was seen from legacy media survey polls, as we reported this weekend.

In particular, over $2 billion in bets on Polymarket price a 61.7% victory for the Republican candidate. Meanwhile, Kalshi traders are pricing a 59% chance of victory for Donald Trump, which has been rising in both markets.

The outcome of today’s voting will be known in the following days, settling the election and the prediction markets’ bets. Yet, the commodity, stock, and cryptocurrency markets are already analyzing this and other data, pricing the US presidential election result.

How the commodity, stock, and cryptocurrency markets are pricing the US presidential election

Overall, trading experts, investors, and analysts expect the market to price a Trump victory bullish and a Harris victory bearish.

As Finbold reported, 40% of institutional investors plan to reduce their equity risk under a Kamala Harris presidency. The legendary investor Warren Buffett has been systematically offloading his stock holdings in the expectation of a capital gain tax.

Looking at commodities, Michael McGlone warned gold’s parabolic rally would prove unsustainable under a Harris administration. Bloomberg’s senior commodity strategist compared the gold performance to US Treasury bonds – expected to rise if the Democrat party wins.

On that note, Chartered Financial Analyst (CFA) Michael A. Gayed said, “What’s going on in bonds is absolutely terrifying.”

Donald Trump is also favored over Kamala Harris by cryptocurrency market analysts who believe Bitcoin (BTC) could finally break out of its seven-month downtrend, making a new all-time high at $94,000, according to Peter Brandt. Bitcoin historical returns in November suggest BTC could trade between $75,275 and $100,334 by the end of the month.

S&P 500, Gold, and Bitcoin price analysis on election day

As the US presidential election day started and the stock market opened, traders are already pricing a bullish outcome.

Notably, gold is trading at $2,737 per ounce, up 0.10%, outperformed by the S&P 500 and Bitcoin. The former is up 0.75% since the stock market opened, registering 5,755 points. In the meantime, BTC leads with 3% gains, trading at $69,884 at the time of this writing.

However, opening the US market positively does not guarantee traders will continue pricing the US presidential election day this way. There is a lot to happen during the next few days before the United States elects its new president. Traders must be cautious as volatility, fake moves, and liquidations can take over – including in prediction markets.