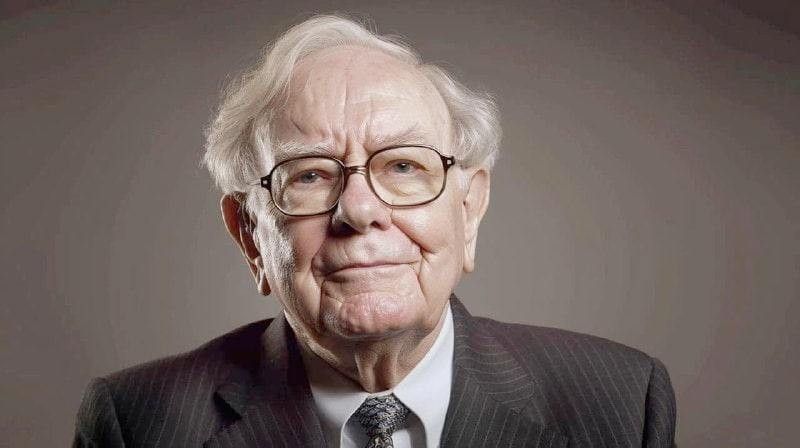

Warren Buffett’s exit from the chief executive role at Berkshire Hathaway (NYSE: BRK.B) has brought one of the most closely followed eras in modern financial history to a close. This move has prompted markets to reassess the company’s valuation.

Notably, Buffett stepped aside at the start of 2026, handing operational control to longtime successor Greg Abel while remaining chairman and a major shareholder.

While the transition had long been planned, it still marked a psychological turning point for investors who had closely tied Berkshire’s performance to Buffett’s judgment.

Since the leadership change, Berkshire Hathaway’s stock has struggled to gain momentum. By press time, the shares were trading at $493, down 0.72% in 2026 since Abel took over. Over the past year, BRK shares have rallied over 5%.

While the move may appear modest, it is likely to fuel debate over whether the stock is beginning to shed what investors have long described as the “Buffett premium,” the extra valuation assigned to Berkshire because of Buffett’s reputation, discipline, and track record.

The Buffett premium effect

For years, the so-called Buffett premium reflected confidence in the Oracle of Omaha’s capital allocation, deal-making, and disciplined risk management, supporting a valuation above that of Berkshire’s underlying businesses.

At the same time, market reaction has also been shaped by succession uncertainty. While Abel is widely viewed as a capable leader, he lacks Buffett’s symbolic stature, raising concerns that Berkshire could be treated more like a conventional conglomerate than a uniquely guided investment vehicle.

These concerns center less on near-term operations and more on long-term capital deployment. Investors are closely watching how Berkshire uses its vast cash reserves, whether its acquisition strategy shifts, and whether the discipline that defined the Buffett era is maintained. Any change in approach could affect future valuations.

Supporters, however, argue the recent decline reflects sentiment rather than fundamentals, noting that Berkshire’s diversified portfolio remains highly profitable.

Featured image via Shutterstock