Bitcoin (BTC) has crashed back to a four-month range low of $60,000, currently trading at $61,500. As things develop, cryptocurrency analyst CrypNuevo projects BTC returning to the $67,000 price zone by the end of July.

CrypNuevo shared this particular analysis in his “Sunday Update” as a thread on X on June 30. Notably, the analyst foresees a volatile week ahead due to macroeconomic news, which he expects BTC price to respond to.

Overall, he mentioned news related to the MiCa regulation in Europe and other economic data, mostly from the United States, like non-farm payroll, unemployment rate, and FOMC minutes.

Furthermore, the professional trader points out three key Bitcoin levels to watch in the following two to three weeks. In summary, he believes Bitcoin will test resistance at $64,000, retrace to $59,000, and surge to $67,000.

Bitcoin price analysis and the road back to $67,000

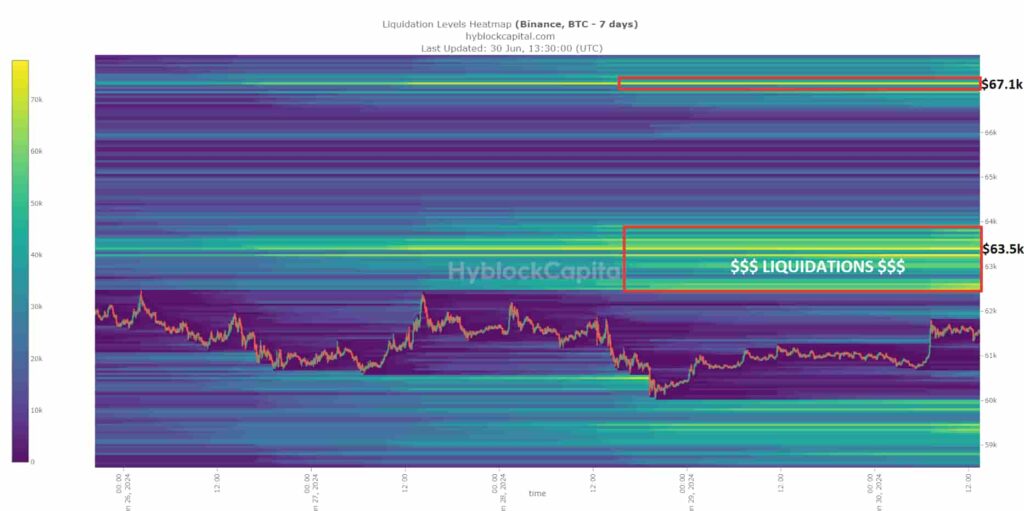

CrypNuevo identifies two key liquidity areas: $62,500 to $63,500 in the short term and $67,100 in the mid-term. According to him, these are liquidation targets that crypto whales usually look for when setting squeezes.

However, the analyst notes a long wick on the chart, which typically needs filling to balance open interest gaps. This wick-filling process has a high probability of occurring soon, says CrypNuevo.

Consequently, the analyst projects a three-phase movement for Bitcoin over the next two to three weeks.

First, BTC will likely make an impulsive move up to $64,000, liquidating high-leverage short positions. Then, it may retrace to around $59,285, filling 50% of the wick. Finally, Bitcoin could surge to $67,000, after forming a potential accumulation range.

Traders should closely monitor these key levels and be prepared for potential price swings. Despite short-term volatility, the overall trend suggests a bullish outlook for Bitcoin in the coming weeks. Particularly, three in every four BTC traders on Binance have opened long positions in the last 24 hours.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.