One of the most dominant narratives that has driven financial markets in the past two years is the potential of artificial intelligence to reshape entire industries and open up a new frontier in terms of efficiency. Unsurprisingly, semiconductor stocks have been some of the best performers in that timeframe.

Broadcom (NASDAQ: AVGO) stock is in that category — as the business manufactures and designs a wide range of semiconductors, it was well-poised to benefit. In a pretty unique case, AVGO stock has seen quite a bit of volatility over the course of the year — with both significant crashes and surges.

At press time, Broadcom stock was trading at $179.46 — on a year-to-date (YTD) basis, prices have rallied by 65.34%. However, more recently, the stock experienced a rapid 4.41% move to the upside on December 11, after news broke that the company might have secured what is potentially a very lucrative partnership with Apple (NASDAQ: AAPL).

Broadcom stock rises on AI chip rumors

This latest development was caused by news that Broadcom is developing a server chip specially designed for AI workloads with Apple, specifically for the latter’s Apple Intelligence models. Reportedly, this chip is set to enter mass production in 2026 and is currently codenamed ‘Baltra’, per The Information, which broke the news.

According to the article, the business intends to leverage Taiwan Semiconductor Manufacturing’s (NYSE: TSM) advanced N3P production process. Although neither company has commented on the rumours thus far, the original source cites ‘people with direct knowledge of the matter’, and the markets seemed to have deemed the news credible enough.

In Apple’s developer conference in June, the tech giant had stated that it would endeavor to use its own server chips for the new features — if this new report is credible, that ambition appears to have run into some crucial road block behind the scenes — particularly as Apple has had great success with in-house chips thus far.

In contrast with the way Broadcom stock has reacted, Apple stock hasn’t moved much on account of the news — marking an almost imperceptible 0.7% gain in the same timeframe.

Wall Street is quite bullish on Broadcom stock

Even before the onset of this latest development, equity researchers from Wall Street’s premier firms were quite optimistic regarding AVGO stock. The company’s next earnings report will be released after market close on December 12 — just one day after the time of publication.

Citigroup (NYSE: C) semiconductor stock analyst Christopher Danely expects to see a beat versus consensus estimates, owing to ‘an uptick in sales of non-AI semiconductors and better-than-feared gross margins owing to an increase in software mix’.

In addition, he raised his price target for Broadcom stock to $205 from $175, maintaining a previous ‘Buy’ rating. If met, this mark would represent a 14.23% upside from the current AVGO stock price.

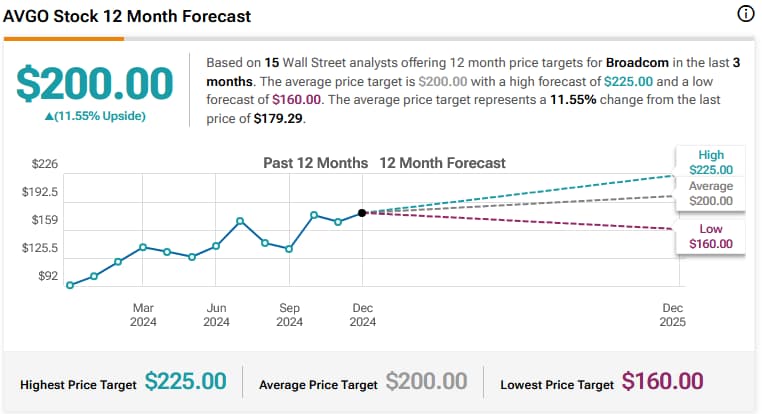

That view isn’t a fringe opinion by any means — of the 15 analysts who track and issue ratings for Broadcom shares, 13 rate them a ‘Buy’, and only 2 rate them a ‘Hold’. None rate the stock a ‘Sell’. On average, equity researchers set a $200 price target for Broadcom shares.

In any case, investors should keep an eye out for the company’s next earnings report, as well as how prices will react in the immediate aftermath to determine whether or not a long position is warranted, as well as what would be an appropriate entry price.

Featured image via Shutterstock