Gold prices (XAU/USD) continue to exhibit heightened volatility, raising the question of whether the yellow metal can achieve the much-anticipated $3,000 milestone.

As of press time, gold is trading at $2,650, marking a modest daily gain of 0.18%. A combination of technical and fundamental factors suggests that gold’s next move could be pivotal, setting the stage for a potential breakout.

Technical analysis: A setup for a breakout

Notably, an analysis by Gold Predictors indicates that the metal remains firmly bullish. The analyst highlighted that gold has rebounded strongly from the lower boundary of its ascending channel, a key technical level demonstrating robust support and investor confidence.

Following this rebound, gold entered a consolidation phase, which is typically a precursor to a significant breakout. If the price moves higher, gold is likely to retest the $2,760 resistance level and potentially aim for $2,800.

Moreover, based on the recent price movement, an expert with the pseudonym GPT Profit Hunter, in a November 27 post, highlighted that gold’s one-hour chart is approaching a support-turned-resistance zone near $2,660, which aligns with the 61.8% Fibonacci retracement level.

“According to the 1-hour time frame, Gold is approaching a support-turned-resistance zone. This area also aligns with the 61% Fibonacci retracement level. If a 1-hour candle closes above $2660 in gold I will look for long opportunities,” the analyst said.

The expert highlighted that a one-hour candle close above this level could signal a breakout, paving the way for gold to target $2,660 and potentially $2,700.

Fundamental factors – Geopolitical dynamics elevate gold demand

Gold’s safe-haven appeal remains bolstered by escalating geopolitical tensions. The ongoing Russia-Ukraine conflict has intensified global risk sentiment, with reports of Russia deploying advanced missiles and utilizing North Korean troops.

Ukraine’s counteroffensive, involving Western-supplied missiles striking deep into Russian territory, further escalates the situation, keeping markets on edge.

In addition, U.S. President-elect Donald Trump’s announcement of tariffs on imports from Canada, Mexico, and China has heightened global trade uncertainty.

While Treasury Secretary nominee Scott Bessent is expected to adopt a phased tariff strategy, these measures have prompted investors to hedge against potential economic instability by increasing gold allocations.

Meanwhile, a ceasefire agreement between Lebanon and Israel, announced by U.S. President Joe Biden, has eased tensions in the Middle East. However, the broader geopolitical landscape remains fraught with risk, sustaining demand for gold as a safe-haven asset.

Macroeconomic factors supporting gold

On the macroeconomic front, gold prices are supported by a weakening U.S. dollar and mixed signals from the Federal Reserve. The U.S. Dollar Index is consolidating enhancing gold’s appeal to international buyers. Meanwhile, steady yields on 10-year U.S. Treasury bonds reflect uncertainty in bond markets.

Despite robust U.S. economic data, including a rise in the Consumer Confidence Index to 111.7 in November, the highest since July 2023, divisions within the Fed regarding rate cuts have created market unpredictability.

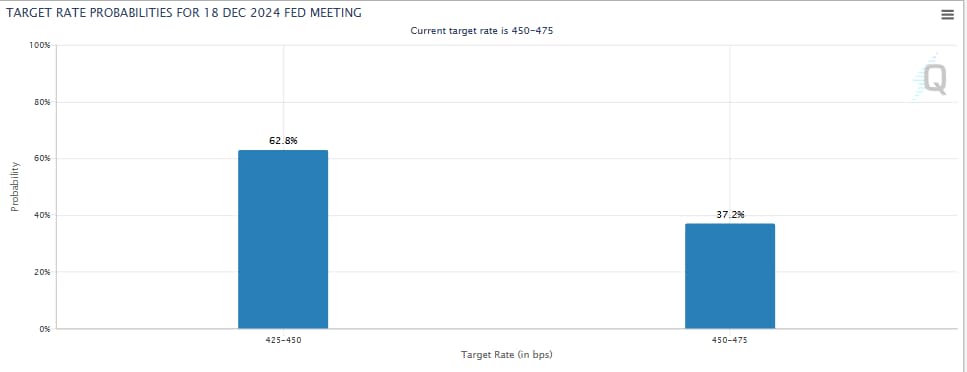

The CME Group’s FedWatch Tool indicates a 63% probability of a 25-basis-point rate cut in December, a move that could weaken the dollar further and support gold prices.

Upcoming U.S. inflation data and Q3 GDP figures are expected to provide additional clarity on the Federal Reserve’s policy direction.

For now, gold remains a favored asset among risk-averse investors, benefiting from dollar weakness and the uncertainty surrounding Fed policies.

While the $3,000 milestone remains elusive for now, a confluence of geopolitical tensions, macroeconomic uncertainty, and weakening dollar dynamics could serve as catalysts for gold’s next big move.

For investors, the yellow metal remains a compelling choice, balancing risks with its proven safe-haven appeal.

Featured image from Shutterstock.