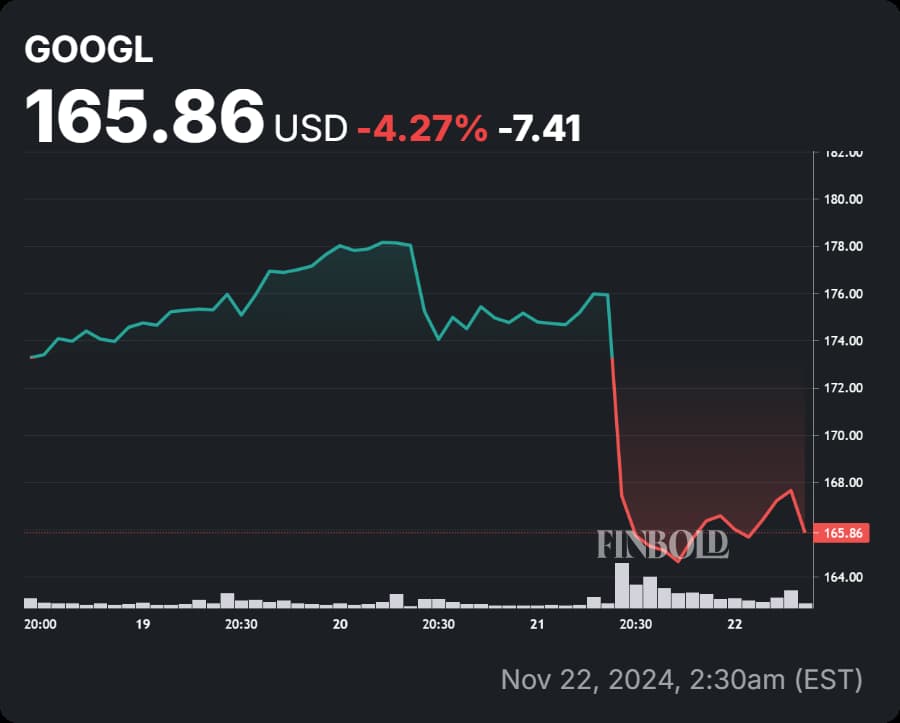

Alphabet Inc. (NASDAQ: GOOGL) shares plunged over 4% on November 21, after the Department of Justice (DOJ) called for Google to divest its Chrome browser as part of proposed antitrust remedies.

This proposal marks a significant escalation in the DOJ’s long-running legal battle, which accuses Google of maintaining an illegal monopoly over internet search and advertising.

According to a court filing on November 20, selling Chrome would “permanently stop Google’s control of this critical search access point and allow rival search engines to compete fairly.”

The case is the most aggressive antitrust action by the government since its landmark battle against Microsoft in the late 1990s.

What the antitrust lawsuit against Google is all about

Alphabet has recently been at the center of a series of antitrust lawsuits. On August 5, 2024, a federal judge ruled that Google had maintained an illegal monopoly in online search and advertising.

The DOJ’s lawsuit, filed in 2020, highlighted concerns about Google’s overwhelming market dominance and alleged that the company used unfair practices to suppress competitors like Bing and DuckDuckGo.

Central to the case was Google’s establishment of exclusive contracts with major companies, including Apple, making Google the default search engine on their devices. This effectively sidelined competitors and prevented them from gaining market share.

The judge found that Google’s practices, which control 89.2% of the search market, violated antitrust laws by limiting competition and driving up advertising prices, breaching Section 2 of the Sherman Act.

DOJ’s proposed remedies shake Google’s business model

Chrome, which Google launched in 2008, provides the search giant with data it uses for targeting ads. The DOJ said in the filing that forcing the company to get rid of Chrome would create a more equal playing field for search competitors.

The DOJ’s suggested remedies extend beyond Chrome’s divestiture. This includes barring Google from entering exclusionary agreements with companies like Apple (NASDAQ: AAPL) and Samsung to secure default search engine status, a tactic that reportedly costs Google billions annually.

Furthermore, the agency seeks to prevent Google from prioritizing its search engine across its ecosystem, offer competitors affordable access to its extensive web index, and allow online publishers to opt out of having their content used to train Google’s AI models.

One of the most contentious proposals involves the potential divestiture of Google’s Android operating system. While the DOJ did not explicitly demand this, it left the possibility open if the primary remedies fail to effectively restore competition.

Android’s integration with Chrome has historically solidified Google’s grip on the search market, and any forced separation could significantly disrupt the mobile ecosystem.

Market reaction and broader implications

Google’s stock tumbled to $166.68 in pre-market trading, reflecting investor concerns over the DOJ’s push to dismantle parts of its business.

Chrome, while not a direct revenue generator, is a cornerstone of Google’s strategy, funneling users into its ecosystem and bolstering its ad revenues, which accounted for $65.6 billion in Alphabet’s third-quarter earnings.

Analysts warn that losing Chrome could lead to diminished user engagement and reduced revenue from its flagship services like Search and YouTube.

Kent Walker, Alphabet’s legal chief, called the DOJ’s proposals “overbroad,” warning that forced divestitures of products like Chrome and Android could undermine consumer security and privacy while weakening investments in artificial intelligence.

“ DOJ’s wildly overbroad proposal goes miles beyond the Court’s decision. It would break a range of Google products — even beyond Search — that people love and find helpful in their everyday lives.” –Kent Walker

Meanwhile, a second DOJ antitrust case against Google, focusing on its dominance in the online advertising market, is underway. Dubbed the AdTech trial, it began on September 9 and alleges that Google’s control over digital advertising has harmed both advertisers and content creators.

What’s next for GOOGL stock

At the close of the last trading session, GOOGL was valued at $166, ending the day with a decline of over 4% but still reflecting a 1% gain on the monthly chart.

The case’s prospects are further complicated by the potential transition to a new Trump administration, as the Justice Department’s stance may shift under a new attorney general.

Despite this uncertainty, investors view the DOJ case as a significant risk to Google’s stock. A judgment favoring the DOJ could have serious repercussions for the company.

The federal court presiding over the matter has scheduled a two-week hearing in April 2025 to determine the necessary changes for Google to comply with antitrust laws.

The stakes are high for Alphabet, as its business model faces continuous scrutiny and potential upheaval.

Featured image via Shutterstock