The stock market concluded the last week on a downturn despite the S&P 500 index reaching an all-time closing high on Thursday, March 7. Amidst this market fluctuation, specific stocks have showcased noteworthy performances, both bullish and bearish, and deserve scrutiny.

In light of these circumstances, guided by key fundamentals, Finbold has identified the following three stocks that require attention this week.

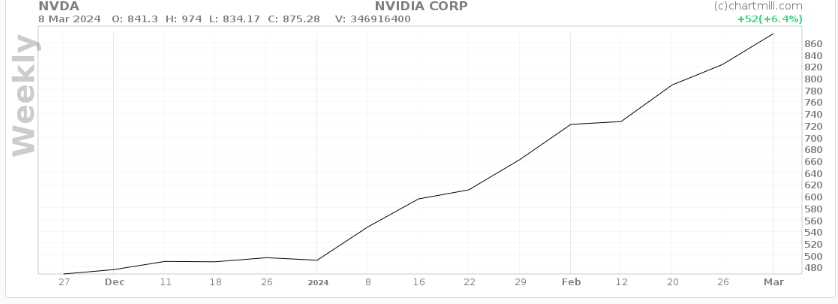

Nvidia

Nvidia’s (NASDAQ: NVDA) stock has seen a significant upward trend in recent months, primarily propelled by its foray into the artificial intelligence (AI) sector, which has driven its market capitalization beyond $1 trillion.

As we enter a new week, the spotlight is on Nvidia, particularly in light of its performance on Friday, March 8. Notably, NVDA experienced a bearish reversal, an occurrence not witnessed in seven years. As reported by Finbold, Nvidia concluded the week with a 5.5% decline despite an earlier surge of 5.1% on the morning of March 8.

This development carries implications, particularly in assessing the impact of the AI sector on the broader stock market. Speculation is now rife that this correction might signify a conclusion to the AI boom.

Given Nvidia’s status as a symbol of the AI rally, monitoring how Nvidia responds becomes crucial. There is anticipation regarding whether Nvidia will continue its ascent towards $1,000 or undergo further correction.

By press time, Nvidia’s stock was trading at 875.28, reflecting a 5.5% decrease within 24 hours.

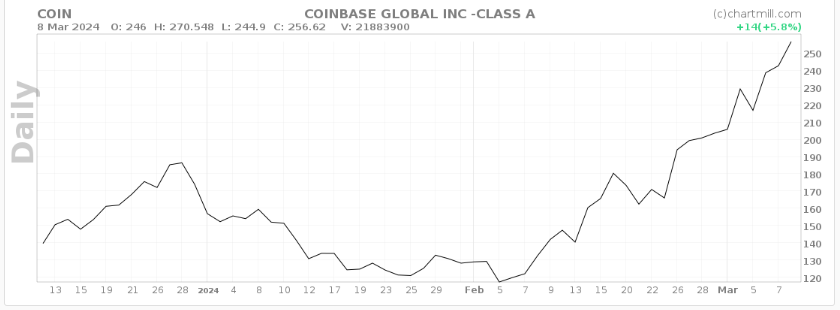

Coinbase

Amid a dynamic period of activity in the crypto market, publicly traded companies within the sector have demonstrated notable strength. Coinbase (NASDAQ: COIN), a prominent entity in this space, has showcased a steady recovery throughout 2024, riding the wave of the crypto sector boom, particularly with Bitcoin (BTC) reaching an all-time high of over $70,000.

The recent upswing in Coinbase’s stock price can be attributed to its integral role in expanding spot Bitcoin exchange-traded funds (ETF). Various financial institutions offering Bitcoin-based ETF products have selected Coinbase Custody as a trusted crypto custodian for investors’ Bitcoin holdings.

Investors should monitor COIN closely to observe how the equity responds to the crypto market. Speculation is rife regarding Bitcoin’s trajectory, with some anticipating the leading cryptocurrency will continue rallying while others project a potential pullback. Therefore, it is intriguing to monitor whether COIN can sustain its gains concerning the overall trajectory of the crypto sector.

By press time, COIN was trading at $256.62 with year-to-date gains of over 60%.

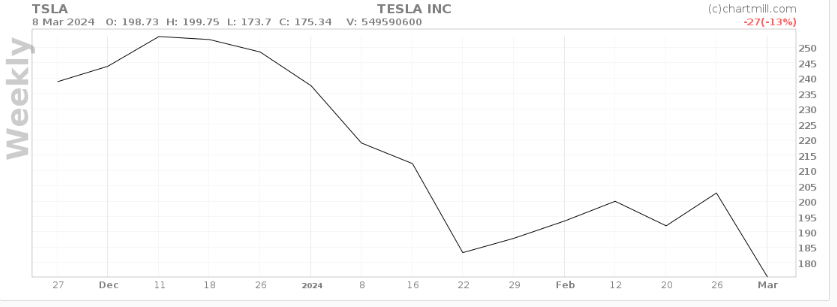

Tesla

The electric vehicle (EV) manufacturer has experienced a tumultuous year, marked by significant losses and a struggle to keep pace with the stock market. Tesla (NASDAQ: TSLA), in particular, has been affected by the overall deceleration in the growth of the EV sector, introducing an element of uncertainty.

In the case of TSLA, the equity has witnessed a nearly 30% drop in 2024, and investors could face further challenges in the upcoming weeks.

Attention will be focused on Tesla in the coming week as the equity aims to find support and move toward the $200 level. Therefore, it will be interesting to observe whether TSLA experiences further declines from this threshold.

Adding to the uncertainty is the projection from analysts at Morgan Stanley (NYSE: MS), who anticipate Tesla will continue facing financial challenges in 2024. As they reduced their price target from $345 to $320, the analysts expressed concerns about the ongoing sluggishness in EV demand despite price cuts, the decision of fleet operators like Hertz to divest EVs, and the allure of “strong hybrid momentum” diverting potential EV buyers.

In response to this outlook, Tesla concluded the last week on a low note for the third consecutive day. By press time, Tesla’s share price stood at $175.34, with 24-hour losses of almost 2%.

In summary, while the mentioned stocks have distinct fundamentals that can influence their overall trajectory, they remain susceptible to the overall market sentiment.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk