Sitting members of the United States Congress often invest in defense stocks — and they’ve seen stellar returns over the last year.

These stock trades have become a frequent topic of discussion owing to ethical quandaries — particularly when this sort of insider trading comes from politicians appointed to committees and subcommittees that regulate specific industries, such as defense.

The latest data from the US Senator Stock Trading Radar by Finbold revealed just how much sitting members of the House and Senate have outperformed the wider market with their recent defense stock trades.

Raytheon, Lockheed, and Northrop Grumman are insider favorites

Unsurprisingly, three of the largest aerospace defense contractors were the most traded stocks — RTX, formerly Raytheon (NYSE: RTX), Lockheed Martin (NYSE: LMT), and Northrop Grumman (NYSE: NOC).

Representative Kevin Hern of Oklahoma’s 1st congressional district, who sits on Congress’ tax-writing committee, bought between $1,001 and $15,000 in Lockheed shares on June 28. Since then, LMT’s stock price has increased by 29.71% — far outpacing the S&P 500’s 4.52% gain in the same period.

Depending on exactly how many shares were purchased, Rep. Hern has gained between $297 and $4,456 from that single trade.

A member of the House Select Committee on Intelligence, Rep. Josh Gottheimer of New Jersey’s 5th congressional district, bought between $1,001 and $15,000 in Northrop Grumman stock on July 19. Since then, NOC is up 24.19% — while the S&P has only risen by 3.61%.

At the low end, an investment of exactly $1,001 would net $242 in profit, while a $15,000 investment would have secured a sum of $3,628.

However, the most impressive returns by far were seen by Senator Markwayne Mullin of Oklahoma, who, perhaps unsurprisingly, sits on the Armed Services Committee.

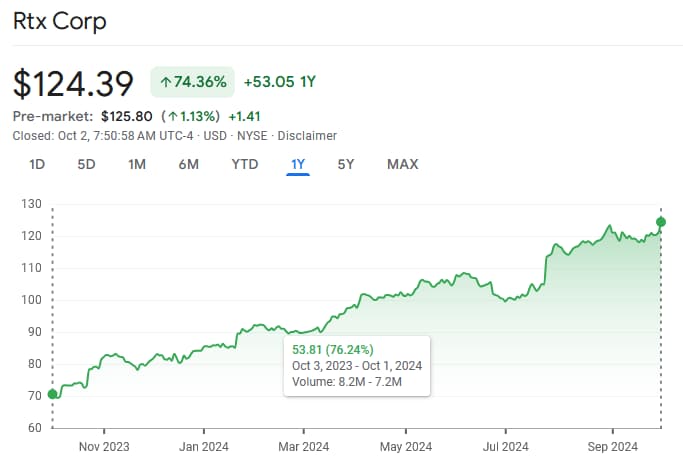

Mullin bought between $1,001 and $15,000 in RTX stock on October 3. The price of Raytheon shares has surged by 76.24% during that timeframe — and although the S&P 500 saw gains of 34.94% in the same period, the disparity is still a staggering 41.3% in Mullin’s favor.

All in all, the Senator from Oklahoma could be up anywhere from $413 to $6,195.

Unfair institutional advantages

Finally, let’s compare absolute dollar amounts when contrasting these particular trades with the average performance of the S&P 500.

Kevin Hern’s gains for his LMT stock trade range from $297 to $4,456. In the same period, returns from the S&P 500 on the same initial investments would have netted investors $43 to $645.

Josh Gottheimer’s profits from trading Northrop Grumman shares range from $242 to $3,628, depending on the amount invested. Equivalent investments in the S&P 500 would have secured between $36 and $541.

Finally, Markwayne Mullin’s well-timed acquisition of RTX stock has provided between $413 and $6,195 to the Senator. Investing in the S&P 500 when he did would, while still being a well-timed entry, provide only $349 to $5,241.