Summary

⚈ Liverpool’s $6B valuation and strong revenue growth have fueled the return.

⚈ James now owns part of FSG’s broader portfolio, including the Red Sox and Penguins.

NBA star LeBron James’ initial $6.5 million investment in English Premier League side Liverpool Football Club would now be worth over $100 million in less than 15 years, fueled by the team’s success both on and off the pitch, including trophy wins and major commercial growth.

James’ involvement with Liverpool FC began in 2011, when he acquired a 2% minority stake. While Forbes valued Liverpool FC at around $552 million in 2011, LeBron James’ 2% stake cost only $6.5 million, implying a much lower valuation of approximately $325 million.

Instead of purchasing shares at full market value, James formed a strategic partnership with Fenway Sports Group (FSG). As a high-profile investor expected to enhance Liverpool’s global brand visibility, James likely received a discounted rate in exchange for his marketing influence and promotional value.

Private minority stakes in sports franchises often sell below headline valuations, especially when the investor contributes significant non-financial assets like global branding power. However, the exact terms of James’ agreement have never been publicly confirmed.

In March 2021, James converted his direct Liverpool stake into a broader 1% ownership stake in FSG, gaining exposure across FSG’s diversified sports and media portfolio.

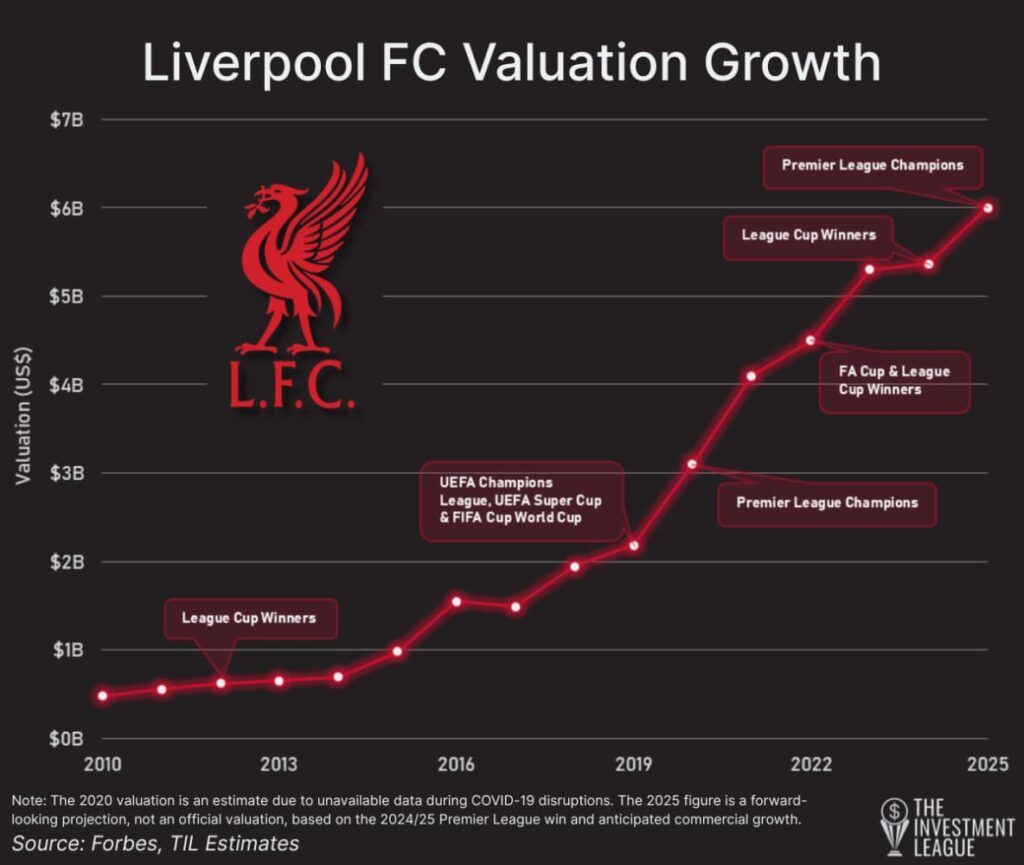

Since then, Liverpool’s valuation has soared to an estimated $6 billion following the club’s 20th Premier League title win in April 2025. It’s important to note that this $6 billion figure is a forward-looking projection based on anticipated future growth and not an official sale price, according to The Investment League.

Had James retained his original 2% stake in Liverpool, it would now be worth approximately $120 million.

LeBron James ROI with FSG stake

However, James’ 2021 conversion to an FSG partnership shifts the focus to FSG’s broader valuation. According to Forbes, FSG was valued at $12.95 billion in 2024—a 25% increase from the prior year. Based on this valuation, James’ 1% stake is now worth approximately $129.5 million, delivering a nearly 20-fold return on his original investment.

It’s worth noting that there is no publicly available information confirming whether James invested additional capital when he became an FSG partner.

Liverpool’s financial performance remains central to this growth. In 2024, Liverpool generated $719 million in annual revenues and posted operating income of $102 million.

Revenue streams included approximately $97 million from matchday earnings, $282 million from broadcasting, and $340 million from commercial activities, while maintaining a debt-to-value ratio of just 3%.

Featured image via Shutterstock