Bitcoin (BTC) has hit an impressive new all-time high of $80,000 as of November 10, 2024, driven by post-election optimism and increased institutional adoption.

Over the past four years, Bitcoin has demonstrated remarkable resilience, especially for investors who entered the market during the depths of the COVID-19 crash in March 2020.

During the initial pandemic shock, Bitcoin suffered a dramatic decline, dropping by over 50% in a single day to reach a low of $4,106.98 on March 13, 2020.

This period of market upheaval created an ideal entry point for long-term investors who saw the potential in BTC as a hedge against traditional financial uncertainty.

How much would $1,000 invested in BTC be worth now?

To put this in perspective, if an investor had placed $1,000 into Bitcoin on March 13, 2020, at the COVID-19 low of $4,106.98, they would have acquired approximately 0.2434 BTC.

Today, with Bitcoin trading at $79,460, that initial $1,000 investment would now be valued at approximately $19,348, resulting in an extraordinary gain of around 1,834.75%.

Moreover, for American citizens, the COVID-19 stimulus checks provided a unique investment opportunity. Many who invested their $1,200 stimulus check in Bitcoin at the time of the market downturn have reaped substantial returns.

According to data from monitoring resource BitcoinStimulus, U.S. citizens who used their first $1,200 stimulus check from April 2020 to purchase Bitcoin would now see that investment valued at around $15,578, an increase of 1,181%.

Current market sentiment: Bullish, yet cautious

The recent surge in Bitcoin’s value can be attributed to a unique mix of political and economic factors in 2024.

Bitcoin and the broader cryptocurrency market have seen renewed momentum, fueled by optimism surrounding Donald Trump’s return to office and his favorable stance toward digital assets.

This optimism, alongside a strong wave of buying interest across various assets, has boosted the crypto market cap by $800 billion over the past two months, reflecting robust bullish sentiment.

Further supporting Bitcoin’s rally, the Federal Reserve’s recent 25-basis-point rate cut has weakened the dollar, making assets like Bitcoin more appealing to investors looking for inflation-resistant alternatives.

This rally has driven the Bitcoin Fear and Greed Index to “Extreme Greed,” now at a level of 78, which is historically high and often signals possible market corrections due to overbought conditions.

While optimism remains strong, some experts are cautioning that these elevated conditions could lead to short-term pullbacks if sustained.

Derivative data paints a mixed picture

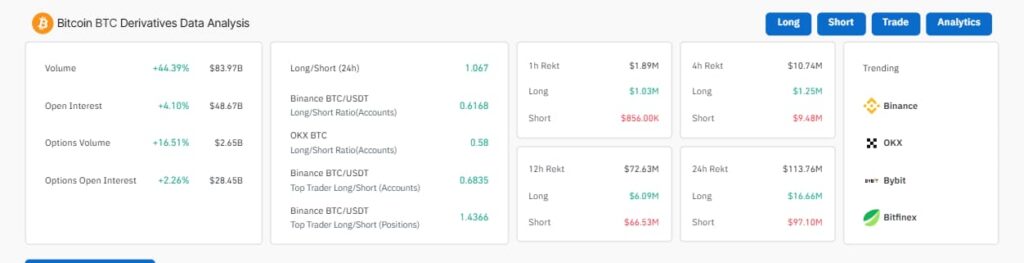

Bitcoin derivatives data retrieved from CoinGlass reveals a generally bullish sentiment, with a notable 44.39% increase in trading volume and a 4.10% rise in open interest, indicating heightened market participation.

The slight long bias in the 24-hour long/short ratio and the strong preference for longs among top traders on Binance further support the bullish case.

Additionally, significant short liquidations, particularly in the 12-hour and 24-hour periods, suggest a short squeeze, which could fuel further price increases.

However, there are cautious signals as well. The long/short ratios on platforms like Binance and OKX are below 1.0, showing more short positions on these platforms, which could indicate that traders expect a potential pullback.

This mixed sentiment suggests that while the momentum is currently bullish, there is a risk of short-term corrections if overbought conditions persist.

Bitcoin price analysis

Bitcoin was trading at $79,683 at press time, up almost 4% in the past 24 hours.

As we look ahead, Bitcoin’s price trajectory will likely be influenced by a complex interplay of political shifts, increased institutional interest, and evolving economic policies.

Although current market sentiment leans toward bullishness, Bitcoin’s proven resilience and role as a hedge against traditional economic volatility solidify its appeal as a long-term asset.

This confluence of factors suggests continued growth potential in Bitcoin’s journey, as it adapts to an evolving financial landscape and garners further mainstream acceptance, with the potential to reach $100,000 and beyond.

Featured image via Shutterstock