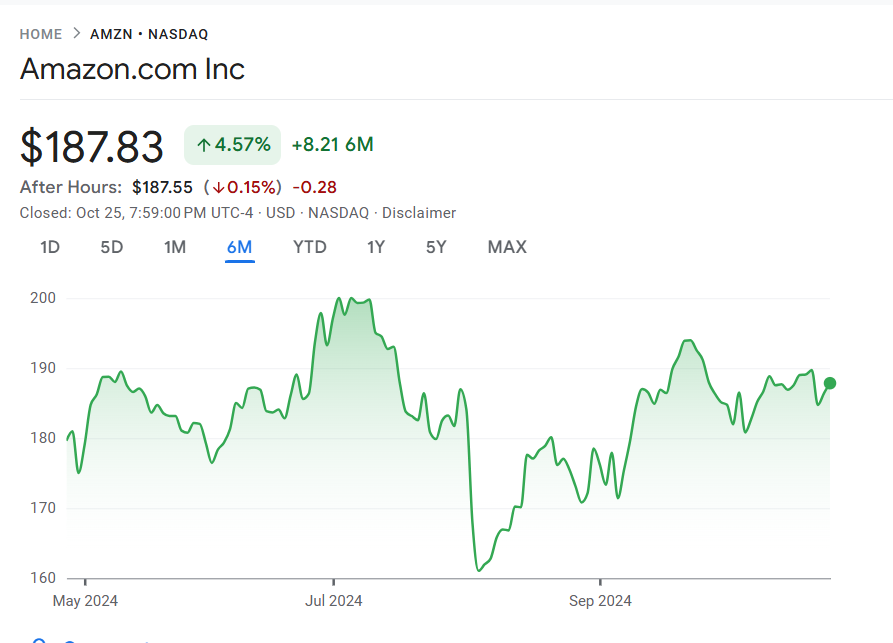

As Amazon (NASDAQ: AMZN) prepares for its third-quarter earnings release on October 31, market expectations are rising. With Amazon’s stock price relatively flat over the past quarter at a current level of $187, investors are wondering if this upcoming report could serve as a catalyst for renewed momentum.

While macroeconomic challenges are pressuring Amazon’s core retail business, its strengths in cloud computing and advertising remain focal points, likely playing a key role in its Q3 results and providing potential for a stock surge.

AWS’s stronghold in the cloud market

Amazon Web Services (AWS) has consistently delivered robust performance, emerging as a core profit engine for Amazon.

Recent quarters show AWS revenue accelerating, reaching $26.3 billion in Q2, a year-over-year increase of 18.8%. With high demand for Amazon’s in-house AI processors, Trainium and Inferentia, AWS is gaining traction among businesses prioritizing cloud-driven AI solutions.

This ongoing growth in AWS could be a significant stabilizing factor for Amazon’s Q3 earnings.

Advertising gains and expansion

Amazon’s advertising segment has become an increasingly profitable line of business, with over 20% year-over-year growth for multiple quarters. In Q2 alone, Amazon added $2 billion in advertising revenue, driving its annual total to a substantial $50 billion.

Sponsored ads remain a cornerstone of this revenue stream, while the introduction of ads on Prime Video has broadened its reach within the digital advertising sector. The strategic use of AI in ad targeting and measurement tools enhances Amazon’s ad relevance, offering brands improved visibility.

For Q3, analysts expect another strong performance in advertising, which could reinforce investor sentiment.

Addressing retail sector headwinds

Amazon’s core retail business, representing a large share of its revenue, has faced headwinds due to reduced consumer spending.

Recent macroeconomic conditions and increasing competition from rivals like Shein and Temu have impacted the company’s sales forecasts and kept its stock performance in check.

However, Amazon has responded by optimizing its logistics and delivery capabilities, expanding its same-day service, and regionalizing its fulfillment centers to boost efficiency and lower costs.

The retail segment’s performance will be under scrutiny this quarter, as it represents Amazon’s largest revenue channel. While AWS and advertising provide strength, investors will be keen to see if Amazon’s operational improvements in retail lead to tangible gains in Q3.

Project Kuiper: Amazon’s bold space venture

Project Kuiper, Amazon’s satellite-based internet initiative, adds a unique dimension to its growth strategy. Targeting underserved regions, Kuiper aims to create a global satellite internet network.

Despite high upfront costs, estimated between $16.5 billion and $20 billion, Kuiper represents Amazon’s venture into an untapped market.

In the Q2 earnings call, Amazon noted a slight decrease in North America’s operating margin due to increased spending in areas such as Kuiper. This has spurred analyst debate about the impact on Amazon’s margins.

Despite this, analysts see this as a long-term investment that could yield substantial revenue once Kuiper achieves scale.

Notably, Amazon has yet to specify the full scope of Kuiper’s investment, leaving investors eagerly awaiting updates in the Q3 earnings call to gauge Kuiper’s financial trajectory.

Analysts maintain optimism

Analysts have generally remained optimistic about Jeff Bezos’s company, as evidenced by its overall ‘strong buy’ rating across price target aggregate platforms.

The average price target set by Wall Street researchers is around $224, while advanced AI models project prices of $225 and $200, respectively. The consensus indicates optimism about the company, making it a potential candidate for gains post-earnings.

In summary, Amazon’s Q3 earnings will likely set the tone for its stock in the near term. Strong results in AWS and advertising could reassure investors about Amazon’s growth prospects, especially if operating margins improve.

On the flip side, weaker-than-expected retail performance might hold back the stock, particularly if macroeconomic headwinds persist. Overall, Amazon’s Q3 report has the potential to re-energize its stock and reinforce its position as a tech giant well-equipped for the future.