The cryptocurrency market started a bull rally on February 7, led by Bitcoin (BTC). However, XRP is lagging behind, maintaining a relevant volume of bearish short positions, creating short-squeeze opportunities for next week or sooner.

A short squeeze happens when short-sellers are liquidated, facing a sudden price surge during trend reversals. These liquidations force the repurchase of the shorted cryptocurrency, driving the price even higher, triggering further liquidations, and potentially making it skyrocket.

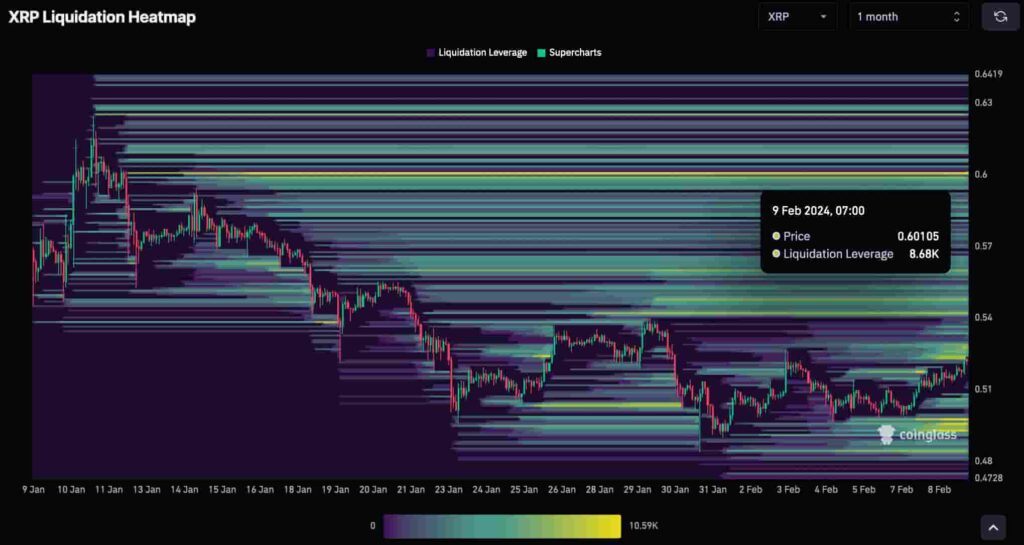

In this context, Finbold gathered data from CoinGlass about the crypto derivatives market on February 9. In particular, we spotted short squeeze potential on XRP in the monthly time frame.

Short squeeze alert for XRP next week

XRP has heavy liquidity accumulation at the $6 price level. More specifically, there are $8,680 in short liquidations at $6.01, making it an appealing target for market makers.

Additionally, XRP has many smaller liquidity pools all the way upwards before reaching these higher levels. For example, there is a relevant concentration of short positions between current prices and $0.56. These will likely suffer a short squeeze, possibly triggering a larger movement.

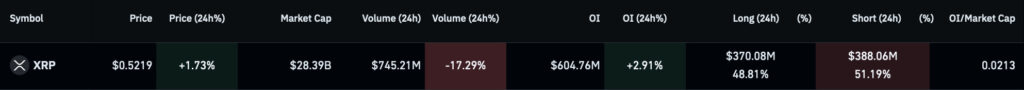

Interestingly, XRP is trading at $0.52 by press time, up 1.73% in the last 24 hours. A short squeeze to the largest liquidity pool would result in over 15% gains for the token. In the meantime, traders have opened over $388 million in short positions since yesterday, accruing 51.19% of the total daily volume.

Notably, XRP shows a strong buy signal according to a Relative Strength Index (RSI) overbought status.

Nevertheless, investors must consider the possible reasons behind this cryptocurrency lagging for a surge or having short-sellers interest.

Moreover, the crypto landscape changes fast and daily, made of highly volatile assets. Thus, investors must trade cautiously, following the trends and adapting to each new development.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.