U.S. politicians often capture public interest with their stock market trades, inspiring some investors to mimic their strategies to achieve similar results.

Among them, Representative Marjorie Taylor Greene, a Republican from Georgia’s 14th congressional district, has had a particularly intriguing investment journey.

Receive Signals on US Congress Members' Stock Trades

Stay up-to-date on the trading activity of US Congress members. The signal triggers based on updates from the House disclosure reports, notifying you of their latest stock transactions.

While her earlier trading history was met with skepticism—giving rise to jokes about an ‘inverse Marjorie’ approach akin to the ‘inverse Cramer’ ETF—2024 marked a significant shift in her portfolio performance.

Picks for you

With a renewed emphasis on big tech and a more diversified investment strategy, Greene’s portfolio performance saw notable improvement, defying the narrative of her earlier missteps.

While replicating Marjorie Taylor Greene’s extensive portfolio may not be feasible, a closer look at her key investments offers valuable insights into her evolving strategic approach. Here’s a breakdown of how three of her most significant holdings fared in 2024.

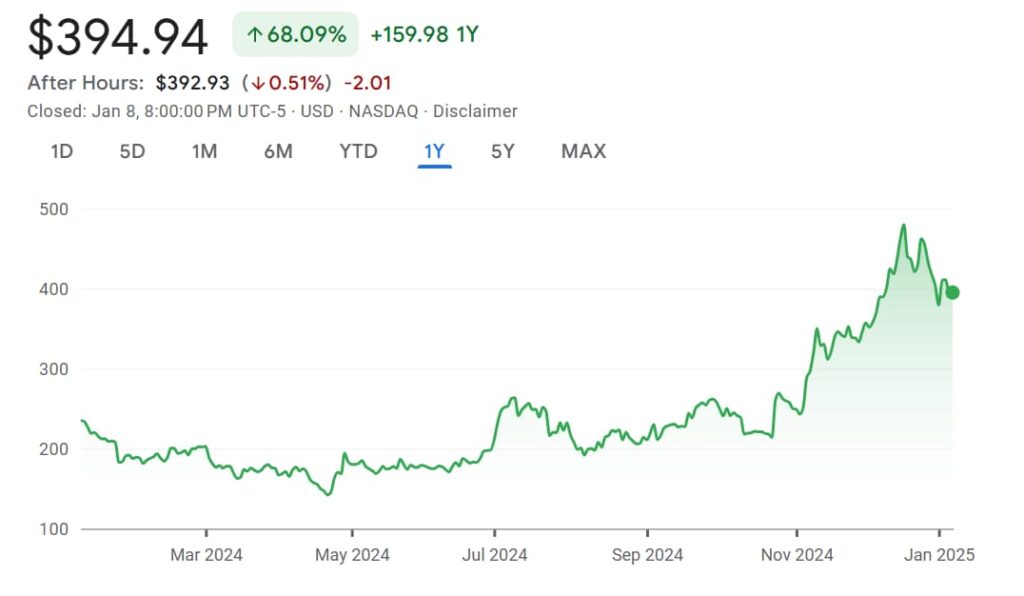

Tesla (NASDAQ: TSLA)

Tesla (NASDAQ: TSLA) accounted for 4.91% of Representative Marjorie Taylor Greene’s portfolio, marking it a key contributor to her investment performance.

After a sluggish start in early 2024, Tesla’s stock surged 68% by the year’s end, closing at $403.84. The rally was largely attributed to Donald Trump’s re-election and a strengthened political alliance between Elon Musk and Trump, which reignited investor optimism about Tesla’s prospects.

However, Tesla faced headwinds in early 2025, with its stock dropping to $394 by January 8 following a report that the National Highway Traffic Safety Administration (NHTSA) had launched an investigation into 2.6 million Tesla vehicles with the ‘Actually Smart Summon’ feature.

Concerns over crashes involving obstacle detection failures led to a temporary dip, casting a shadow over Tesla’s near-term performance.

Alphabet Inc. (NASDAQ: GOOGL)

Alphabet Inc. (NASDAQ: GOOGL), representing 3.49% of Marjorie Taylor Greene’s portfolio, delivered an impressive 37% gain in 2024.

While multiple factors likely contributed to the rally, a standout development was the announcement of its breakthrough quantum computing processor, ‘Willow,’ which improved investor confidence. The stock closed at $195.39 as of January 8, marking an uptrend heading into 2025.

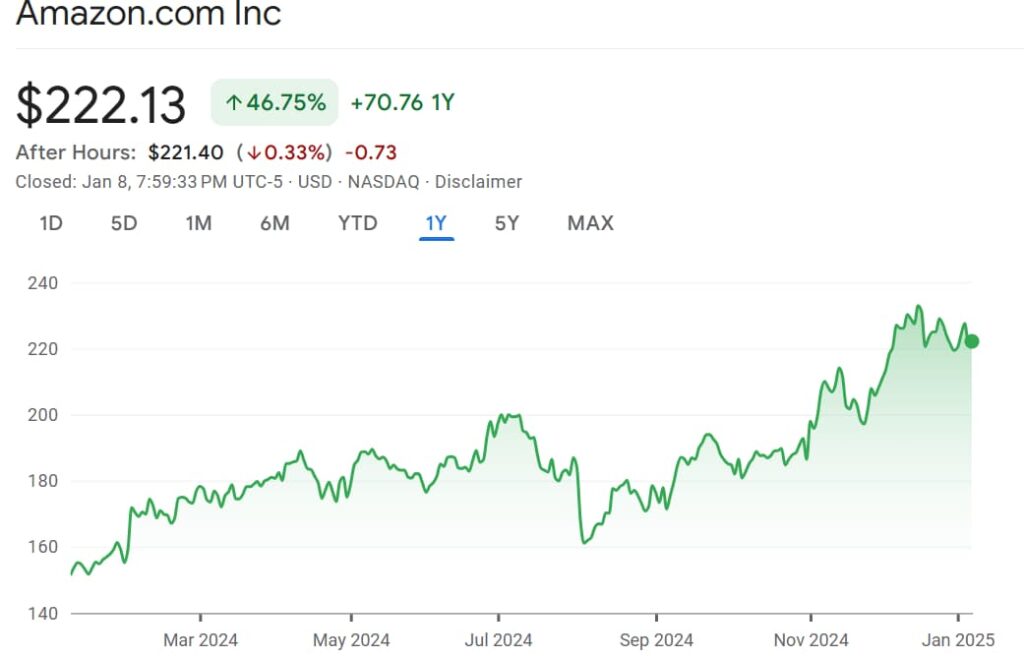

Amazon (NASDAQ: AMZN)

Amazon (NASDAQ: AMZN), representing 3.35% of Marjorie Taylor Greene’s portfolio, has shown impressive growth, with the stock trading at $222.13 as of the market close on January 8, reflecting a one-year gain of 46%.

This strong performance is largely attributed to Amazon’s advancements in technology, particularly through Amazon Web Services (AWS), which continues to dominate the cloud computing sector.

Additionally, the company’s growing involvement in the AI boom has positioned it well for further expansion, providing optimism for sustained growth in 2025.

$1,000 invested in Marjorie Taylor Greene’s portfolio at the start of 2024

That being said, If $1,000 were evenly split between Tesla, Google, and Amazon at the start of 2024, the portfolio would be worth approximately $1,503.33 by the end of the year, with nearly 50% upside.

While Marjorie Taylor Greene’s trading strategy may not boast the same level of reliability as some high-profile political portfolios, her recent gains suggest a steady streak of success, prompting the question of whether her approach merits closer consideration.

Featured image via Shutterstock