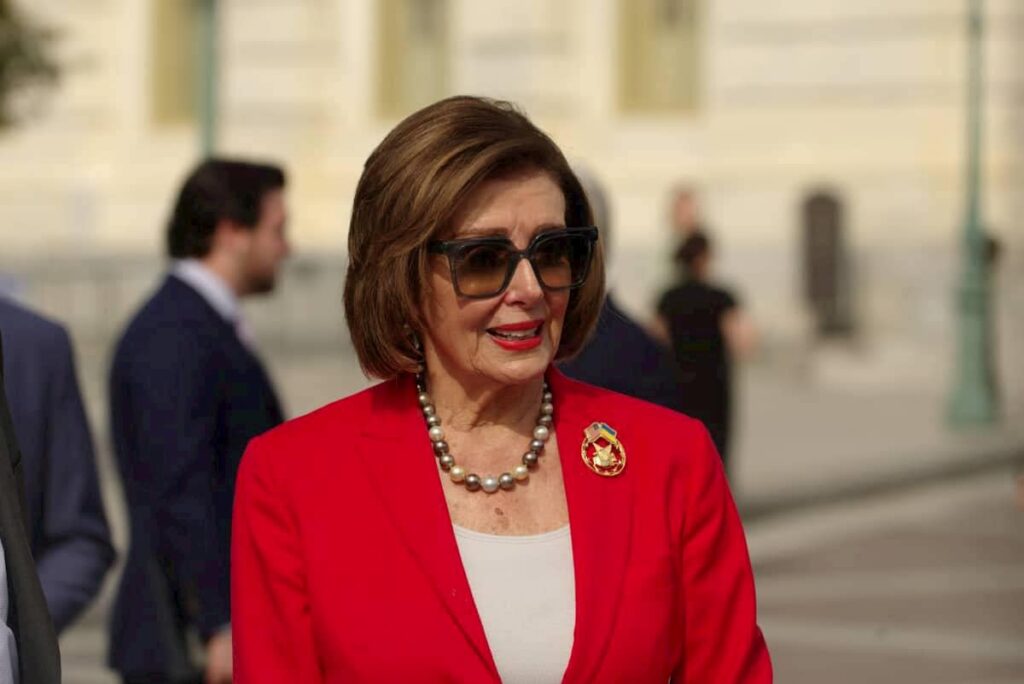

Former House Speaker Nancy Pelosi has continued her stock market activity into 2025, drawing renewed scrutiny over her trades.

As one of the most active and successful congressional traders, Pelosi has drawn attention to her uncanny market timing and strong portfolio performance, which have sparked concerns about potential insider trading.

Receive Signals on US Congress Members' Stock Trades

Stay up-to-date on the trading activity of US Congress members. The signal triggers based on updates from the House disclosure reports, notifying you of their latest stock transactions.

Staying true to her past investment patterns, the lawmaker filed disclosures on January 17, as required by congressional regulations, revealing that she purchased shares in five major companies, including Amazon (NASDAQ: AMZN), Alphabet (NASDAQ: GOOGL), Nvidia (NASDAQ: NVDA), Tempus AI (NASDAQ: TEM), and Vistra (NYSE: VST), on January 14.

Notably, her bet on semiconductor giant Nvidia has been particularly lucrative, delivering substantial profits in the past as it maintains leadership in the booming artificial intelligence sector.

Investing in Pelosi’s 2025 trades

Investors might be prompted to replicate Pelosi’s latest trades, considering her past market success. In this line, if you had invested $1,000 equally across the stocks disclosed on January 17, $200 in each, here is how your portfolio would look over a month later, as of the close of markets on February 21.

Notably, the five stocks have delivered mixed performances. Amazon has dipped slightly, down 0.5%, leaving the $200 investment at $199. While not a major loss, it’s been a slow start for the e-commerce giant.

Google has also faced a steep decline, falling 4.9% and reducing the initial $200 investment to $190.20.

On the other hand, Nvidia stock has slightly edged upward by 2%, turning $200 into $204. The chipmaker’s gains come as the company attempts to move past the sell-off stemming from the DeepSeek AI volatility.

The clear standout is Tempus AI, which has surged 113% over the period, turning a $200 investment into an impressive $426. Notably, the American health technology company has gained momentum from multiple factors, with investor confidence growing partly due to its promising financial outlook.

Preliminary results for the fiscal year 2024 indicate robust revenue growth of approximately 30% year-over-year, reaching around $693 million. However, TEM has seen notable losses in the short term, aligning with the general market sentiment.

Meanwhile, Vistra has struggled, dropping 11% and leaving the $200 investment at $178.

Pelosi’s portfolio total 2025 returns

The initial $1,000 investment would now be worth $1,197.20, a total return of 19.72% in just over a month, largely driven by Tempus AI’s outsized gains. Without Tempus AI’s performance, the portfolio would have been nearly flat or slightly down, highlighting the importance of diversification.

Overall, the volatility experienced by the portfolio reflects broader market conditions, which have been weighed down by several factors, including trade tariff uncertainty and the Federal Reserve’s interest rate decision.

Given that it’s just over a month since Pelosi made her 2025 trades, it’s too early to judge whether the politician has hit or missed with this new purchase—especially considering her history of long-term winning picks.

Featured image via Shutterstock