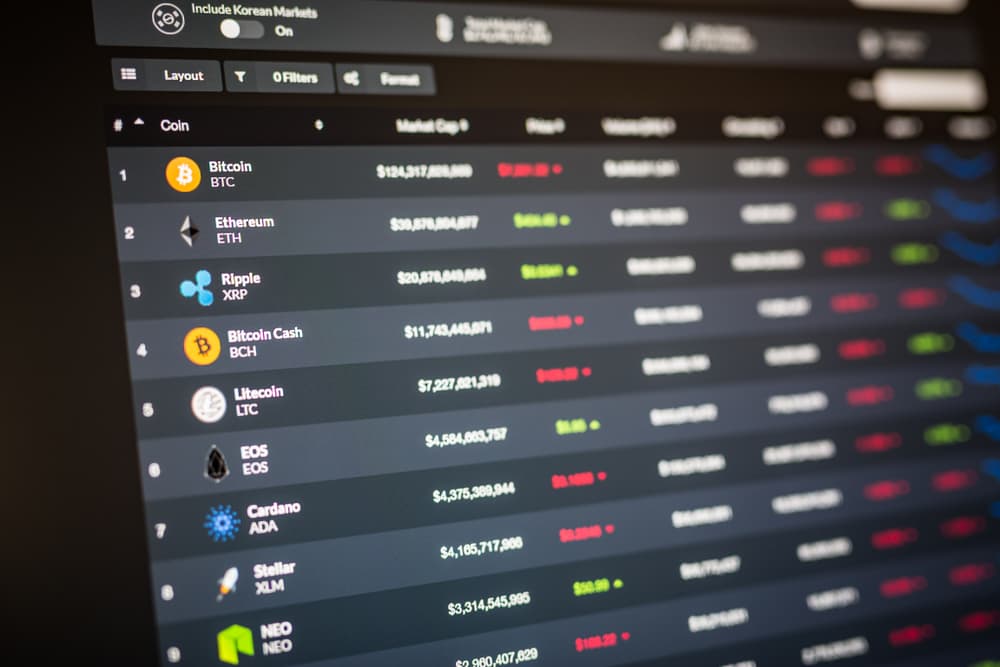

After investing in Bitcoin and driving the asset’s price to new levels, institutional investors and wealth managers are now focusing on altcoins.

A new research by Nickel Digital Asset Management indicates that 32% of institutional investors with an allocation of Bitcoin in their portfolio will invest in altcoins for the first time in the next 12 months.

Notably, about 33% of the investors believe that the investment will involve a significant amount, while 29% project their altcoin investment will be gradual.

On the motivation behind the planned altcoin investment, 54% of the institutions indicate the move is in line with the ongoing growth of the cryptocurrency sector.

Another 45% note that it is part of diversifying their investments from Bitcoin. In comparison, 44% are motivated by the belief that an upside potential of the crypto market warrants a long-term portfolio allocation.

Commenting on the findings, Anatoly Crachilov, co-founder and CEO of Nickel Digital, said the move is in line with the growth of the DeFi sector, with some altcoins showing a faster growth rate than Bitcoin. According to Crcahilov:

“Many DeFi protocols have seen their market cap increasing dramatically over the past year, with valuations rising faster than Bitcoin. These assets address real-life use cases and are based on greater programmability than Bitcoin, reflected in their price dynamics. It is no surprise, therefore, that forward-looking institutional investors and wealth managers are increasingly paying attention to this emerging part of the crypto market.”

The study surveyed institutional investors and wealth managers from the US, UK, France, Germany, and the UAE. Collectively, they control $275.5 billion in assets under management.

Impact of institutions on crypto markets

Early this year, the cryptocurrency markets embarked on a bull run emanating from increased institution entry culminating in Bitcoin attaining a record price of almost $65,000. If the same is replicated under altcoins, the affected coins might record a similar surge like Bitcoin.

The development comes despite some analytic stating that an altcoin season is still far from being. For instance, Ben Lilly, crypto economist & partner at Jarvis Labs, noted that there is no indication the focus was about to turn to altcoins.

[coinbase]