Despite the widespread impact of the ongoing crypto winter on the cryptocurrency sector, the payments industry has demonstrated significant interest in integrating digital currencies into its offerings.

A recent Deloitte study revealed that 54% of major retailers with revenues surpassing $500 million had allocated at least $1 million to enable cryptocurrency payments. This move aims to provide customers with a broader range of transaction options. The growing trend emphasizes the importance of incorporating cryptocurrencies into the payment landscape. Companies that do not adapt to this shift risk falling behind their competitors.

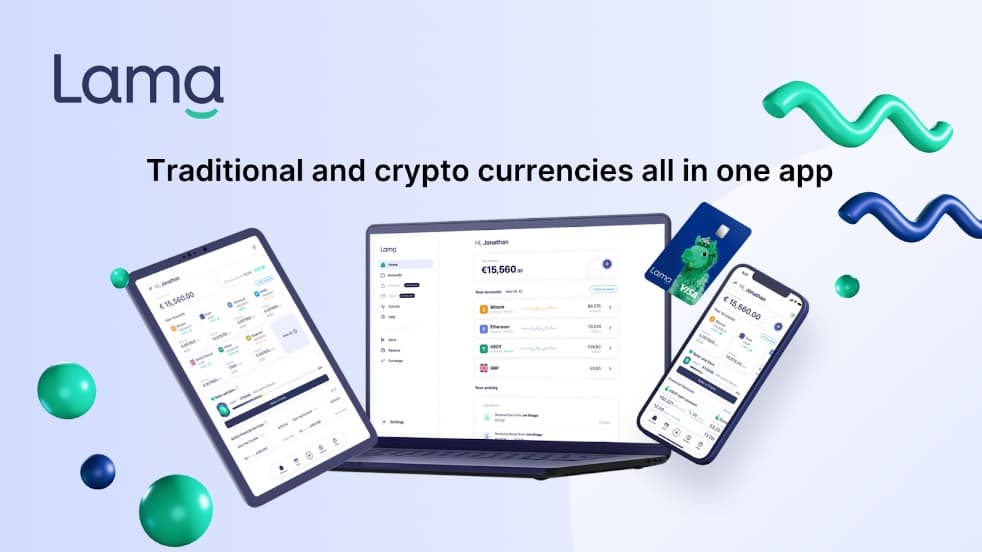

In response to this trend, Lama, a modern payments and financial services technology solution, is pushing the envelope to address the everyday needs of consumers and businesses using cryptocurrencies.

While blockchain technology has been available for over a decade, it is still out of reach for many people due to the technical know-how required to navigate most platforms. This barrier hinders billions of potential users from adopting the technology. Additionally, with their user-friendly interfaces, mainstream payment applications like Venmo and PayPal further deter individuals from embracing blockchain-based apps.

Lama aims to transform this landscape by making cryptocurrency payments more accessible and straightforward for users.

What is Lama?

Lama is a registered cryptocurrency exchange known for its user-friendly platform allowing users to pay and receive payments in fiat and cryptocurrencies easily and instantly. Aiming to introduce cryptocurrencies to the broader market, Lama offers an easy-to-use app that combines traditional bank accounts and crypto wallets for individuals and businesses alike.

Lama offers diverse products catering to different audiences, from business-to-consumer (B2C) to business-to-business (B2B) clients. The Lama ecosystem encompasses an app available on App Store and Google Play, which features cryptocurrency wallets and IBANs.

“We believe that making crypto and traditional currencies meet in one app is the perfect way to experience the future of banking. We expect from the future that financial transactions should be really easy, cheap, and time efficient.” Jocelyn Braun, Co-founder and CEO at Lama Technology Group

What Does Lama Offer?

The Lama ecosystem has expanded a lot after launching over a year ago into a one-stop shop for crypto and fiat payments, deposits, and swaps. Lama provides various products that emulate traditional financial services, catering to cryptocurrencies and fiat currencies. These products include the Lama app, Lama Banking Accounts, Lama multi-currency wallets, Lama Visa Cards, Lama Earn accounts, Crypto Loans, Lama over-the-counter (OTC) exchange platform, Lama NFTs, and the Lama Metaverse.

The Lama App

The Lama app is a user-friendly platform that enables seamless purchasing and withdrawal of cryptocurrencies using fiat currency. Additionally, it allows users to earn cashback and rewards while managing their cards and accounts, all within a single, intuitive application.

With the Lama app, users can quickly open an account in under five minutes, complete with cryptocurrency wallets and IBANs. The Lama accounts offer integrated storage for Bitcoin and various other cryptocurrencies, as well as fiat currencies such as Euros and GBP. This streamlined approach makes it convenient for users to manage their digital and traditional currencies within a user-friendly platform. The app’s design and features aim to facilitate seamless transactions and promote broader adoption of cryptocurrencies in everyday life.

Lama and Visa

Lama has partnered with Visa to provide both virtual and physical card options, allowing users to easily spend their cryptocurrencies at brick-and-mortar stores or online platforms. The Lama Visa card, linked to users’ Lama accounts (crypto and fiat), enables seamless conversion of cryptocurrencies to fiat currencies at the point of sale. This integration allows for a convenient spending experience, similar to a traditional debit or credit card.

The Lama Visa card offers compatibility with a wide range of cryptocurrencies, making it a versatile payment solution for crypto enthusiasts. Furthermore, the card may include additional benefits such as cashback, rewards, or discounts, incentivizing its use for everyday purchases. By bridging the gap between cryptocurrencies and traditional payment systems, the Lama Visa card promotes the mainstream adoption of digital currencies and simplifies their use for daily transactions.

Lama Earn Accounts

With Lama’s crypto earn account feature, users can enjoy the benefits of earning interest on their cryptocurrency holdings. By depositing digital assets into a dedicated earn account within the Lama app, customers can generate passive income as their crypto assets accumulate interest over time.

This feature offers an additional income stream for Lama users and incentivizes long-term investment in cryptocurrencies, and fosters a greater engagement with the digital asset ecosystem.

Lama OTC

Lama’s over-the-counter (OTC) service is designed to cater to users looking to purchase large volumes of cryptocurrencies quickly and efficiently while securing the most competitive rates.

The OTC service provides users with better rates compared to standard exchange orders. Additionally, the OTC service typically offers enhanced privacy, faster transaction times, and personalized customer support to ensure a seamless trading experience for clients seeking substantial cryptocurrency purchases.

Is Lama Safe

Lama has integrated institutional-grade custody service technology through its partnership with Ledger, keeping users’ funds safe and secure. The platform guarantees that only account owners can access their assets by adhering to stringent security protocols and frameworks aligned with global standards. This robust approach to security emphasizes the protection of users’ funds and reinforces trust in the Lama platform.

Lama is committed to providing exceptional customer support for users throughout their cryptocurrency journey. With a dedicated support team readily available, users can always connect with a real person to receive assistance. Lama offers in-app messaging and an in-app call option to ensure secure communication, allowing users to interact with the support team directly and safely within the platform.

Regulatory Compliance

Lama is a registered cryptocurrency exchange in Lithuania, enabling users across the EU to easily open and manage crypto accounts.

Furthermore, Lama has been authorized as an eMoney Distributor by Modulr Finance B.V, which itself is regulated by De Nederlandsche Bank. This authorization allows EU users to seamlessly open and access Euro accounts within the platform.

In addition, Lama has achieved PCI DSS compliance certification, ensuring high level of security and enabling the provision of Visa cards to its users. This combination of registrations, authorizations, and certifications demonstrates Lama’s commitment to delivering a reliable and secure platform for its users across the EU.

Lama plans to provide personal and Business Banking Accounts, which can be set up in minutes. These accounts function similarly to traditional bank accounts but also incorporate additional opportunities powered by DeFi. The app lets users directly engage with DeFi protocols like Compound and Aave.

The full extent of cryptocurrency’s disruptive impact on the banking industry has yet to be realized. Nevertheless, Lama is following in the footsteps of trailblazers like PayPal, pushing the boundaries and reshaping traditional financial frameworks as we know them. Follow their Twitter account for more updates.

Media Contact

Website – https://www.lamatechnology.com/

Lama App – https://www.mylama.eu/

Twitter – https://twitter.com/mylama_eu

Contact Email – [email protected]