China could inadvertently spark a Bitcoin (BTC) price crash as reports emerge that local governments are offloading their stash of seized assets despite a nationwide cryptocurrency trading ban.

If these sales accelerate, the market could face a flood of supply, triggering volatility and potentially a price drop reminiscent of the 2021 crash that followed China’s cryptocurrency trading ban.

Simply put, dumping large quantities of Bitcoin onto the market could create a supply influx, overwhelming demand, and driving prices down.

China ranks as the world’s second-largest Bitcoin holder after the United States, with approximately 194,000 BTC, valued at $16 billion.

On the other hand, by the end of 2023, local governments reportedly held around 15,000 BTC, worth $1.4 billion, accumulated through criminal seizures.

Now, these assets are being sold through private firms, some of which have facilitated billions in sales since 2018, with proceeds converted to yuan and funneled into government accounts, Reuters reported on April 16.

Lack of laws guiding crypto sales

The outlet noted that the current sell-off, conducted without clear regulatory oversight, amplifies risks. To this end, legal experts have criticized the inconsistency of banning crypto while profiting from seized assets, suggesting that the central bank should oversee these sales to mitigate market disruption.

However, a shift in China’s stance could change the narrative. If the country were to lift its crypto ban, investors could see it as a bullish signal, potentially driving Bitcoin prices higher amid growing confidence in regulatory clarity.

This comes as China remains embroiled in a fierce trade war with the United States, which could further impact its economy. Interestingly, the U.S., under President Donald Trump, has taken a friendlier stance toward Bitcoin, making it part of the strategic reserve.

Bitcoin price analysis

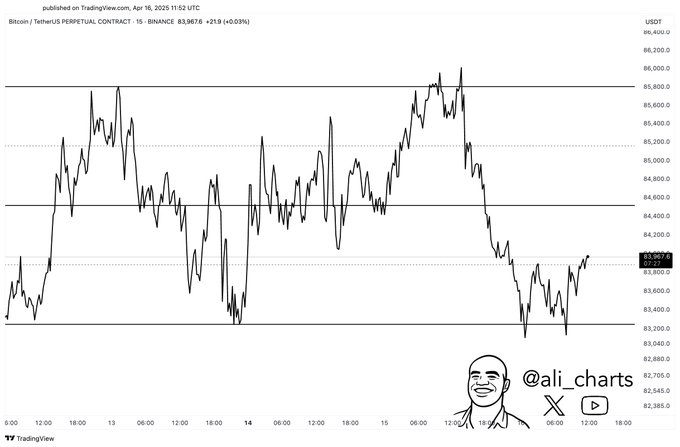

According to prominent cryptocurrency analyst Ali Martinez, through an X post on April 16, Bitcoin is consolidating within a defined horizontal channel, with strong support holding at the $83,200 level.

Despite recent volatility, the price has bounced off this key support, signaling potential strength in the near term. Currently, Bitcoin is trading at $83,805, down over 2% on the daily chart. However, the digital asset is up 9% over the past week.

If the $83,200 floor holds, a move toward the channel’s midpoint or upper boundary, around $84,800 to $86,000, remains in play.

Featured image via Shutterstock