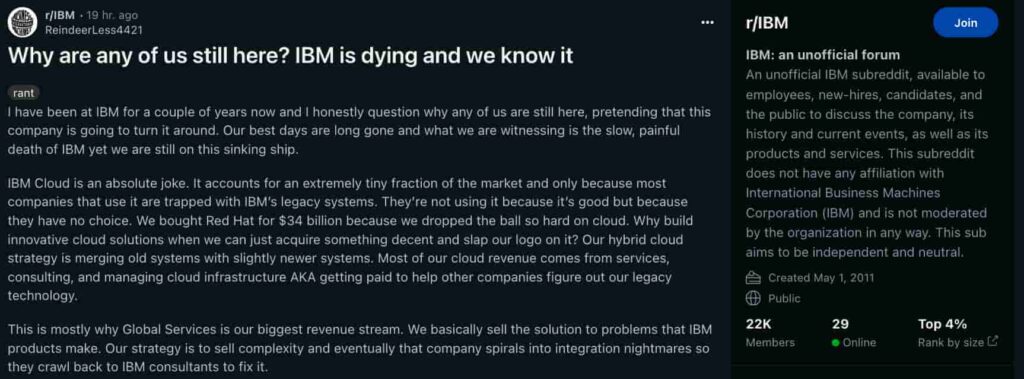

An allegedly IBM Corporation (NYSE: IBM) employee went to Reddit on September 27 for a long rant against the company. In the original post, the user u/ReindeerLess4421 questions, “Why are any of us still here,” warning that “IBM is dying and we know it.”

According to the alleged employee, IBM “monetizes on confusion,” foreseeing an imminent collapse as the company relies on legacy contracts. ReindeerLess4421 argues that its strategy is “to sell complexity” and then solutions for a problem IBM created.

“We sell tech to trap companies in it, then charge them forever to keep it working. The only reason companies are with IBM is because the cost of leaving is higher than the cost of staying and we make billions just off that equation. There is no bright future.”

– u/ReindeerLess4421

Interestingly, comments on the unofficial subreddit r/IBM and in a post on X show agreement with IBM’s employee rant.

Employee’s rant: Why he thinks IBM is dying

Overall, the alleged employee argues that IBM is in a “slow, painful death,” held back by outdated technology and corporate inertia.

According to the employee, IBM Cloud holds a minuscule market share because clients are trapped by legacy systems rather than choosing them for their merits. Namely, IBM’s $34 billion acquisition of Red Hat exemplifies its failure to innovate internally, opting instead to “acquire something decent and slap our logo on it.”

Moreover, the employee criticizes IBM’s reliance on maintaining System Z mainframes and charging exorbitant fees for software and maintenance. He claims IBM exploits the high cost and complexity of moving off these systems, trapping companies in a cycle of dependence. Software licensing practices further lock clients into proprietary systems like DB2 and Websphere, with Enterprise License Agreements designed to extract maximum revenue.

The company’s attempt to enter the AI market with watsonx is dismissed as a desperate move lacking genuine innovation. “We are just riding off the coattails of Meta and other open-source models,” the employee states.

Furthermore, the employee highlights workforce morale issues due to cost-cutting measures like offshoring and replacing experienced employees with lower-wage workers. This strategy, ReindeerLess4421 argues, harms long-term productivity and profitability. The employee foresees that once clients find ways to migrate off IBM’s legacy systems, companies like Microsoft, Google, and AWS will dominate the market, leaving IBM with “nothing but scraps.”

In conclusion, he urges colleagues to leave IBM and seek opportunities in modern technology fields, stating, “There is no growth or innovation… Get out while you can and develop skills in modern technology.” The overall message portrays IBM as a company surviving on obsolete systems and customer entrapment, with a grim outlook for the future.

IBM stock price analysis

However, the IBM stock price chart tells a different story than the “IBM is dying” warning. IBM closed on Friday, September 27, at $220.84 per share despite the employee’s rant going viral.

This recent price action set a new all-time high for the leading technology company, which has accumulated gains of 169.42% since 2004. IBM regained growth this year after over a decade of stagnation, as Finbold reported in March.

Yet, the stock market could still react to the employee rant during the next week as participants digest the message. At this point, traders and investors should be cautious and closely monitor related developments.