Following a prolonged period of insider trading for Nvidia (NASDAQ: NVDA) stock, during which its largest shareholders, led by CEO Jensen Huang, have offloaded millions in NVDA shares, it looks like the company’s top man is done with selling – at least for now.

Indeed, it seems that the Nvidia CEO is no longer dumping his company’s stock for the time being, considering he has already fulfilled the plan to get rid of six million NVDA shares ahead of time, and the stock price has responded to this development accordingly.

Why Nvidia CEO sold stock

Specifically, the NVDA stock offloading was part of a trading plan that Huang adopted earlier this year, which envisioned him selling six million NVDA shares, concluded six months before its expiration date, with a total sale of $713 million worth of the stock, according to the report from September 24.

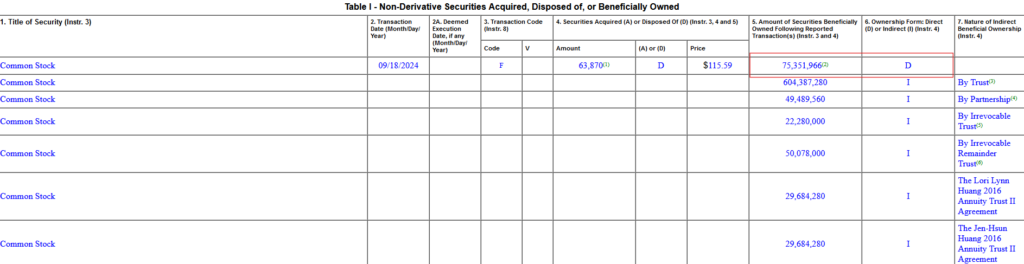

So, how many shares of Nvidia does Jensen Huang own now? Notably, as per the form filed with the United States Securities and Exchange Commission (SEC), this leaves him with 75.4 million Nvidia shares in direct ownership, in addition to the 796 million stocks owned through trusts and partnerships.

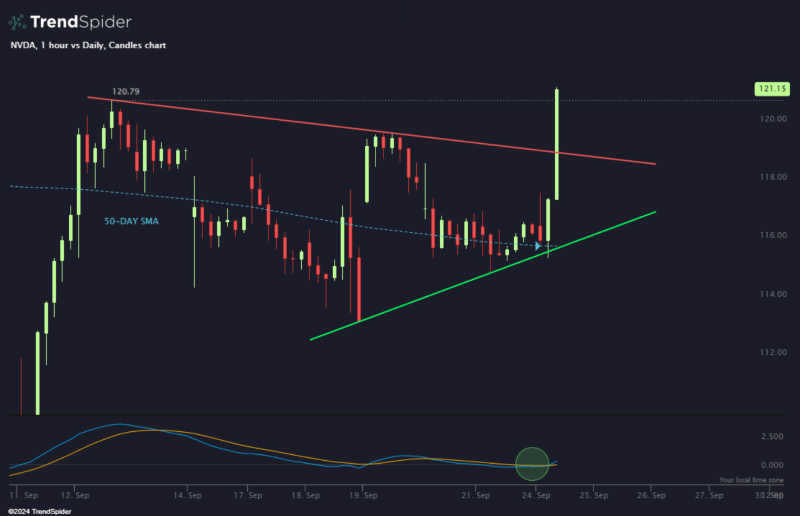

Meanwhile, the news that the semiconductor behemoth’s CEO is done selling Nvidia stocks might trigger a multi-day rally, especially as the stock has made a massive upward move in the hours after it came out, as per the observations by market analytics and trading platform TrendSpider.

Nvidia stock price analysis

Indeed, shortly after the public learned that the insider Nvidia selling might be over for now, NVDA stock pumped from $115 to $120 and is currently trading at $121.02, up 3.68% on the day, advancing 2.39% across the week, and reducing to 4.74% its losses from the past month, while still recording a 150.10% growth this year, as per data on September 25.

Furthermore, as the TrendSpider team earlier noted, Nvidia stock has exploded to its new month-to-date highs off the 50-day simple moving average (SMA) and is going to soar further as it has also broken out of the descending trend line and the previous resistance zone.

On top of that, the moving average convergence divergence (MACD) indicator has recorded a bullish crossover, which, combined with the fact that it is occurring just above the zero line, further strengthens the bullish case and positive technical setup for Nvidia stock price.

Overall, Nvidia stock has strong fundamentals, and its recent technical analysis (TA) indicators suggest more room for price growth. However, trends can easily change, so doing one’s own research and keeping up with the news, like say, potential NVDA stock split, Nvidia stock prediction, and similar, is essential.