Nvidia (NASDAQ: NVDA) has been one of the standout growth companies in recent memory.

On October 3, the company paid out a quarterly dividend with a record date of September 12 — $0.010 per share was paid out.

While Nvidia stock is doubtlessly attractive in terms of capital appreciation, is it worth the volatility and risk for income investors?

At the time of publication, NVDA shares were trading at $132.63 apiece, having rallied by 7.51% over the course of the last seven days, boosting monthly returns to 26.22% and year-to-date (YTD) gains to 179.05%.

NVDA dividends versus peers and competitors

To put Nvidia’s dividend payout into perspective, at press time, $1,000 can purchase seven full shares. At current prices, those seven shares would cost $928 — and eight would bring the price up above $1,000 to $1,061.

For that $928 investment, investors would have received $0.070 — or $0.28, slightly more than a quarter on an annual basis. Nvidia’s quarterly payment of $0.010 pales in comparison to AI competitors, such as Qualcomm’s (NASDAQ: QCOM) $0.85, Broadcom’s (NASDAQ: AVGO) $0.53, or Texas Instruments’ (NASDAQ: TXN) $1.30 — even accounting for stock price differences.

Whereas those semiconductor businesses have mature business models and generate consistent revenues from royalties, Nvidia and AI chip competitor AMD (NASDAQ: AMD) are focused on high-growth areas like AI, machine learning, and cloud computing, which require significant reinvestment to maintain high R&D budgets — hence their dividends are small, or in the case of AMD, nonexistent.

This holds true for the majority of high-growth tech stocks, which are also NVDA competitors.

Income investors can still benefit from Nvidia

Accruing a large stream of dividend payments by investing in NVDA is not a feasible strategy for the vast majority of income investors due to the large capital requirement, low dividend payout ratio, and low dividend yield.

On a strictly literal basis, NVDA’s dividend is not worth it for income investors.

However, even dividend investors can incorporate it into their overall strategy. Simply put, outright ignoring the company’s rapid rise could be counterproductive.

Most income investors still have a part of their portfolio dedicated to growth assets — and having little exposure to capital appreciation, particularly in bull markets is a wasted opportunity.

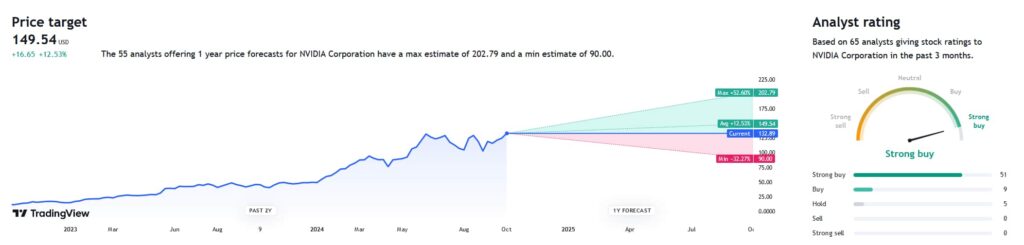

At press time, based on 65 analyst ratings, Nvidia is a ‘Strong Buy’, with an average 12-month price target of $149.54 — which would represent a 12.53% gain compared to NVDA’s current stock price.

While fears of an AI bubble abound, keeping the allocation modest would allow income investors to diversify and gain exposure to potentially stellar returns — all without significantly jeopardizing their focus on passive income and taking on undue risk.

Should the fears of a bubble not materialize, the demand for the company’s new Blackwell chips and cloud computing solutions is likely going to keep stock prices rising for quite some time.

Investing in Nvidia to leverage the stock’s outsized gains could allow income investors to take their profits and reinvest them in other assets that are more attractive from an income perspective, like stable blue chip stocks.