Crypto markets have recently faced a sharp downturn, dropping to their lowest levels in three months and reversing most of the gains seen after Donald Trump’s U.S. presidential victory. The pullback has been fueled by both macroeconomic uncertainty and crypto-specific factors, deepening investor concerns about the market’s trajectory.

Among the key factors weighing on sentiment is the recent Bybit exchange hack, described as the biggest crypto heist in history, which has further eroded trust in centralized platforms. Meanwhile, record outflows from spot Bitcoin exchange-traded funds (ETFs) suggest that institutional investors are temporarily pulling back, adding to selling pressure and fueling volatility.

As a result, the global cryptocurrency market cap has fallen to $2.77 trillion, marking a 0.8% decline in the last 24 hours. As the market matures, accurately predicting cycle stages has become increasingly difficult.

This cycle alone has seen significant deviations from previous patterns, raising questions about whether the bull run is over or if another major rally is still ahead.

Why this cycle is different

Koroush Khaneghah, Founder of Zero Complexity Trading, notes that institutional involvement is a key factor distinguishing this cycle from previous ones. Unlike past cycles, institutions and even countries are accumulating Bitcoin (BTC) with BlackRock (NYSE: BLK) alone holding nearly $52 billion worth of BTC.

This growing institutional demand could result in increased BTC dominance, shallower pullbacks, and Bitcoin leading major market movements.

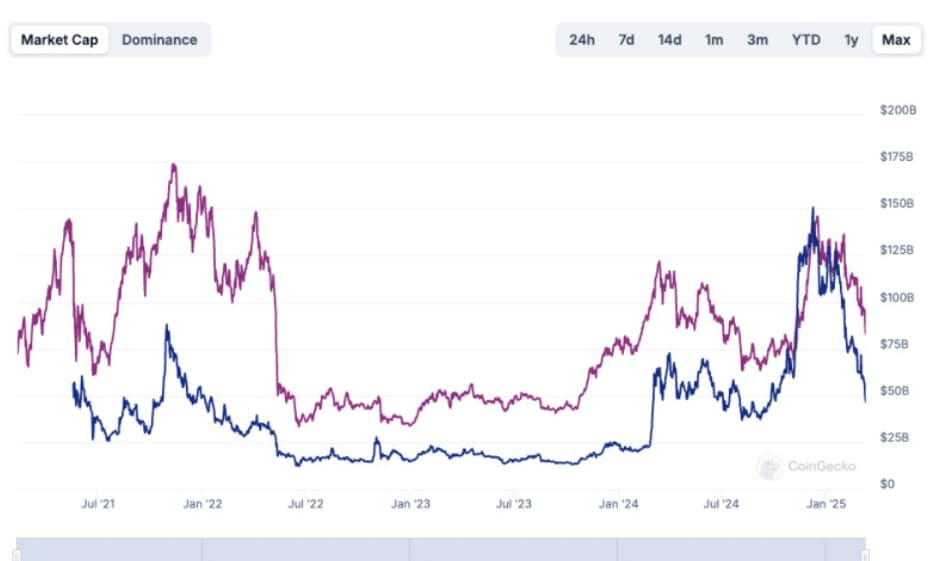

Meanwhile, the altcoin market has undergone capital dispersion, with liquidity spread across multiple sectors rather than concentrated in one. The result has been a more fragmented market, where no single sector—such as DeFi or memecoins—has experienced parabolic growth like in past cycles.

Why bull run is not over yet

At the same time, Khaneghah observed that Bitcoin has only retraced 26% from its all-time high, whereas previous cycles have seen corrections of 40 to 50% before continuing higher.

Historically, Ethereum (ETH) surpassing its previous cycle high has triggered a full-fledged altseason, yet ETH has not even reached $4,000 in this cycle. This suggests that the altseason may simply be delayed, potentially extending the cycle far longer than expected.

For altcoins to regain momentum, analysts highlight the ETH/BTC pair as a critical indicator. A bottoming of ETH/BTC, combined with capital rotation from memecoins into DeFi and Real World Assets (RWA), could reignite altcoin rallies.

That being said, Bitcoin dominance has surged to new highs, with its monthly Relative Strength Index (RSI) touching 70, a level that suggests BTC’s dominance over the crypto market is reaching a critical point. According to analyst Seth, for the final phase of the Bitcoin bull run to materialize, BTC dominance must decline.

Featured image via Shutterstock