The crypto world loves a good spectacle, and World Liberty Financial (WLFI) certainly delivered one. With a jaw-dropping $36-40 billion fully diluted valuation before it even hit mainstream trading, the Trump-backed DeFi token became the talk of social media for all the wrong reasons. But while everyone was busy debating whether WLFI’s sky-high price tag made sense, Unich was quietly building something far more tangible on Solana.

When Politics Meets Crypto: WLFI’s Rocky Road to Market

WLFI’s journey to market has been anything but smooth. The token was officially unlocked for trading on September 1, 2025, but not without drama. Technical issues plagued the launch, with Coinbase Wallet users unable to connect to the unlock process, leaving investors frustrated during a critical pre-trading period.

The real wake-up call came when WLFI futures debuted on Hyperliquid. Opening at $0.44, the token quickly tumbled 44% to below $0.25 within hours, slashing its fully diluted valuation from $44 billion to $24 billion. Traders weren’t buying the hype. Negative funding rates showed just how confident the market was in further downside, with shorts piling in from day one.

The math behind WLFI’s valuation never quite added up. With only 20% of tokens in circulation and the remaining 80% locked behind governance votes, the effective circulating supply was minimal compared to that massive FDV. Critics pointed out that this created an artificial scarcity that inflated the token’s perceived value far beyond what fundamentals could justify.

What made the situation worse was the lack of clarity around WLFI’s actual utility. Unlike established DeFi protocols with clear revenue streams and proven product-market fit, WLFI remained largely a governance token for a platform that hadn’t fully defined its purpose. The result? A classic case of valuation getting ahead of substance. Yet in the same market where WLFI struggled to justify its price tag, another project was quietly proving that building first and tokenizing later might be the smarter play.

Unich: Building Real Value While Others Chase Headlines

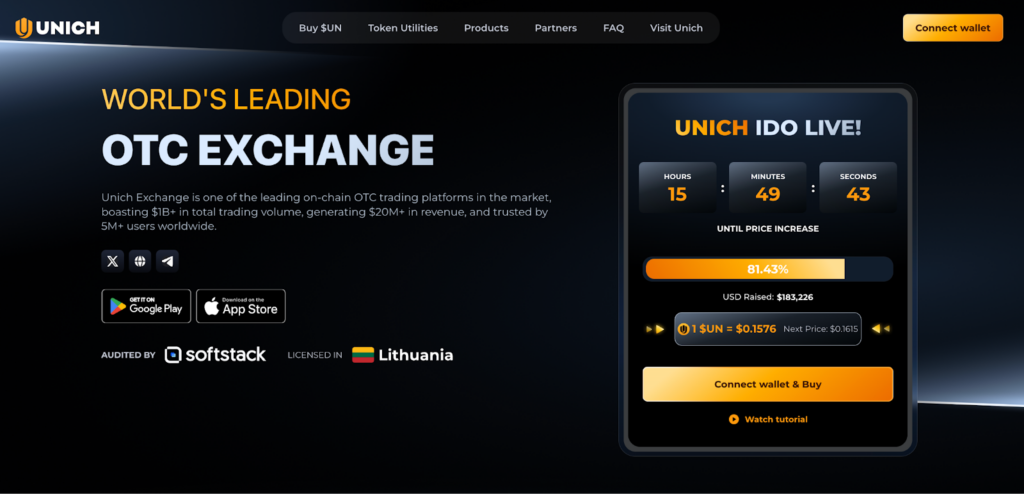

While WLFI dominated crypto Twitter with its controversial launch, Unich OTC was busy proving that sustainable growth beats flashy valuations every time. The Solana-based OTC exchange has achieved something WLFI couldn’t: real adoption with clear utility.

Solving Real Problems, Not Creating Hype

Unich Pre-Market addresses one of crypto’s most persistent pain points: the Wild West of pre-TGE token trading. Traditional OTC deals rely on trust and Telegram screenshots, a recipe for scams and defaults. Unich flipped this model by introducing smart contract-backed collateral requirements for both buyers and sellers. No more blind faith needed.

Next Gen Pre-Market Hub for Web3 🪐

— Unich.com 🆓 (@unich_com) July 24, 2025

A convergence of innovative trading models – where people around the world can trade Pre TGE projects.

We’re driving innovation in DeFi and rolling it out on Unich. pic.twitter.com/O5ZyLiRjGF

The results speak louder than any marketing campaign. In just six months since mainnet, Unich processed over $1.2 billion in trading volume and attracted 5 million users across 190+ countries. More importantly, the platform generated $20 million in actual revenue from real transactions, not speculative trading.

Token Performance That Makes Sense

The contrast with WLFI becomes even clearer when looking at token performance. When $UN listed on Unich Pre-Market, it surged from $0.16 to $0.80 within 24 hours, hitting $1 million in daily volume before reaching the ATH of $0.99 and settling in the $0.70-0.75 range.

UN performance on Pre-Market OTC

The Unich token sale currently offers $UN at $0.15, representing a massive discount to market rates. With confirmed listings on top-tier centralized exchanges post-IDO and a fully diluted valuation of just $150 million, $UN offers far more reasonable entry than WLFI’s inflated expectations.

What sets $UN apart isn’t just its reasonable valuation. The token captures value through multiple revenue streams: trading fees, staking rewards offering 20-30% APY, and a quarterly buyback-and-burn mechanism using 30% of profits.

Add in governance rights and reduced platform fees for holders, and you have a token with actual utility driving demand. This tokenomics model mirrors successful exchange tokens like BNB and OKB, but in a niche that’s still emerging.

While projects like WLFI grab headlines with astronomical valuations, Unich demonstrates that steady growth built on solid fundamentals usually wins the long game.

The Unich IDO represents a rare chance to participate at ground level in a project that’s already proven its worth through real adoption and revenue. With major exchange listings confirmed post-IDO and a valuation that actually makes sense, sometimes the best opportunities are the ones quietly building value while others chase the spotlight.