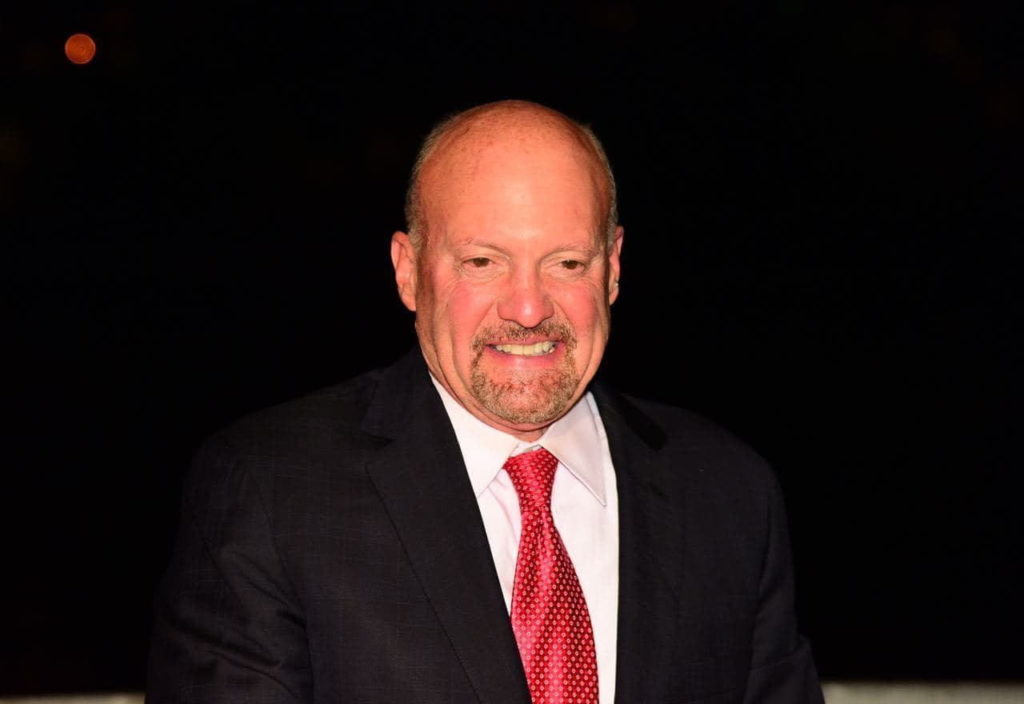

Jim Cramer is a media personality known for his energy and stock market advice on CNBC’s “Mad Money.” Cramer has also become a notable voice in the world of cryptocurrencies, usually showing a bearish bias on Bitcoin (BTC).

However, although his stance on the leading cryptocurrency has fluctuated over time, his latest comments signal a pivotal belief in Bitcoin’s resilience. During a recent appearance on CNBC‘s “Squawk on the Street,” Jim Cramer discussed Bitcoin reaching new highs, cruising above $45,900 on January 2.

According to the investor, the buzz around potential Bitcoin spot ETF approvals significantly drove this rally. Interestingly, he observed that investors could look for it as a selling opportunity, hinting at a possible sell-off scenario following the ETF hype.

“The people who are in it for that will use that chance to sell.”

— Jim Cramer

Yet, Cramer remarked that “this thing, you can’t kill it,” referring to Bitcoin. He underscored that despite uncertainties in the market, Bitcoin, or its spot ETF, is “here to stay.”

Inverse Jim Cramer ETF and Bitcoin’s forecasts

Notably, Jim Cramer’s predictions have become a meme among investors. People seem to believe that the opposite of his predictions is what will actually happen in the future.

A twist to Cramer’s influential comments comes with the “Inverse Cramer ETF.” This financial instrument is known for taking a contrarian stance to Cramer’s public positions. The ETF highlights the complexity of decoding Jim Cramer’s influence on market movements, especially regarding an asset as volatile as BTC.

In particular, the current comments could be either bullish or bearish. Formerly backed by the belief that “Bitcoin can’t be killed,” while later contradicted by the idea of people using the rumors of increased demand as part of an exit liquidity strategy.

He then concluded by admitting being wrong in the past about Bitcoin’s price performance:

“This is the remarkable comeback that was unexpected, except for all the bulls who happened to be right.”

— Jim Cramer

In closing, investors should approach Bitcoin with prudence. While influential figures like Cramer share their perspectives, the cryptocurrency market remains unpredictable. Experts advise doing a thorough research and maintaining due diligence when trading BTC, as the currency’s journey, much like Cramer’s opinions, can be a rollercoaster ride.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.