In times of pandemics and wars, the economy is facing meaningful challenges worldwide with unprecedented inflation growth, national debt accumulation, interest rate hikes, and liquidity crises. Many of the proposed solutions that worked before, under better conditions, are not accomplishing the expected results, and experts struggle to find the right path to follow.

Particularly, the banking system is highly exposed to what is now argued to be a fragile structure.

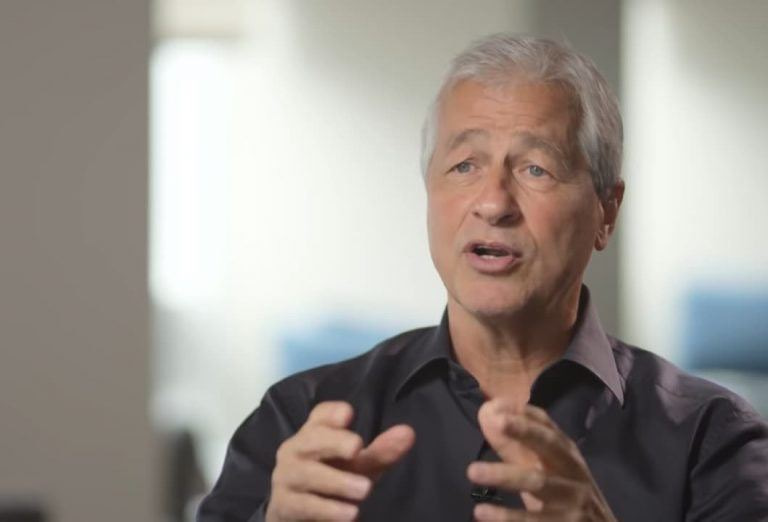

On that, Jamie Dimon — CEO of JPMorgan Chase & Co (NYSE: JPM) — believes that several geopolitical factors, including the ongoing war in Ukraine and conflict in Israel, could keep inflation at elevated levels, according to a Reuters report on October 13.

“This may be the most dangerous time the world has seen in decades.”

— Jamie Dimon, JPMorgan’s CEO

Interestingly, the 30-day FED Funds futures pricing data from the CME Group indicates that there is a 90% chance that the Federal Reserve of the United States will not increase interest rates in the next meeting, set to happen on November 1. This is a meaningful change from the 57% probability registered one month ago.

JPM results and price analysis

Nevertheless, JPMorgan Chase & Co has reported positive results for its investors in 2023 Q3. Positively affected by the interest hikes in the last quarters, JPM’s net interest income (NII) rose 30% to $22.9 billion, from Q2.

Despite that, JPMorgan Chase & Co stock struggled in the last three months, going from $148.70 per share to $145.81 per share at the time of publication.

‘The most dangerous times’, according to Jamie Dimon

Notably, Jamie Dimon is not the only one to see a challenging future ahead.

Mike McGlone, Senior Macro Strategist at Bloomberg Intelligence, has been warning his followers about a foreseen recession in the stock market, following leading indicators such as commodities and Bitcoin (BTC). McGlone’s most recent warning about a great reset was reported by Finbold on October 12.

“Bitcoin may lead [a] great reset by going down (because it went up). Some may call it momentum, but the technical mantra that ‘it will go up because it rose’ (…) is showing the opposite in crypto assets and base metals.”

— Mike McGlone (@mikemcglone11)

Moreover, the best-selling author Robert Kiyosaki has been promoting Bitcoin, gold, and silver as good investment alternatives for what he believes is a coming hyperinflation in the United States, that will crash the US Dollar (USD).

Other renowned experts in the financial sector, such as Ray Dalio and Peter Schiff, have been warning about an expected and unprecedented debt crisis in the American country.

In this context and with so many indicators, investors may indeed be facing one of the most dangerous times in history. However, not even the most experienced personalities are absolutely sure of what is coming next due to the already-mentioned unprecedented and unforeseen economic reality humanity is living in.

Featured image via NBC News YouTube.