Despite Nvidia (NASDAQ: NVDA) taking center stage in the artificial intelligence (AI) and data center market, Advanced Micro Devices (NASDAQ: AMD) might still become a strong challenger, and a leading investor believes now is the time to take the opportunity and purchase its stocks.

As it happens, 5-star investor Victor Dergunov has expressed his view that AMD might soon experience a massive turnaround, predicting substantial growth in the future, arguing that this was the right moment to “take the plunge” and buy some AMD shares, as per a report on September 25.

AMD stock price prediction

Specifically, Dergunov, who is among the top 4% stock experts at TipRanks, addressed AMD’s tactics for releasing new AI chips on a yearly basis, similar to that of Nvidia, and AMD CEO Lisa Su’s belief that the MI350 chip could compete with Nvidia’s Blackwell series, allowing it to challenge Nvidia’s dominance.

“AMD is undervalued and poised for growth, especially in the AI segment, with the potential for better-than-expected Q3 earnings and robust future guidance. (…) Despite lagging Nvidia, AMD remains a top ‘picks and shovels’ player, doing the heavy lifting in the AI space. (…) The Nvidia/AMD gap in the AI space could narrow as we progress.”

Furthermore, the investor pointed out that AMD’s current price seemed attractive, “at only about 29 times next year’s consensus EPS estimates,” and shares residing at around a third below their 52-week high, as well as the possibility of a positive surprise with its next earnings and guidance report.

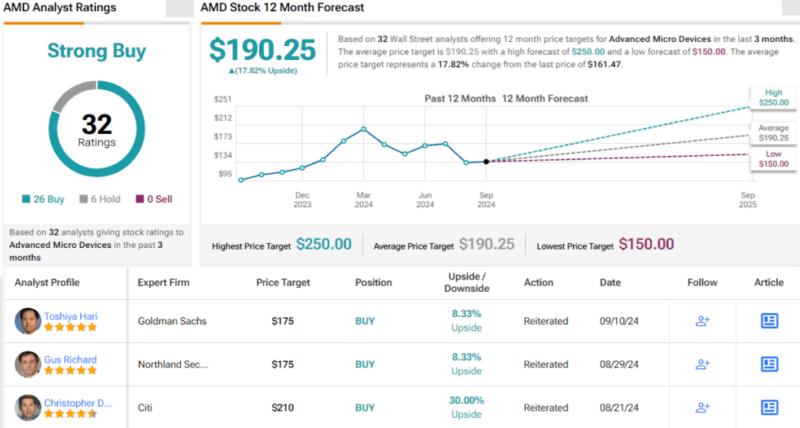

Finally, Dergunov also highlighted the company’s “enormous potential in the ultra-lucrative enterprise AI segment,” rating AMD shares as a ‘strong buy,’ reflecting the consensus of the majority of other stock analysts at TipRanks, only six of which believe it is a ‘hold,’ and with no ‘sell’ calls.

At the same time, these analysts have offered their AMD stock price prediction targets for the next 12 months, with the average at $190.25, which would reflect an increase of 13.75% from its current price, with the lowest target at $150 (-10.31%), and the highest at $250 (+49.48%).

AMD shares price analysis

For the time being, the price of AMD stock stands at $167.25, which indicates a 0.63% decline on the day, an increase of 7.41% across the week, adding up to the 14.72% gain over the past month, and accumulating an advance of 21.16% on its year-to-date (YTD) chart, as per the latest data on September 27.

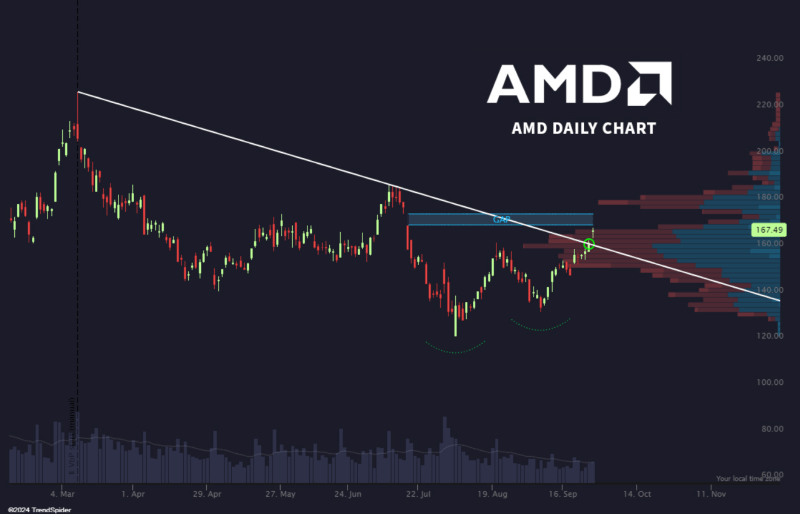

Notably, AMD stock is about to test a key resistance area between $170 and $175 while confirming a double-bottom pattern could signal a bullish reversal, according to the chart shared by market analytics and trading platform TrendSpider in an X post on September 26.

Overall, AMD shares might, indeed, move toward new highs, provided they successfully test the resistance, after which they could continue to challenge Nvidia’s dominance, so now could be the right time to get on board. That said, trends in the stock market can easily change, so doing one’s own research is critical.