With gold potentially living up to its historical reputation as a safe haven in times of uncertainty, it has emerged that global central banks have been busy accumulating the precious metal, deviating from historical trends.

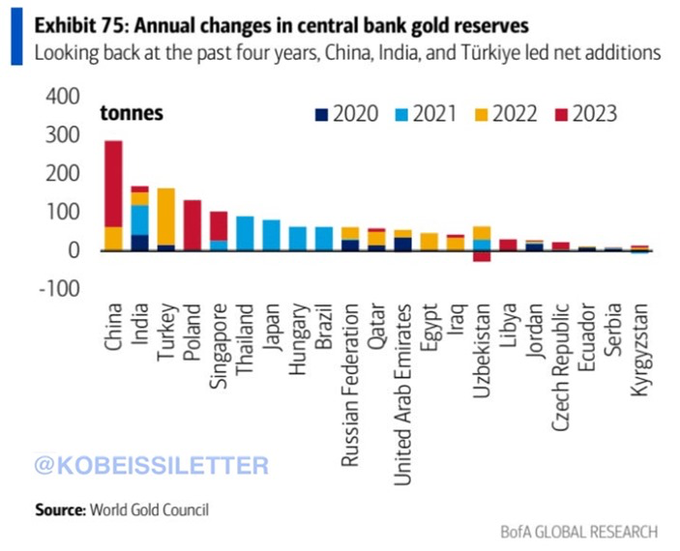

Particularly, data provided by The Kobesissi Letter in an X (Twitter) post on April 22 revealed that China is among the leading players, having acquired a record-breaking 290 tonnes of gold in 2022.

Interestingly, in the previous year, China’s gold reserves increased by over 225 tonnes. This trend aligned with China’s central bank’s consistency in boosting its gold holdings for 17 consecutive months.

The scale of China’s gold acquisitions is mirrored globally. In 2022 and 2023, world central banks collectively purchased 1,081 and 1,037 tonnes of gold, respectively.

According to the data, these figures mark a historic milestone, considering that never before in history have central banks collectively acquired over 1,000 tonnes of gold at different prices in a single year. This trend suggests a systemic reevaluation of traditional reserve assets and a notable departure from past practices.

Drivers of gold accumulation

One plausible explanation is the growing skepticism surrounding fiat currencies’ long-term stability. With geopolitical uncertainties, inflationary pressures, and the continuation of currency devaluation, central banks appear to be hedging their bets by bolstering their gold reserves.

Gold has long been considered a safe-haven asset, retaining its value even in times of economic turbulence. In contrast, fiat currencies are susceptible to fluctuations driven by monetary policies, geopolitical events, and market sentiment.

Furthermore, the historic levels of the commodity’s accumulation by central banks raise pertinent questions about the future of the global financial system. In this case, with other possible alternatives such as Bitcoin (BTC), it remains to be seen if the precious metal will be at the center of global monetary stability.

Gold’s bullish momentum

Indeed, the data on the accumulation of gold emerged during a period when the metal has seen a rise to new record highs in the wake of geopolitical tensions sparked by the Israel and Iran conflict.

At the same time, economies such as the United States continue to be impacted by stubborn inflation, an element deemed to have contributed to recent gold gains.

At the moment, the gold momentum appears to be cooling down amid a possible easing of the conflict in the Middle East. By press time, an ounce of gold was trading at $2,346.20.