Last year was fairly dynamic for Avalanche (AVAX) as It was marked by a string of major partnerships including the ones with the gaming company BLRD and a key provider of cloud computing infrastructure – Amazon’s (NASDAQ: AMZN) AWS.

In the final months of 2023, AVAX was also making interesting moves on the crypto market – both in terms of price and volume, which briefly surged in early October after Stars Arena was launched and before it suffered from a major hack.

On the price side, the cryptocurrency was one of the major winners of the fourth quarter rally and is up more than 187% compared to January 2023.

Still, it underwent a major decline, much like other major players on the market, following a Matrixport report stating that the SEC will, in fact, not approve a spot Bitcoin exchange-traded fund (ETF) before the second quarter of 2024.

Despite the decline and downward momentum, and – unlike Bitcoin (BTC) – failing to reclaim its recent highs, Avalanche is still substantially above its price at the start of December.

The uncertainty stemming from the tumultuous and mixed events of late 2023 and early 2024 prompted Finbold to consult the predictive AI-driven machine-learning algorithms of CoinCodex to try and figure out whether AVAX will continue declining in January or regain a more bullish momentum.

Predictive algorithm maps AVAX performance in January

The algorithms of CoinCodex predict a slightly upward trajectory for Avalanche – albeit with significant volatility – and estimate that AVAX will land at $32.98 on January 31, 2024.

While this is below its price at the time of publication – $34.44 – it is more indicative of the forecast volatility than overall price expectations. Upon extending the view toward early February, CoinCodex foresees that Avalanche will find itself slightly above $37 in one month’s time.

This slightly bullish trajectory is also reflected in Avalanche’s designation of “greed” on the “Fear and Greed Index” – an index that tracks investor attitude – and reflective of a generally neutral sentiment toward the cryptocurrency prevailing at press time.

AVAX price analysis

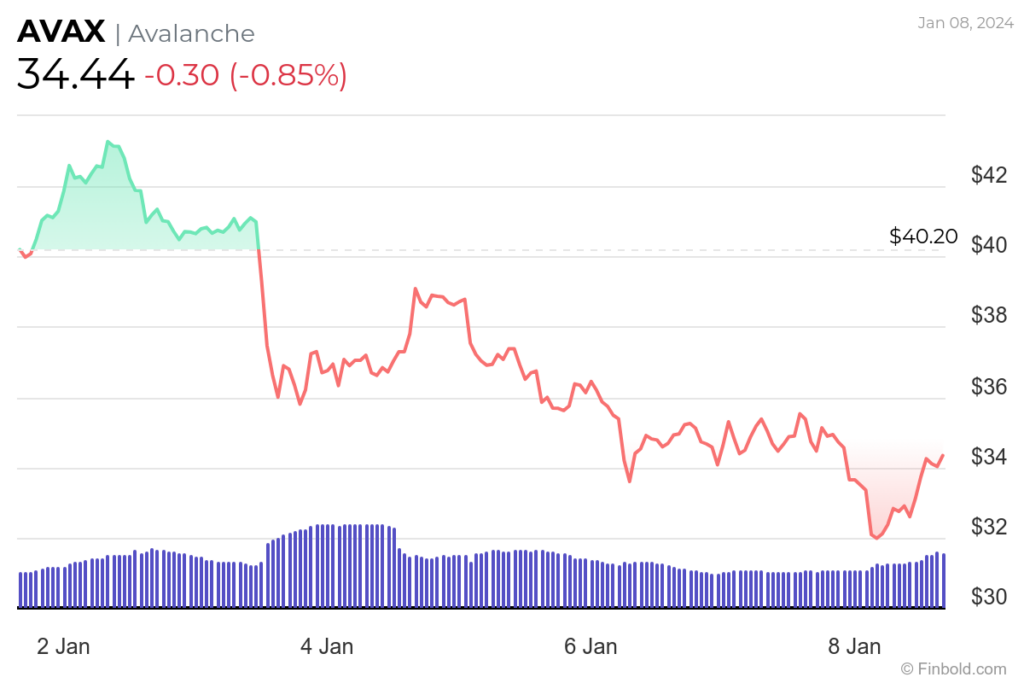

While Avalanche has been losing ground since Christmas Day, the downward trend became particularly evident on January 3 when it, along with many other cryptocurrencies, rapidly fell by approximately 13%.

Generally, this downtrend continued in the first week of 2024, and in the last 7 days, AVAX is 14.74% in the red. The decline is also evident on January 8, as the cryptocurrency is down to $34.44 – by 0.85% – in the last 24 hours by the time of publication.

Zooming out, however, paints a different picture. In the last 30 days, Avalanche is, in total, still up 22.68%. Additionally, it is significantly above its January 2023 prices and has climbed 186.84% in the last 52 weeks.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.