Nvidia (NASDAQ: NVDA) reports earnings today with sky-high projections surpassing $46 billion in revenue and $1.01 earnings per share (EPS).

The results will also double as a litmus test for Trump’s tariff strategy and sales approach overseas, particularly in China.

As the market’s expectations grow, we projected a potential NVDA stock price target for September 1 by leveraging Finbold’s AI prediction agent, which used multiple LLMs to generate an average forecast for improved accuracy while incorporating momentum-based indicators into its context.

Nvidia stock price prediction

The artificial intelligence (AI) predicted NVDA shares would trade $184.98 on September 1, up 2.61% from the current price of $180.28.

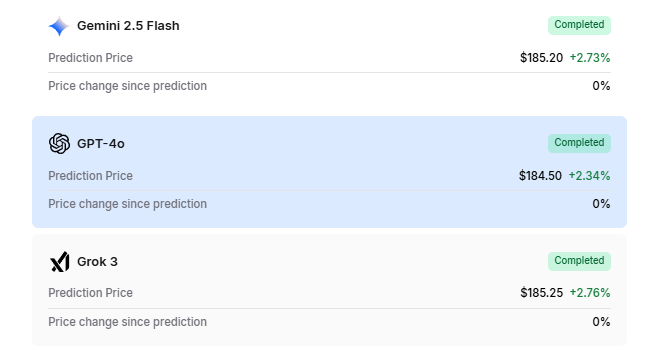

In our prompt, we used three language learning models, each expressing a positive outlook on the stock.

Grok 3 was the most bullish, predicting the semiconductor stock would hit $185.25 by the end of the month, implying a 2.76% upside potential.

Google’s Gemini 2.5 Flash model predicted a slightly lower upside of 2.73%, setting the price target at $185.20.

OpenAI’s model, on the other hand, forecasted a price of $184.50, seeing a potential upside of 2.34%.

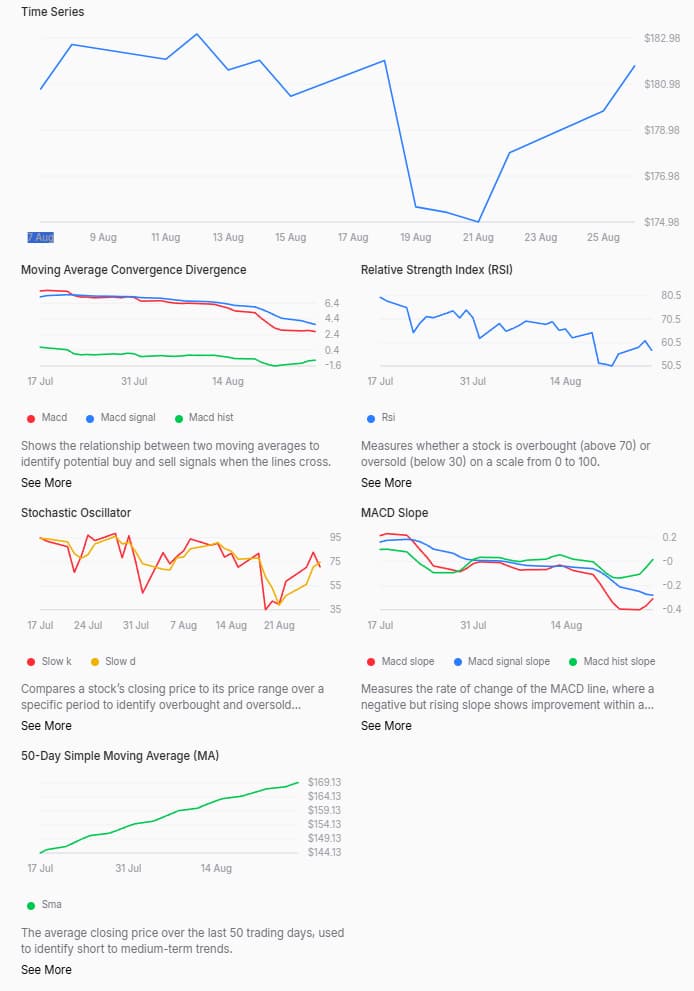

Our AI prediction agent also incorporated a number of technical indicators, which painted a mostly positive picture for the stock.

Most notably, Nvidia is currently trading at $180.26, which is above its 50-day moving average (MA) of $168.49, indicating that the medium-term uptrend is still intact. However, momentum indicators show some short-term weakness, with the moving average/convergence divergence (MACD) line at 2.744 sitting below the signal line at 3.643 and the histogram reading of -0.899 pointing to a bearish crossover.

Both the MACD and signal slopes are also negative, suggesting declining momentum. Moreover, the histogram slope is nearly flat, so selling pressure could be stabilizing rather than accelerating.

The stochastic oscillator, with slow %K at 70.60 and slow %D at 74.51, are not at extreme levels, but a cross downward from there could trigger a short-term pullback.

The relative strength index (RSI) reading of 57.20 is neutral and slightly bullish, though, implying the stock has more room to go higher.

Overall, it appears that Nvidia is relatively bullish from a technical perspective, with only the near-term momentum slowing down, pointing toward potential consolidation or a mild pullback before the upward trend continues.

Feature image via Shutterstock