U.S. politicians have long drawn attention for their stock market trades, with some investors even attempting to replicate their portfolios in hopes of securing similar returns. Representative Marjorie Taylor Greene, the Republican congresswoman from Georgia’s 14th district, has been no exception.

Once widely mocked for her poor investment performance—with some even floating the idea of an ‘inverse Marjorie’ strategy, a nod to the infamous ‘inverse Cramer’ ETF, Greene’s trading record has taken a notable turn in 2024.

Her pivot toward big tech and broader diversification has begun to yield improved results, gradually shifting perceptions of her stock-picking abilities. In fact, she now stands out as one of the few investors—on or off Capitol Hill—to post significant gains in recent weeks.

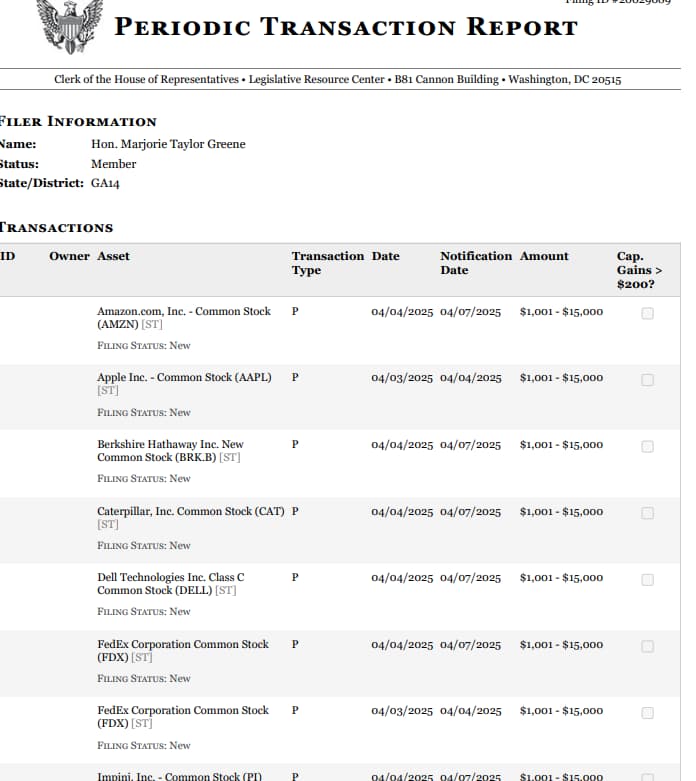

Now, amid a tariff-induced market sell-off and growing fears of a potential recession, Greene has disclosed yet another series of trades. According to her latest financial filings, the congresswoman executed more than a dozen new purchases across several sectors, buying the tariff dip.

Receive Signals on US Congress Members' Stock Trades

Stay up-to-date on the trading activity of US Congress members. The signal triggers based on updates from the House disclosure reports, notifying you of their latest stock transactions.

What Marjorie Taylor Greene has been buying ?

The newly disclosed trades on April 4, 2025, span a wide range of sectors.

Among the notable additions to her portfolio are tech giants like Amazon (NASDAQ: AMZN) and Apple (NASDAQ: AAPL), semiconductor firms including Qualcomm (NASDAQ: QCOM) and Lam Research (NASDAQ: LRCX), and financial heavyweights such as JPMorgan Chase (NYSE: JPM) and Berkshire Hathaway (NYSE: BRK.B).

The congresswoman also invested in major names from the industrial and retail sectors, including Caterpillar (NYSE: CAT), FedEx (NYSE: FDX), UPS (NYSE: UPS), and Nike (NYSE: NKE).

Other purchases included Dell Technologies (NYSE: DELL), Norfolk Southern (NYSE: NSC), Old Dominion Freight Line (NASDAQ: ODFL), Lululemon (NASDAQ: LULU), Impinj (NASDAQ: PI), RH (NYSE: RH), and Southern Company (NYSE: SO), a major U.S. utility provider.

Each of these transactions was valued between $1,001 and $15,000, according to her financial disclosure filed on April 7.

Featured image via Shutterstock