The impressive rally mounted by Palantir (NASDAQ: PLTR) back in November of 2024 hasn’t lost steam in the new year. On the contrary — a standout Q4 earnings report released on February 3 only fanned the flames of investor confidence, and Palantir stock continued its meteoric rise.

While Wall Street equity analysts aren’t entirely convinced that there is more upside in the short to medium-term, it would appear that Jim Cramer’s statement that ‘nothing can stop Palantir’ rings true, at least for the time being.

One interesting and recent development is Capitol Hill’s vote of confidence. PLTR shares have been bought by U.S. politicians a grand total of five times — and since one of those trades occurred way back in 2021, it can be safely disregarded.

Finbold’s congressional trading radar recently picked up the fifth instance in which a politician has invested in Palantir stock in 2025.

Receive Signals on US Congress Members' Stock Trades

Stay up-to-date on the trading activity of US Congress members. The signal triggers based on updates from the House disclosure reports, notifying you of their latest stock transactions.

Taylor Greene is the 4th politician to invest in Palantir stock

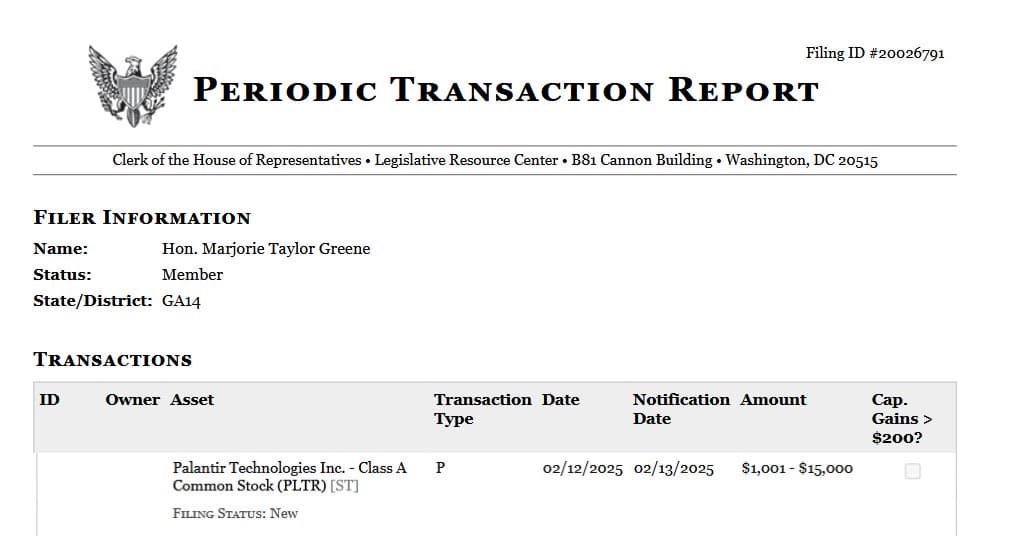

A periodic transaction report from the Clerk of the House of Representatives dated February 14 reveals that Marjorie Taylor Greene, the controversial Representative of Georgia’s 14th congressional district, invested between $1,001 and $15,000 in Palantir stock on February 12.

At the time, a single PLTR share was trading at $117.39. Accordingly, the Congresswoman could have purchased anywhere from 8 to 120 full shares.

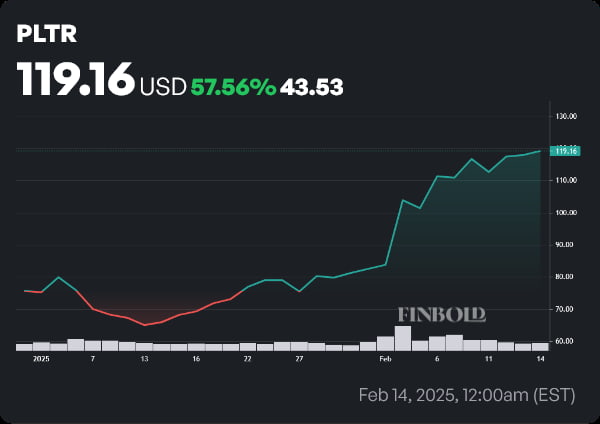

By press time on February 17, the price of Palantir stock had increased to $119.16 — marking a 1.5% gain since the time of Taylor Greene’s purchase, and a 57.56% increase since the start of the year.

What makes this a suspicious trade is the fact that the Representative sits on the congressional Subcommittee on Counterterrorism and Intelligence. These are areas of strategic importance to Palantir — roughly half of the data analytics company’s revenue stems from government contracts — most of which deal with counterterrorism and intelligence.

Despite the impressive surge of Palantir stock, the high valuation remains a concern. Insiders have intensified their selling efforts since the start of the year. In the first 10 days of 2025, insiders dumped more than $40 million worth of PLTR shares — in February, a member of the board liquidated an additional $1.6 million in Palantir stock.

As unstoppable as the rally appears to be, there is a growing expectation that a pullback of significant magnitude will occur at some point. Readers should keep an eye out for that dip — the company’s long-term prospects are incredibly solid, so getting in on a more favorable price would represent a more attractive proposition in terms of risk and reward.

Featured image via Shutterstock