The U.S. economy could be heading for turbulence as overinflated asset markets face growing risks from global and domestic shocks, according to economist Mark Zandi.

Zandi, chief economist at Moody’s Analytics, cautioned that recent stock market volatility highlights how fragile the current economic expansion has become, he said in an X post on October 13.

His warning came after U.S. stocks tumbled 2% on Friday, erasing roughly $2 trillion in market value. The sell-off was triggered by China’s decision to tighten export controls on rare earth minerals, key components for the technology sector, which has driven much of the stock market’s recent gains.

The move reignited tensions between the world’s two largest economies. In response, President Donald Trump announced plans to impose an additional 100% tariff on Chinese imports to the U.S., raising fears of a renewed trade war.

Zandi noted that markets have become increasingly “juiced-up,” with stock prices soaring to stretched valuations that leave little room for error.

“The downdraft in stock prices last Friday is a reminder of how vulnerable juiced-up asset markets are and the threat this poses to the fragile economy,” Zandi said.

Any unexpected shock, whether from geopolitical friction, trade disruptions, or domestic instability, could easily derail investor confidence and trigger a deeper correction.

Impact of government shutdown

Adding to the risks, the ongoing federal government shutdown threatens to amplify uncertainty at a time when the economy is already showing signs of strain.

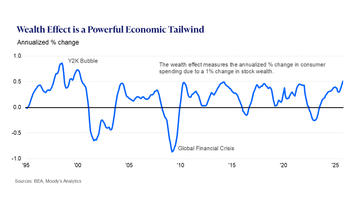

Over the past year, the stock market’s rapid ascent has played a key role in supporting consumer spending among wealthier Americans through the so-called “wealth effect.”

Zandi estimates that the rise in stock prices contributed nearly half a percentage point to real GDP growth, accounting for about one-fourth of total growth during the year.

“Whether this is the start of a more serious correction in the stock market is unknowable, but given how high stock prices have risen and how stretched valuations have become, everything must stick to script to avoid one,” he added.

However, the economist warned that this momentum could quickly fade if equity prices continue to slide.

Meanwhile, as reported by Finbold, Zandi has consistently warned that the economy remains at risk of falling into a recession, noting that the chances of a downturn are highly elevated.

Featured image via Shutterstock