After mixed success in recent weeks, raising concerns about the sustainability of its rally, the price of Nvidia (NASDAQ: NVDA) stock seems to be recovering, and a newly released artificial intelligence (AI) model is quite bullish in terms of its price performance in 2025.

As it happens, Nvidia stock has been making positive gains lately despite fears that it might be in a bubble, much like the Dot-com bubble from the 2000s, with some stock market experts comparing it to another technology giant, Cisco (NASDAQ: CSCO), before and after the burst.

Meta AI’s Nvidia stock price target 2025

Taking into consideration the above and other relevant factors, Finbold has asked the Meta Platforms (NASDAQ: META) AI assistant, Llama 3.1, to offer insights into the possible price targets for Nvidia stock in the following year, and it has delivered its findings from the viewpoint as of August 19.

Will Nvidia stock reach $1,000? According to Meta’s advanced AI platform, it might, as it stated that Nvidia stock could return to its pre-split price of $1,200 per share within one year, “assuming the U.S. economy remains in at least a minimal growth mode and the stock market remains at least slightly bullish.”

On the other hand, it has also taken into account the lower-end Nvidia stock prediction of $150 by certain equities market experts, concluding that the “potential price range for Nvidia stock in 2025 could be between $150 to $1,200, with some predictions suggesting even higher values.”

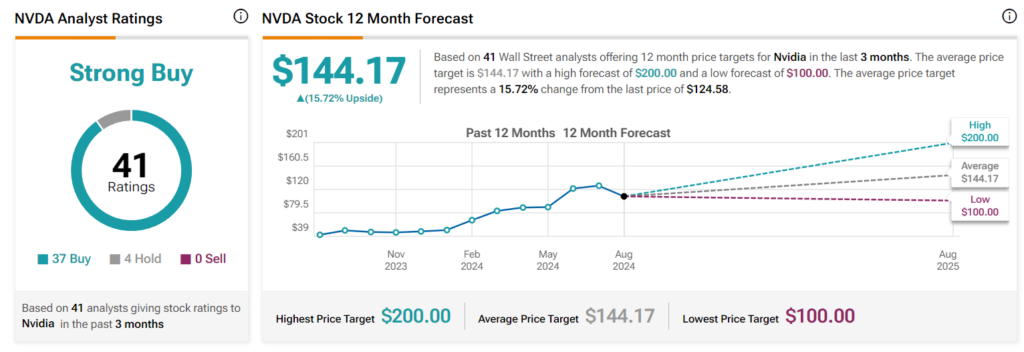

What stock experts say about NVDA price target

At the same time, Nvidia stock prediction by Wall Street experts, the majority of whom agree that NVDA stock is a ‘strong buy,’ stands at an average of $144.17, suggesting a 15.73% increase from its current situation, with the lowest target at $100 (-19.73%), and the highest at $200 (+60.54%), per TipRanks information.

Among these experts is Rosenblatt Securities analyst Hans Mosesmann, who believes that the technology giant could become Wall Street’s first $5 trillion company, setting his Nvidia stock price target at $200 as it maintains its dominance in AI graphics processing units (GPUs).

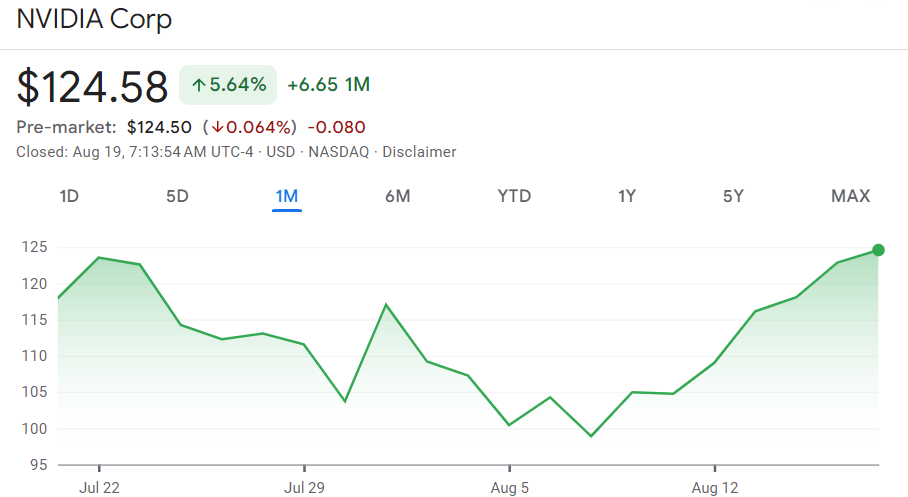

Nvidia stock price analysis

Meanwhile, the Nvidia stock price currently amounts to $124.58, indicating a 1.40% gain on the day, adding up to the increase of 17.19% across the past week, accumulating an advance of 5.64% on its monthly chart, as well as growing 158.63% since the year’s beginning, as per data on August 19.

So, why is NVDA stock so high? One of the answers to the question of why is Nvidia stock going up could lie in the AI boom, as well as its dominance in the GPU field, as experts have observed, suggesting that Meta AI’s Nvidia stock forecast could, indeed, come true.

However, a wise investor should take the chatbot’s NVDA stock forecast 2025 with a grain of salt, as it is just an AI platform, and conduct their own research, keep up with any relevant NVDA news, and carefully weigh any risks involved in participating in the stock market trading.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.