With one week left to the Federal Open Market Committee (FOMC) meeting on September 18, finance traders and investors wonder what the United States Dollar’s next move will be as the Federal Reserve could decide favorably for the first interest rate cut in years.

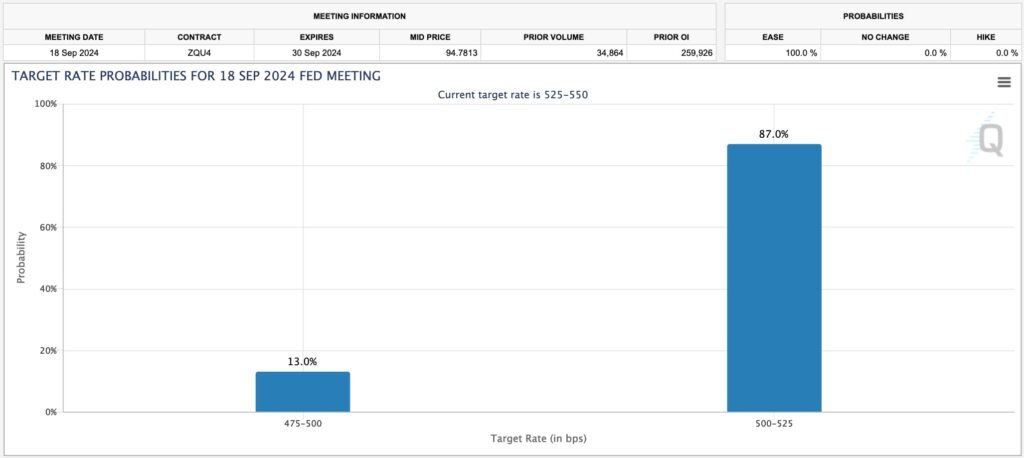

Following the Consumer Price Index (CPI) year-over-year inflation of 2.5% released today, the market speculates on the Fed’s decision. Notably, the CME FedWatch tool forecasts an 87% chance of a 25 basis points (bps) interest rate cut.

Overall, the market bets on a 100% chance of a rate cut. Only 13% of investors believe in a 50 bps reduction to a 475 to 500 bps target. Interestingly, the difference between a 25 or 50-bps rate cut has increased over time, with a bigger jump after today’s CPI data.

U.S. Dollar Index (DXY) analysis

In this context, a trading analyst shared an idea on TradingView, predicting the U.S. Dollar index (DXY) would crash. According to yuchaosng, the DXY is on the third wave of the Elliott Wave theory, heading down for a crash.

The trader proposes a short position against the “greenback.” Moreover, he believes it will underperform against the Euro (EUR) and the Japanese Yen (JPY). As of this writing, the DXY trades at 101.75.

Meta AI U.S. Dollar (DXY) price prediction with an interest rate cut

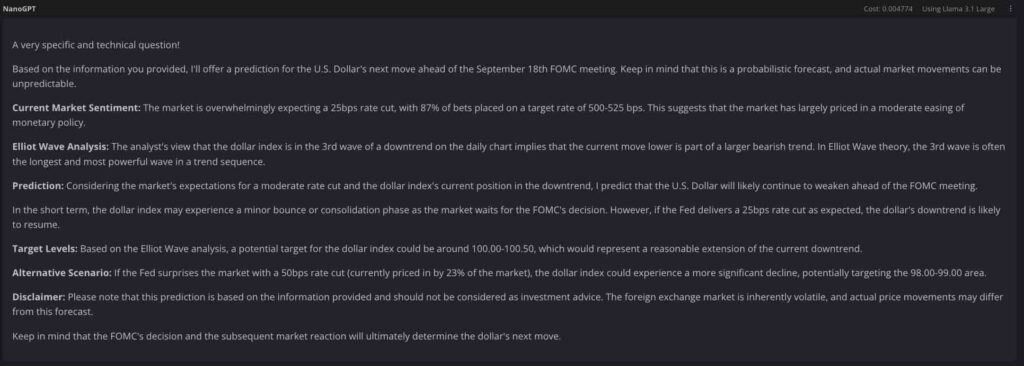

Looking for further insights, Finbold shared this context with Meta‘s (NASDAQ: META) most advanced artificial intelligence (AI) model, Llama 3.1 Large, asking for the U.S. Dollar Index’s next move and price prediction.

In particular, Meta AI sees a weakening dollar, although we could see consolidation in the week ahead of FOMC’s meeting. Nevertheless, the scenario is unfavorable for an interest rate cut, either a 25 or 50 bps reduction.

In summary, the AI sees a target between 100 and 100.50 as the most likely scenario. The DXY, however, could go as low as 98, facing a 50 bps interest rate cut.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.